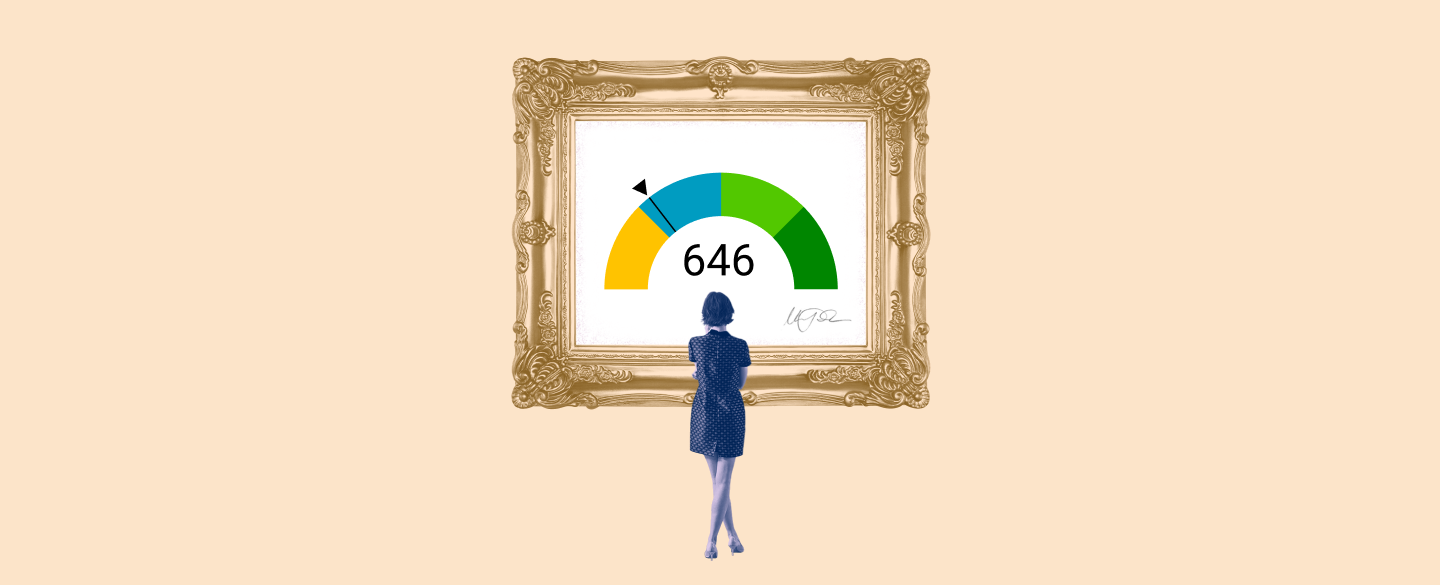

Having a 646 credit score is an important step in reaching financial freedom. It is an indication of your overall ability to handle debt responsibly, which can be an essential part of gaining access to more favorable interest rates, loan offers, and other benefits.

Table Of Content:

- 646 Credit Score: Is it Good or Bad?

- 646 Credit Score: What Does It Mean? | Credit Karma

- Is 646 a Good Credit Score? What It Means, Tips & More

- Is 646 a good credit score? | Lexington Law

- 646 Credit Score (+ #1 Way To Fix It )

- 646 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 646 Credit Score – Is it Good or Bad? How to Improve Your 646 ...

- 646 Credit Score: Good or Bad? | Credit Card & Loan Options

- 646 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- What Is the Average Credit Score in America? | Credit.com

1. 646 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/646-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 646 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 646 FICO® Score is below the average credit score.

2. 646 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/646 Apr 30, 2021 ... A 646 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 646 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

3. Is 646 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/646-credit-score/

A 646 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 646 credit score isn't "bad," ...

4. Is 646 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/646 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

5. 646 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/646-credit-score

Jul 1, 2022 ... A 646 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 646 Credit Score. Lenders ...

6. 646 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/646-credit-score-mortgage/

If your credit score is a 646 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

7. 646 Credit Score – Is it Good or Bad? How to Improve Your 646 ...

https://www.creditrepairexpert.org/646-credit-score/ How to Improve Your 646 FICO Score. Before you can do anything to increase your 646 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 646 FICO Score. Before you can do anything to increase your 646 credit score, you need to identify what part of it needs to be improved, ...

8. 646 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/646/ Nov 9, 2021 ... 646 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 646 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

9. 646 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/646-credit-score/ A 646 credit score is considered as “poor” score. While people with the 646 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 646 credit score is considered as “poor” score. While people with the 646 FICO score won't have as much trouble getting loans as those with lower credit, ...

10. What Is the Average Credit Score in America? | Credit.com

https://www.credit.com/credit-scores/what-is-the-average-credit-score/ Jul 28, 2021 ... In April 2021, that average had risen to 694. That's considered a good VantageScore—in fact, anything over 661 is considered good on the ...

Jul 28, 2021 ... In April 2021, that average had risen to 694. That's considered a good VantageScore—in fact, anything over 661 is considered good on the ...

What factors influence credit scores?

Credit scores are based on a number of factors such as payment history, credit utilization rate, types of accounts held, and credit inquiries. Paying bills on time each month is especially important for maintaining a good score.

How will having a good credit score benefit me?

A good credit score can make it easier to get approved for loans and have access to better interest rates. Having a good score can also help you get better deals when renting or buying things like cars or houses with financing.

How do I improve my 646 credit score?

Some options include making payments on time every month, reducing the amount owed to creditors (debt-to-credit ratio), limiting new account openings, and disputing any inaccuracies on your report.

Conclusion:

Achieving a 646 credit score is a great accomplishment that indicates you can manage debt responsibly. It can open up opportunities in the world of finance and provide greater financial freedom. Taking steps to improve your credit even further is always recommended for long-term success.