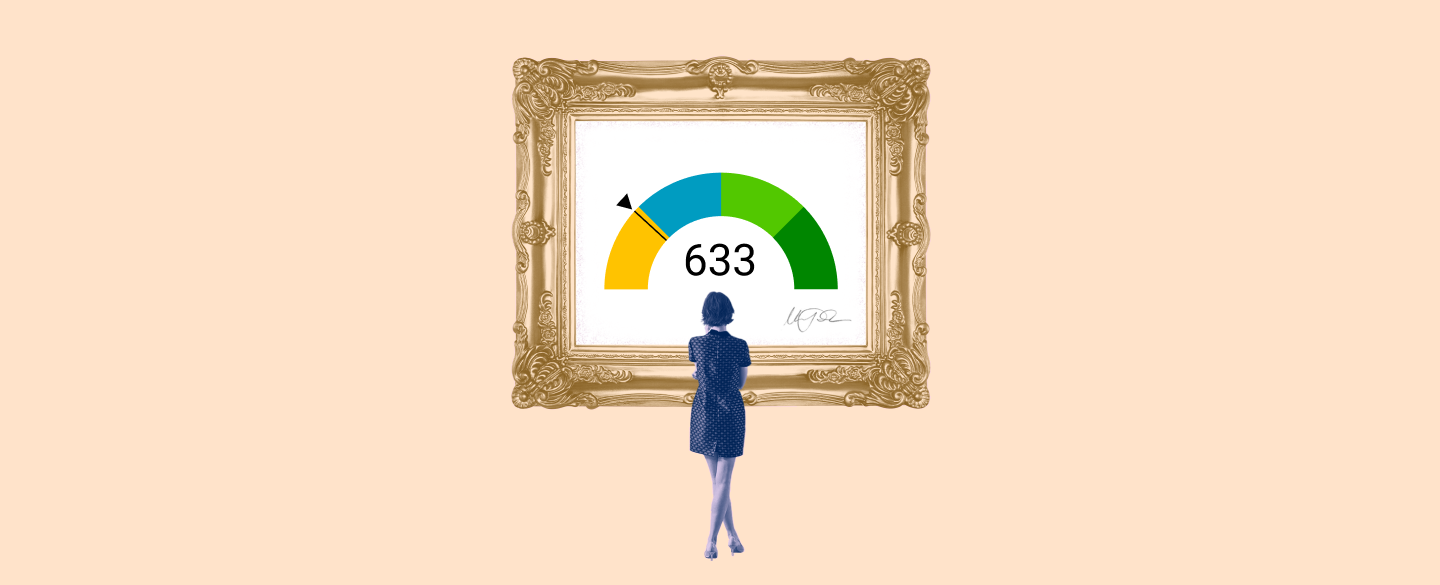

A FICO score is one of the most widely used credit scores, and a 633 FICO score is considered to be a “fair” score. A 633 FICO indicates that you have had some positive payment history, but it also suggests that you may struggle with debt management. It's important to understand exactly what your 633 FICO score means in order to make sure you're taking steps to improve your financial standing.

Table Of Content:

- 633 Credit Score: Is it Good or Bad?

- 633 Credit Score: What Does It Mean? | Credit Karma

- Is 633 a Good Credit Score? Rating, Loans & How to Improve

- 633 Credit Score (+ #1 Way To Fix It )

- 633 Credit Score Mortgage Lenders in 2022 - Non-Prime Lenders ...

- Is 633 a good credit score? | Lexington Law

- 633 Credit Score – Is it Good or Bad? How to Improve Your 633 ...

- 633 Credit Score: Good or Bad? | Credit Card & Loan Options

- Car loan interest rates with 633 credit score in 2022

- 633 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 633 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/633-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 633 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 633 FICO® Score is below the average credit score.

2. 633 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/633 Apr 30, 2021 ... A 633 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 633 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 633 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/633-credit-score/

A credit score of 633 isn't “good.” It's not even “fair.” Rather, a 633 credit score is actually considered “bad,” according to the standard 300 to 850 ...

4. 633 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/633-credit-score

Jun 11, 2022 ... A 633 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 633 Credit Score. Lenders ...

5. 633 Credit Score Mortgage Lenders in 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/633-credit-score-mortgage/

FHA Loan with 633 Credit Score ... FHA loans only require that you have a 580 credit score, so with a 633 FICO, you can definitely meet the credit score ...

6. Is 633 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/633 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

7. 633 Credit Score – Is it Good or Bad? How to Improve Your 633 ...

https://www.creditrepairexpert.org/633-credit-score/ How to Improve Your 633 FICO Score. Before you can do anything to increase your 633 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 633 FICO Score. Before you can do anything to increase your 633 credit score, you need to identify what part of it needs to be improved, ...

8. 633 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/633/ Nov 9, 2021 ... 633 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 633 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

9. Car loan interest rates with 633 credit score in 2022

https://creditscoregeek.com/poor-credit/633/auto/ People with 633 credit score generally can get approved for a car loan as long as they have steady income that they can prove or if they have a co-signer. With ...

People with 633 credit score generally can get approved for a car loan as long as they have steady income that they can prove or if they have a co-signer. With ...

10. 633 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/633-credit-score/ A 633 credit score is considered as “poor” score. While people with the 633 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 633 credit score is considered as “poor” score. While people with the 633 FICO score won't have as much trouble getting loans as those with lower credit, ...

What does a 633 FICO score mean?

A 633 FICO score indicates that you have had some positive payment history, but it also suggests that you may struggle with debt management. This means that lenders view your creditworthiness as average and consider your creditworthiness to be fair, which can make it more difficult to get approved for loans and other forms of financing.

What can I do to improve my 633 FICO score?

There are several steps that you can take in order to improve your 633 FICO score. These include making all minimum payments on time each month, paying down existing debt as much as possible, avoiding opening new lines of credit unnecessarily, and requesting copies of all three major credit reports annually and disputes any errors or inaccuracies they find. Additionally, regularly monitoring your credit report can help you spot fraudulent activity and potential identity theft early on so that it doesn't affect your credit scores further down the line.

Is a 633 Fico Score good enough to get approved for loan?

Generally speaking, lenders view a 633 Fico Score as fair rather than great. While this may not automatically disqualify you from getting approved for certain types of loans or financing, it will often result in higher interest rates or smaller loan amounts than those offered with higher scores. As such, taking the steps mentioned above to improve your score could help increase the chances of loan approval and getting better terms.

Conclusion:

A 633 FICO score is an important indication of how lenders view your financial situation. Understanding exactly what this number represents can help give insight into the kinds of decisions that need to be made in order to ensure future success with loan approval and improved financial standing overall. With diligent work and smart money habits, it is possible not only knowledgeably manage debt but also build wealth over time.