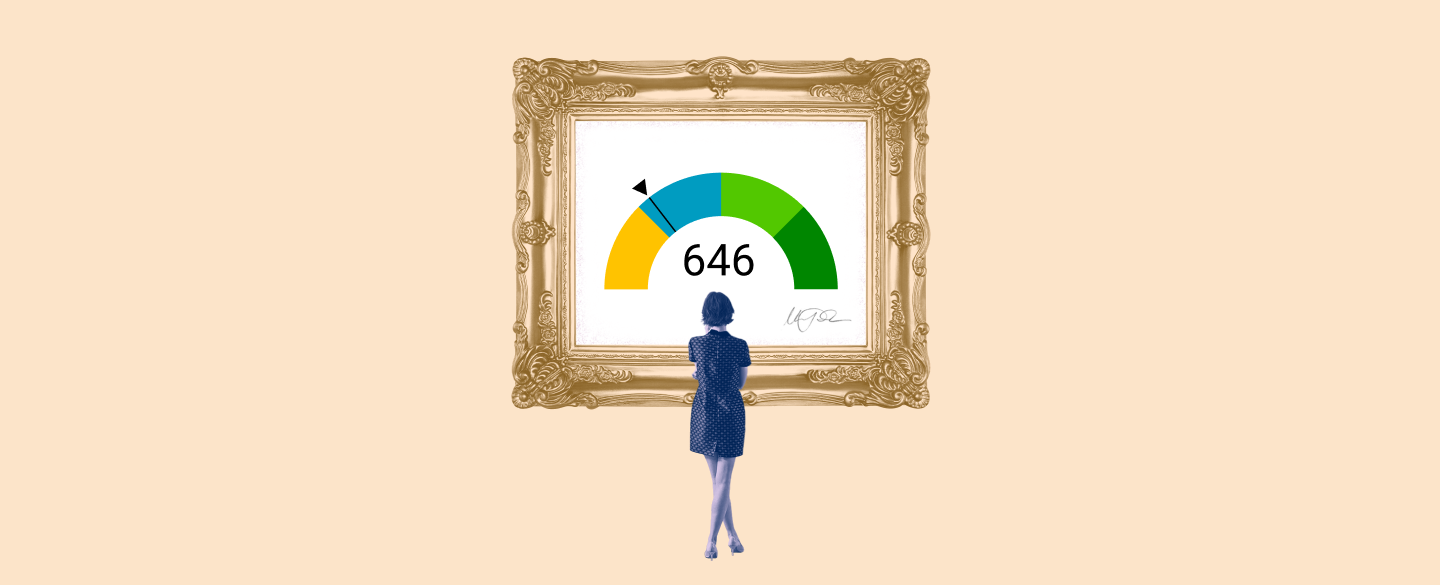

A 646 credit score is a good credit score, and is well above the average American’s credit score. With this score, you have a great chance of being approved by lenders for loans or other forms of credit.

Table Of Content:

- 646 Credit Score: Is it Good or Bad?

- 646 Credit Score: What Does It Mean? | Credit Karma

- Is 646 a Good Credit Score? What It Means, Tips & More

- Is 646 a good credit score? | Lexington Law

- 646 Credit Score (+ #1 Way To Fix It )

- 646 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 646 Credit Score – Is it Good or Bad? How to Improve Your 646 ...

- 646 Credit Score: Good or Bad? | Credit Card & Loan Options

- 646 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- What's Considered a Good Credit Score? | TransUnion

1. 646 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/646-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 646 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 646 FICO® Score is below the average credit score.

2. 646 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/646 Apr 30, 2021 ... A 646 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

Apr 30, 2021 ... A 646 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

3. Is 646 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/646-credit-score/

A 646 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 646 credit score isn't "bad," ...

4. Is 646 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/646 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 646 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/646-credit-score

Jul 1, 2022 ... Is 646 a Good Credit Score? ... A 646 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a ...

6. 646 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/646-credit-score-mortgage/

If your credit score is a 646 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range ...

7. 646 Credit Score – Is it Good or Bad? How to Improve Your 646 ...

https://www.creditrepairexpert.org/646-credit-score/ Each credit agency provides you with a credit score, and these three scores combine to create both your 646 FICO Credit Score and your VantageScore. Your score ...

Each credit agency provides you with a credit score, and these three scores combine to create both your 646 FICO Credit Score and your VantageScore. Your score ...

8. 646 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/646/ Nov 9, 2021 ... 646 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 646 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

9. 646 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/646-credit-score/ A 646 credit score is considered as “poor” score. While people with the 646 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 646 credit score is considered as “poor” score. While people with the 646 FICO score won't have as much trouble getting loans as those with lower credit, ...

10. What's Considered a Good Credit Score? | TransUnion

https://www.transunion.com/blog/credit-advice/whats-considered-a-good-credit-score Dec 10, 2021 ... A good credit score can help you get approved and lock in better rates for loans and other credit. Higher is generally better, but it's hard to ...

Dec 10, 2021 ... A good credit score can help you get approved and lock in better rates for loans and other credit. Higher is generally better, but it's hard to ...

How can I get my 646 credit score?

To get your 646 credit score, you will need to obtain your three-digit FICO score from one of the three major credit bureaus (Equifax, Experian, TransUnion). You can do this by signing up for an online service that monitors your scores or by contacting each bureau directly.

What does a 646 credit score mean?

A 646 credit score is considered to be “good” according to FICO rating standards. This means that you have a trustworthy reputation with lenders and are more likely to be approved for loans or other forms of borrowing than someone with a lower rating.

What advantages does having a 646 credit come with?

Having a 646 credit comes with numerous advantages, including better interest rates on loans and access to higher amounts of money that would otherwise not be available to those with lower ratings. Additionally, a good rating also gives you more influence in negotiations over prices and promotional deals.

Conclusion:

A 646 credit score is a great indicator of financial responsibility and stability which opens up many possibilities when it comes to accessing loans or other types of borrowing. With this rating, you will likely have access to higher loan amounts at lower interest rates than those with lower ratings.