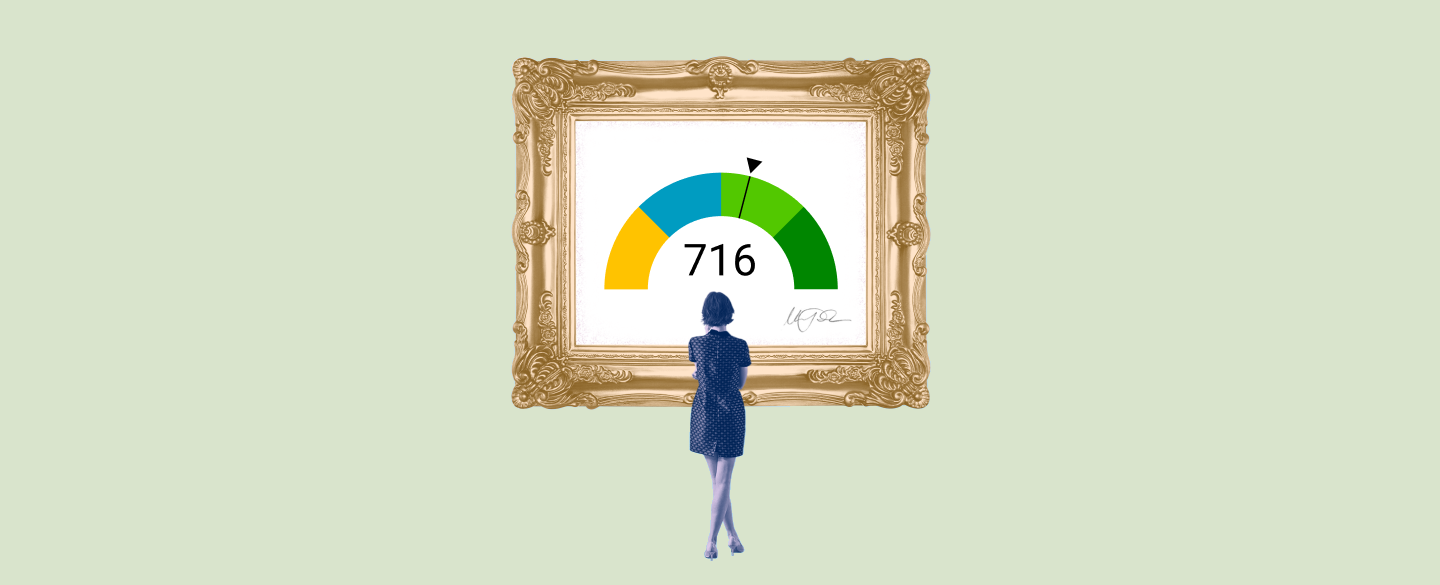

If you’re looking to get a loan, your FICO score is an important factor. The higher your score, the better interest rate you can get – and that’s why understanding what a 716 FICO score means matters. A 716 FICO score is in the upper range of “good” scores, which can help you qualify for more competitive rates on loans and credit cards.

Table Of Content:

- 716 Credit Score: Is it Good or Bad?

- 716 Credit Score: What Does It Mean? | Credit Karma

- 716 Credit Score

- Average U.S. FICO® Score at 716, Indicating Improvement in ...

- 716 Credit Score (+ #1 Way To Improve it )

- Is 716 a good credit score? | Lexington Law

- 716 Credit Score: Is it Good or Bad? (Approval Odds)

- 716 Credit Score – Is it Good or Bad? How to Improve Your 716 ...

- What Is a Good Credit Score? - NerdWallet

- 716 Credit Score - Is it Good or Bad? What does it mean in 2022?

1. 716 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/716-credit-score/ A 716 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 716 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. 716 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/716 Apr 2, 2021 ... A 716 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

Apr 2, 2021 ... A 716 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

3. 716 Credit Score

https://wallethub.com/credit-score-range/716-credit-score/

A 716 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. Average U.S. FICO® Score at 716, Indicating Improvement in ...

https://www.fico.com/blogs/average-us-ficor-score-716-indicating-improvement-consumer-credit-behaviors-despite-pandemic Aug 17, 2021 ... Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic · The FICO Score is a broad-based, ...

Aug 17, 2021 ... Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic · The FICO Score is a broad-based, ...

5. 716 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/716-credit-score

Jul 1, 2022 ... A 716 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 716 Credit Score. Lenders like to ...

6. Is 716 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/716 Oct 11, 2021 ... If you have a credit score of 716, you might be asking yourself, “is 716 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 716, you might be asking yourself, “is 716 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

7. 716 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/716-credit-score/ Is 716 a good credit score? FICO scores range from 300 to 850. As you can see below, a 716 credit score is considered Good.

Is 716 a good credit score? FICO scores range from 300 to 850. As you can see below, a 716 credit score is considered Good.

8. 716 Credit Score – Is it Good or Bad? How to Improve Your 716 ...

https://www.creditrepairexpert.org/716-credit-score/ How to Improve Your 716 FICO Score. Before you can do anything to increase your 716 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 716 FICO Score. Before you can do anything to increase your 716 credit score, you need to identify what part of it needs to be improved, ...

9. What Is a Good Credit Score? - NerdWallet

https://www.nerdwallet.com/article/finance/what-is-a-good-credit-score A good FICO score lies between 670 and 739, according to the company's website. FICO says scores between 580 and 669 are considered "fair" and those between ...

A good FICO score lies between 670 and 739, according to the company's website. FICO says scores between 580 and 669 are considered "fair" and those between ...

10. 716 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/good-credit/716/ Having a 716 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy ...

Having a 716 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy ...

What does a 716 FICO score mean?

A 716 FICO score is considered a “good” credit score. This indicates that you are considered responsible with your credit and have good credit history.

How does a 716 FICO score affect me?

A 716 FICO score means that lenders will view your financial history more favorably than someone with a lower score or worse credit history and may offer loans or lines of credit at more competitive rates.

What should I do if my FICO score is lower than 716?

If your FICO score is lower than 716, there are steps you can take to improve it. These include paying bills on time, reducing debt levels, checking for errors on your reports, signing up for automatic payments and monitoring your accounts regularly.

Are there any other benefits to having a high FICO score?

Yes! Having a high FICO score also helps increase the chances of being approved for new lines of credit or mortgages and even getting lower insurance premiums.

Conclusion:

Achieving a high FICO Score is not an easy task but following these simple steps will help increase your chances of landing competitive interest rates when applying for loans and other services—which makes it well worth the effort!