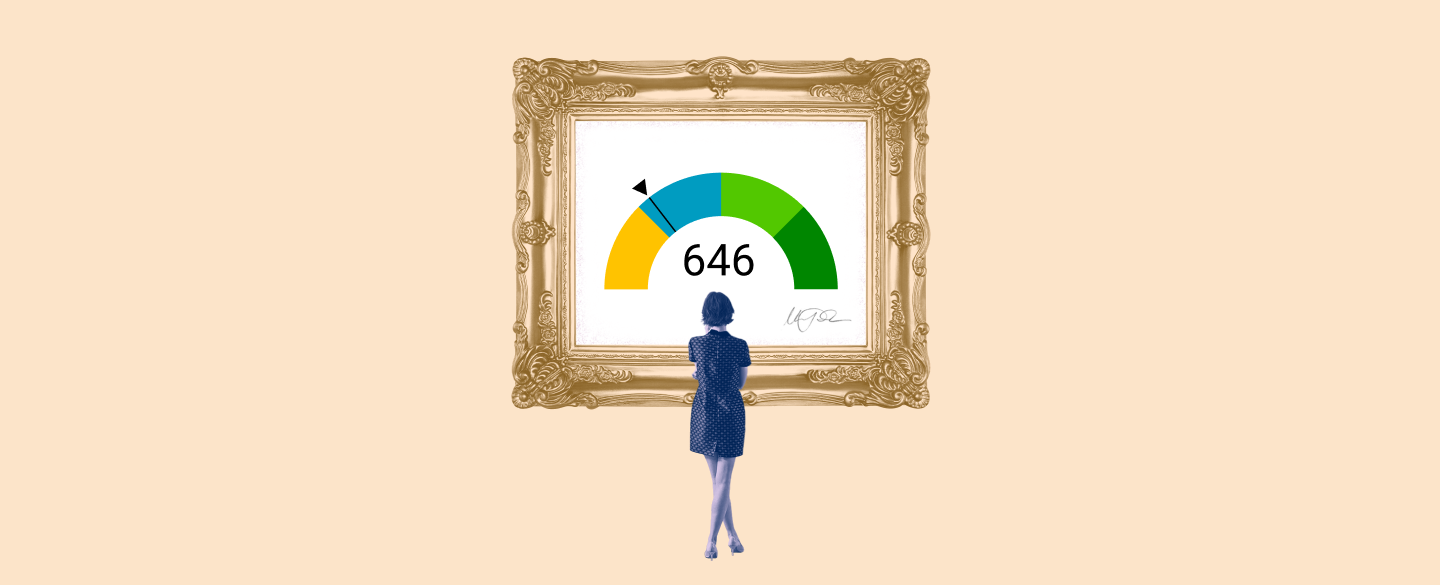

A FICO score is a number that lenders use to determine the creditworthiness of an individual. FICO scores range from 300 to 850, with higher numbers indicating better creditworthiness. A score of 646 falls within the lower-middle range and could still potentially qualify you for certain types of loan approvals.

Table Of Content:

- 646 Credit Score: Is it Good or Bad?

- 646 Credit Score: What Does It Mean? | Credit Karma

- Is 646 a Good Credit Score? What It Means, Tips & More

- 646 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 646 Credit Score (+ #1 Way To Fix It )

- Is 646 a good credit score? | Lexington Law

- 646 Credit Score – Is it Good or Bad? How to Improve Your 646 ...

- 646 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 646 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Is the Average Credit Score in America? | Credit.com

1. 646 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/646-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 646 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 646 FICO® Score is below the average credit score.

2. 646 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/646 Apr 30, 2021 ... A 646 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 646 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

3. Is 646 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/646-credit-score/

A 646 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 646 credit score isn't "bad," ...

4. 646 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/646-credit-score-mortgage/

FHA Loan with 646 Credit Score ... FHA loans only require that you have a 580 credit score, so with a 646 FICO, you can definitely meet the credit score ...

5. 646 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/646-credit-score

Jul 1, 2022 ... A 646 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 646 Credit Score. Lenders ...

6. Is 646 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/646 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

7. 646 Credit Score – Is it Good or Bad? How to Improve Your 646 ...

https://www.creditrepairexpert.org/646-credit-score/ How to Improve Your 646 FICO Score. Before you can do anything to increase your 646 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 646 FICO Score. Before you can do anything to increase your 646 credit score, you need to identify what part of it needs to be improved, ...

8. 646 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/646-credit-score/ A 646 credit score is considered as “poor” score. While people with the 646 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 646 credit score is considered as “poor” score. While people with the 646 FICO score won't have as much trouble getting loans as those with lower credit, ...

9. 646 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/646/ Nov 9, 2021 ... 646 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 646 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

10. What Is the Average Credit Score in America? | Credit.com

https://www.credit.com/credit-scores/what-is-the-average-credit-score/ Jul 28, 2021 ... TL;DR: The average FICO score is 711; the average VantageScore is 688. It can be hard to get a competitive interest rate—or even get a ...

Jul 28, 2021 ... TL;DR: The average FICO score is 711; the average VantageScore is 688. It can be hard to get a competitive interest rate—or even get a ...

What is a good FICO score?

According to Experian, a good FICO score is between 670 and 739. However, it's important to note that some lenders may use different criteria when determining if you are a responsible borrower.

How can I improve my 646 FICO Score?

One way to improve your creditworthiness is by making payments on time, keeping balances low on credit cards and other revolving credit accounts and only applying for new accounts when necessary. You should also monitor your credit reports regularly for errors or inaccuracies that may be holding down your score.

What kind of loans can I get with a 646 FICO Score?

Generally speaking, you may still be able to qualify for auto loans, mortgages and some personal loans with a 646 credit score. It’s possible that you’ll have access to more favorable terms and rates if you have an even higher score.

How long does it take to raise my FICO Score?

The amount of time it takes to build or rebuild your credit depends on several factors, such as how much debt you have and how often payments are made on time. Building good habits over time combined with responsible spending can help lead to an improved credit rating in anywhere from 3 months up to a year or longer depending on your circumstances.

Does my 646 FICO Score make me ineligible for any loans?

Not necessarily; while some lenders may not approve an application based solely upon this score, others may still consider it depending on past performance and other factors such as income level and employment status.

Conclusion:

While having a 646 FICO Score isn't ideal, there are still ways to potentially qualify for loans at favorable terms and rates by building up a strong financial history over time. If you take the necessary steps towards improving your overall picture financially, then eventually you should see results in the form of higher approval rates and better loan conditions.