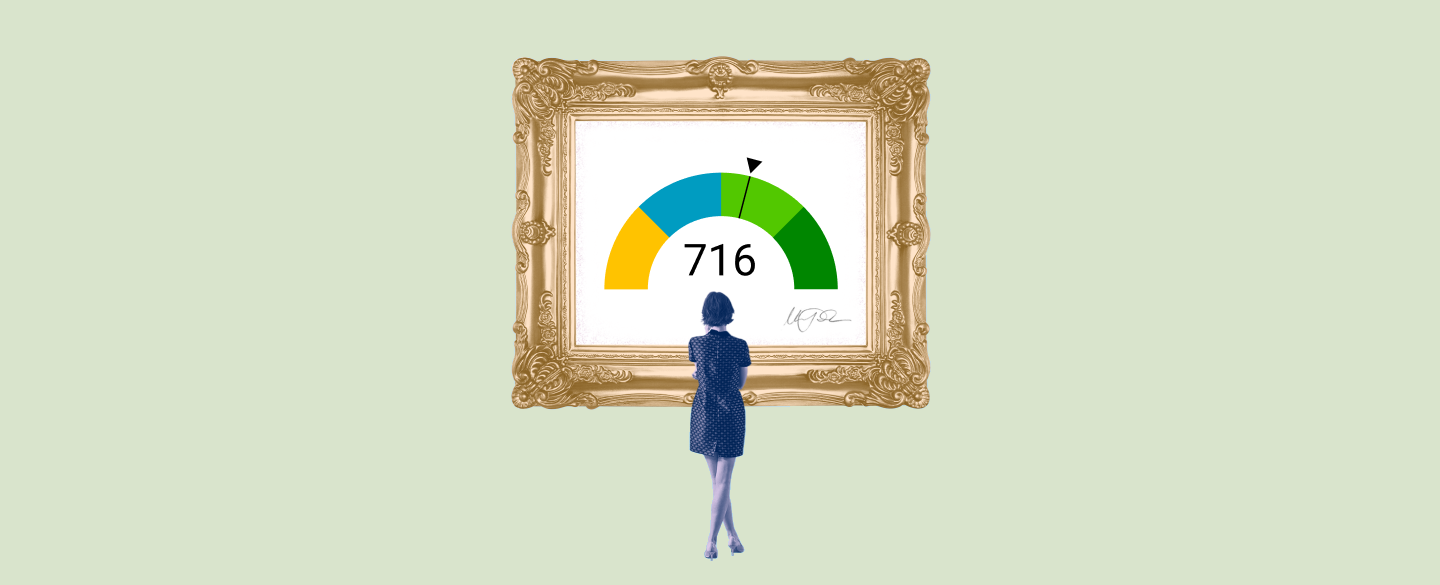

obtaining a car loan with a 716 credit score can be very beneficial. At 716, you are considered to have Good or Very Good credit and will likely qualify for favorable interest rates on your car loan. With a 716 credit score, lenders will consider you less of a risk and provide attractive terms and conditions that will help you purchase the car of your dreams in an affordable way.

Table Of Content:

- 716 Credit Score: Is it Good or Bad?

- 716 Credit Score: What Does It Mean? | Credit Karma

- 716 Credit Score

- Is 716 a good credit score? | Lexington Law

- 716 Credit Score (+ #1 Way To Improve it )

- Car loan interest rates with 716 credit score in 2022

- 716 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 716 Credit Score: Is it Good or Bad? (Approval Odds)

- What Credit Score is Needed to Buy a Car? | LendingTree

- 716 Credit Score: Good or Bad? | Credit Card & Loan Options

1. 716 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/716-credit-score/ 39% Individuals with a 716 FICO® Score have credit portfolios that include auto loan and 31% have a mortgage loan. Public records such as bankruptcies do not ...

39% Individuals with a 716 FICO® Score have credit portfolios that include auto loan and 31% have a mortgage loan. Public records such as bankruptcies do not ...

2. 716 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/716 The best rates for auto loans are typically available to ... that lenders could check, such as FICO® Auto Scores.

The best rates for auto loans are typically available to ... that lenders could check, such as FICO® Auto Scores.

3. 716 Credit Score

https://wallethub.com/credit-score-range/716-credit-score/

A 716 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. Is 716 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/716 Oct 11, 2021 ... A 716 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

Oct 11, 2021 ... A 716 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

5. 716 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/716-credit-score

Jul 1, 2022 ... Trying to qualify for an auto loan with a 716 credit score is relatively cheap. There isn't as much risk for a car lender (which means you get ...

6. Car loan interest rates with 716 credit score in 2022

https://creditscoregeek.com/good-credit/716/auto/ Those with 716 credit score and above will ordinarily meet all requirements for low interest rate auto loans and now and again may stand a chance of using the ~ ...

Those with 716 credit score and above will ordinarily meet all requirements for low interest rate auto loans and now and again may stand a chance of using the ~ ...

7. 716 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/716-credit-score/ The interest rate on the car loan with 716 credit score is 3.9472%, your monthly payment will be $1032.52. The total paid amount will be $37170.63. However, ...

The interest rate on the car loan with 716 credit score is 3.9472%, your monthly payment will be $1032.52. The total paid amount will be $37170.63. However, ...

8. 716 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/716-credit-score/ Can I get an auto loan with a 716 credit score? ... Most auto lenders will lend to someone with a 716 score. However, if you want to ensure you qualify for the ...

Can I get an auto loan with a 716 credit score? ... Most auto lenders will lend to someone with a 716 score. However, if you want to ensure you qualify for the ...

9. What Credit Score is Needed to Buy a Car? | LendingTree

https://www.lendingtree.com/auto/what-credit-score-is-needed-to-buy-a-car/ The higher your credit score, the better the rate you'll get for any loan. A credit score above 660 will typically allow you to ...

The higher your credit score, the better the rate you'll get for any loan. A credit score above 660 will typically allow you to ...

10. 716 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/716/ Nov 11, 2021 ... 716 is a good credit score. Scores in this range are high enough to get most types of credit, but you might not qualify for the best interest ...

Nov 11, 2021 ... 716 is a good credit score. Scores in this range are high enough to get most types of credit, but you might not qualify for the best interest ...

What are some advantages of having a 716 Credit Score when applying for a Car Loan?

Having a Credit Score of 716 can make it easier to qualify for more favorable interest rates, lower down payments, and better repayment terms on your car loan. In addition, you may be able to get approved faster than if you had a lower score.

What types of cars can I buy with my 716 Credit Score?

You should be able to qualify for financing on almost any kind of vehicle with your 716 Credit Score. Whether you’re looking for an economy hatchback or an expensive SUV, lenders should be willing to work with you given your good credit rating.

How long does it take to get approved for a Car Loan with my 716 Credit Score?

The length of time it takes to get approved for a car loan varies depending on the lender and other factors such as income history or debt-to-income ratio. However, since you have good credit at 716, your application is likely to receive priority from lenders and it may take as little as one business day to get approved in some cases.

Will my monthly payments on my Car Loan be higher if I have a 716 Credit Score?

It depends on the type of vehicle loan that you choose and other factors like how long the term is. Generally speaking though, having good credit like yours should allow you to make smaller monthly payments than if your credit was lower at say 600 or below.

Conclusion:

A car loan at a 716 credit score is an excellent opportunity if you are looking into purchasing or leasing an automobile at reasonable terms and conditions. You should have no problem finding great deals from various lenders since they will view you as less of a risk due to your good credit score rating. Make sure to shop around before settling on one offer so that you can find the best option available!