Having a FICO score of 635 is a great way to ensure that you have good credit worthiness and financial security. Knowing what your FICO score is helps you understand how lenders view your creditworthiness. It is important to know what goes into determining this score, as well as some frequently asked questions about it.

Table Of Content:

- 635 Credit Score: Is it Good or Bad?

- 635 Credit Score: What Does It Mean? | Credit Karma

- Is 635 a Good Credit Score? Rating, Loans & How to Improve

- Is 635 a good credit score? | Lexington Law

- 635 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Will a 635 credit score get me an auto loan with no money down ...

- 635 Credit Score (+ #1 Way To Fix It )

- 635 Credit Score – Is it Good or Bad? How to Improve Your 635 ...

- 635 Credit Score: Is it Good or Bad? (Approval Odds)

- Is My Credit Score Good Enough for a Mortgage?

1. 635 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/635-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 635 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 635 FICO® Score is below the average credit score.

2. 635 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/635 Apr 30, 2021 ... A 635 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 635 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 635 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/635-credit-score/

A credit score of 635 isn't “good.” It's not even “fair.” Rather, a 635 credit score is actually considered “bad,” according to the standard 300 to 850 ...

4. Is 635 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/635 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 635 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/635-credit-score-mortgage/

If your credit score is a 635 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

6. Will a 635 credit score get me an auto loan with no money down ...

https://www.compareauto.loan/credit-scores/will-a-635-credit-score-get-me-an-auto-loan

If you've got a credit score near to 635, you are likely to have the best likelihood of approval for that loan if you apply for vehicle loans online. This means ...

7. 635 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/635-credit-score

Jun 11, 2022 ... A 635 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 635 Credit Score. Lenders ...

8. 635 Credit Score – Is it Good or Bad? How to Improve Your 635 ...

https://www.creditrepairexpert.org/635-credit-score/ How to Improve Your 635 FICO Score. Before you can do anything to increase your 635 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 635 FICO Score. Before you can do anything to increase your 635 credit score, you need to identify what part of it needs to be improved, ...

9. 635 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/635-credit-score/ Is 635 a good credit score? FICO scores range from 300 to 850. As you can see below, a 635 credit score is considered Fair.

Is 635 a good credit score? FICO scores range from 300 to 850. As you can see below, a 635 credit score is considered Fair.

10. Is My Credit Score Good Enough for a Mortgage?

https://www.investopedia.com/articles/personal-finance/081115/my-credit-score-good-enough-mortgage.asp/GettyImages-1041512942-60ac71d4ef574abbada73644f78ca0cb.jpg) What Lenders Like to See · 740–850: Excellent credit – Borrowers get easy credit approvals and the best interest rates. · 670–740: Good credit – Borrowers are ...

What Lenders Like to See · 740–850: Excellent credit – Borrowers get easy credit approvals and the best interest rates. · 670–740: Good credit – Borrowers are ...

What is a FICO Score?

