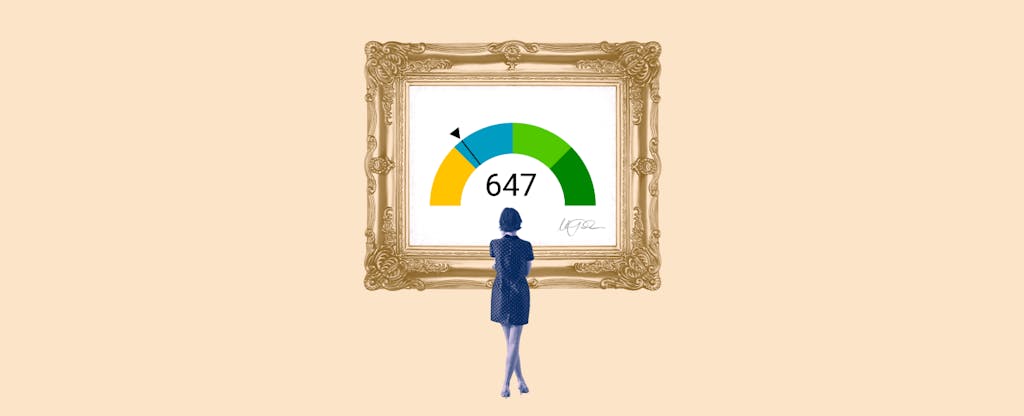

It’s important to understand your credit score. Having a good credit score is key if you are hoping to get approved for any kind of loan or financing. The FICO® Score 647 is one tier above the fair range, meaning it can open more doors and give you better rates and terms than most subprime scores.

Table Of Content:

- 647 Credit Score: Is it Good or Bad?

- Is 647 a Good Credit Score? What It Means, Tips & More

- 647 Credit Score: What Does It Mean? | Credit Karma

- Is 647 a good credit score? | Lexington Law

- 647 Credit Score (+ #1 Way To Fix It )

- 647 Credit Score: Good or Bad? | Credit Card & Loan Options

- 647 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- The credit score you need to take out a mortgage

- 647 Credit Score: Is it Good or Bad? (Approval Odds)

- 647 Credit Score – Is it Good or Bad? How to Improve Your 647 ...

1. 647 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/647-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 647 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 647 FICO® Score is below the average credit score.

2. Is 647 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/647-credit-score/

A 647 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 647 credit score isn't "bad," ...

3. 647 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/647 Apr 30, 2021 ... A 647 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 647 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. Is 647 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/647 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 647 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/647-credit-score

6. 647 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/647/

Nov 9, 2021 ... 647 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

7. 647 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/647-credit-score-mortgage/

FHA Loan with 647 Credit Score ... FHA loans only require that you have a 580 credit score, so with a 647 FICO, you can definitely meet the credit score ...

8. The credit score you need to take out a mortgage

https://www.cnbc.com/2019/07/15/median-credit-score-mortgage.html Jul 15, 2019 ... The median credit score for mortgages taken out this year sits at 759, the report found, and only 10% of mortgage borrowers had credit scores ...

Jul 15, 2019 ... The median credit score for mortgages taken out this year sits at 759, the report found, and only 10% of mortgage borrowers had credit scores ...

9. 647 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/647-credit-score/ Is 647 a good credit score? FICO scores range from 300 to 850. As you can see below, a 647 credit score is considered Fair.

Is 647 a good credit score? FICO scores range from 300 to 850. As you can see below, a 647 credit score is considered Fair.

10. 647 Credit Score – Is it Good or Bad? How to Improve Your 647 ...

https://www.creditrepairexpert.org/647-credit-score/ How to Improve Your 647 FICO Score. Before you can do anything to increase your 647 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 647 FICO Score. Before you can do anything to increase your 647 credit score, you need to identify what part of it needs to be improved, ...

What does a FICO® Score 647 mean?

A FICO® Score 647 is slightly above average in terms of creditworthiness. It is still considered a subprime score, but it puts you in a better position to be approved for loans and financing with more favorable terms.

What kind of interest rate am I likely to get with a FICO® Score 647?

With a FICO® Score 647, you may be able to get an interest rate that is lower than the subprime category but it won’t be prime rates. Depending on other factors such as your income and debt burden, you may still be able to qualify for a loan with good interest rates.

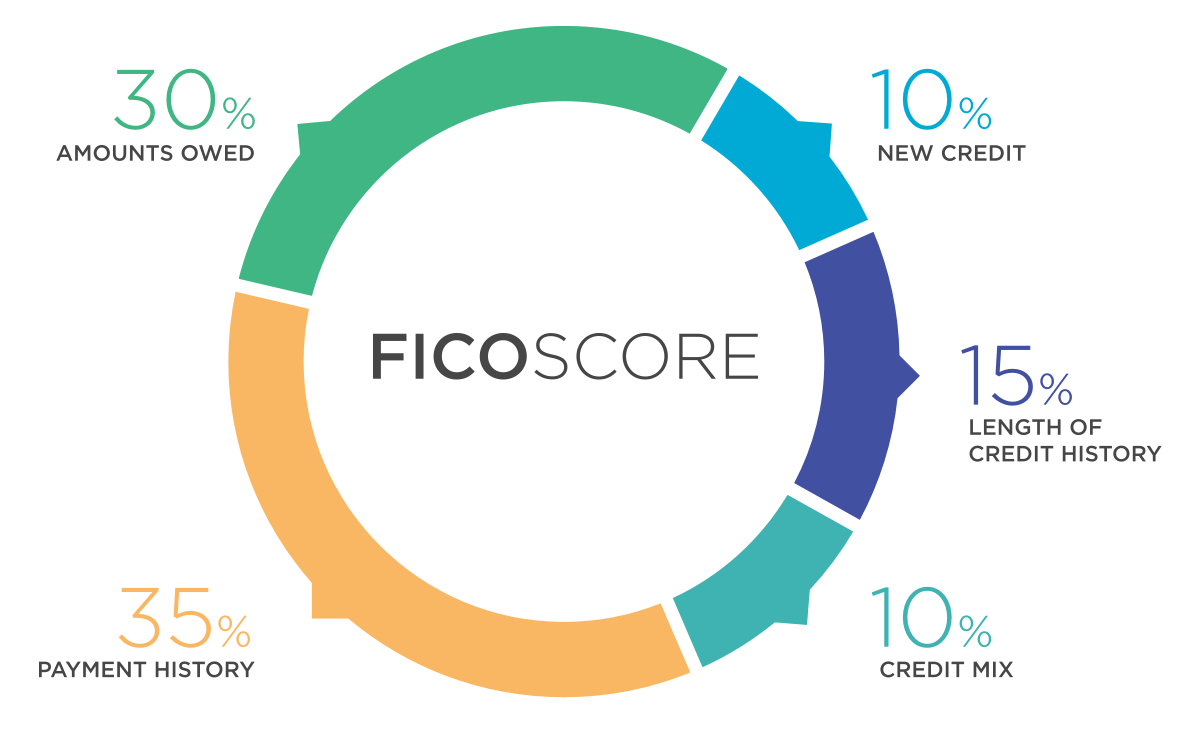

How do I improve my FICO® Score 647?

To improve your FICO® Score 647, there are few simple steps that you can take. First, pay all bills on time each month; late payments can drop your score significantly. Secondly, try to keep your balances low – aim for 30% of your available limit or less. Also, don’t open too many new accounts at once as this could have a negative impact on your credit score. Finally, check your credit report regularly so that you can spot any errors that need correcting immediately.

Should I focus only on paying off debt to raise my score?

Paying off debt should always be a priority when attempting to raise your credit score; however, it may not always make sense from an economic standpoint depending on the amount of debt and interest rate being paid. It is important to analyze things like fees and payment terms before settling any debts in order to maximize savings in the long run.

Conclusion:

s

Having a good credit score opens up many opportunities that would otherwise not be available. A FICO® Score 647 puts you in better standing compared to other subprime consumers and allows for more favorable loan terms and lower interest rates than what would normally be offered in the subprime market. It is important to keep track of bills and payments so that improvements can continue steadily over time until reaching prime lender status.