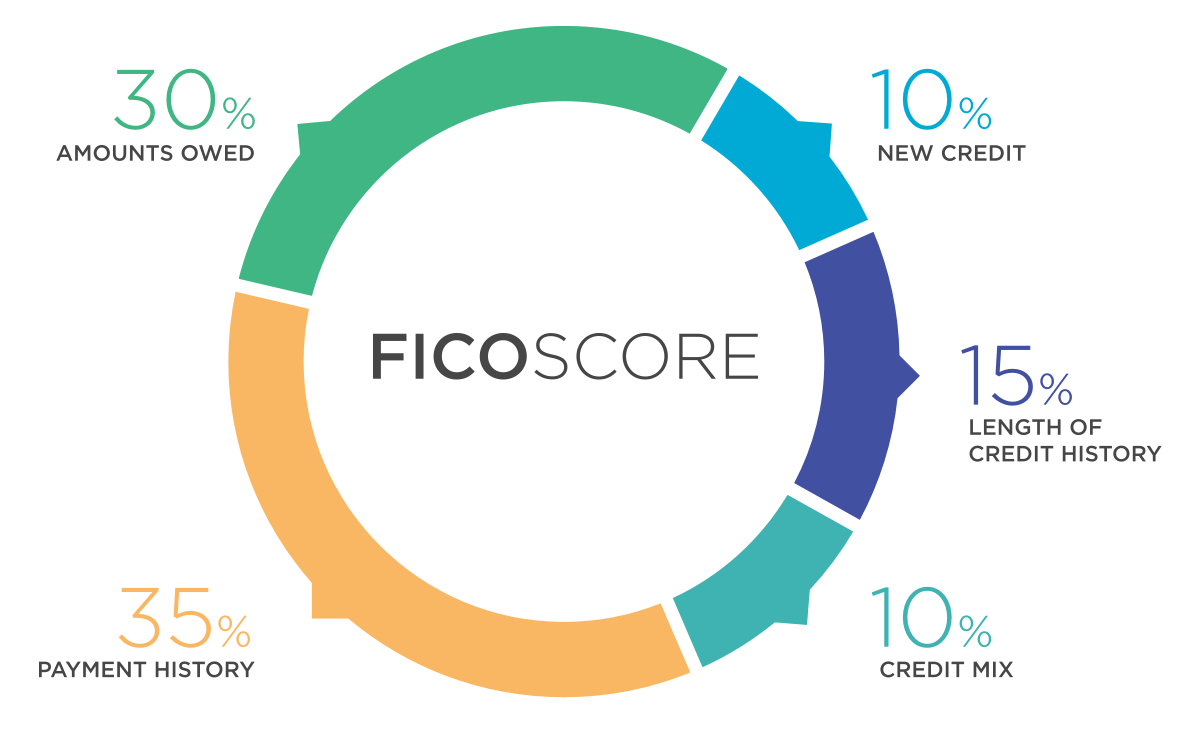

A FICO score is a numerical representation of an individual’s creditworthiness based on their history of making payments and managing their debt. It typically ranges from 300 to 850, with higher numbers indicating better credit management. A 635 FICO score falls within the “good” category, meaning it is likely that lenders will take you seriously when considering loan or credit applications.

How does one get a 635 FICO score?

To achieve a 635 FICO score, individuals should make sure they are up to date on all bills and credit obligations. Additionally, they should reduce any existing debt levels and strive to maintain low balances across their various accounts. It can also be beneficial to regularly request their own credit report to stay informed about changes in their credit status.

What happens if my FICO score drops below 635?

If your FICO score drops below 635, it may no longer be considered “good” according to lenders and creditors. This can result in difficulty qualifying for loans or obtaining new lines of credit, so it is important to do whatever you can to maintain your good standing with lenders by ensuring all payments are made on time and debt levels are kept low.

Are there any factors that could affect my 635 FICO Score?

Yes, certain factors such as late payments or defaults can have an impact on your overall creditworthiness and thus drop your FICO score accordingly. In addition, lenders may consider other elements such as employment history when evaluating loan applications. It is best practice for individuals to remain aware of these potential influences so that they can take the necessary steps towards maintaining a good credit record over time.

What other benefits come along with having a 635 FICO Score?

Having a 635 FICO score means that you have good standing with most creditors and lenders who look at these scores before approving loan applications or extending lines of credits. Some other benefits include being able to take advantage of lower interest rates when applying for loans or mortgages, which can save money in the long run by reducing overall borrowing costs. Individuals may also benefit from quicker approvals when trying to secure lines of credit from banks or other lending institutions.

Conclusion:

Having a 635 FICO score puts you in an advantageous position when it comes to dealing with creditors since most consider this number within the “good” range when assessing potential borrowers for loans or other forms of financial assistance . Understanding what goes into achieving this level as well as familiarizing yourself with any potential influences which could negatively impact it can help ensure success in maintaining good standing with lenders over time.