Having a good credit score is an important aspect when it comes to managing finances. A 637 credit score is considered to be in the fair range and it is important to strive for higher scores. Knowing how a 637 credit score can affect you can help you stay on top of your financial health.

Table Of Content:

- 637 Credit Score: Is it Good or Bad?

- 637 Credit Score: What Does It Mean? | Credit Karma

- Is 637 a Good Credit Score? Rating, Loans & How to Improve

- Can I get a car loan with a credit score of 637? | Jerry

- 637 Credit Score (+ #1 Way To Fix It )

- Is 637 a good credit score? | Lexington Law

- 637 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 637 Credit Score: Is it Good or Bad? (Approval Odds)

- Credit Score Ranges: What Can a 637 Credit Score Get You ...

- 637 Credit Score – Is it Good or Bad? How to Improve Your 637 ...

1. 637 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/637-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 637 FICO® Score is below the average credit score.

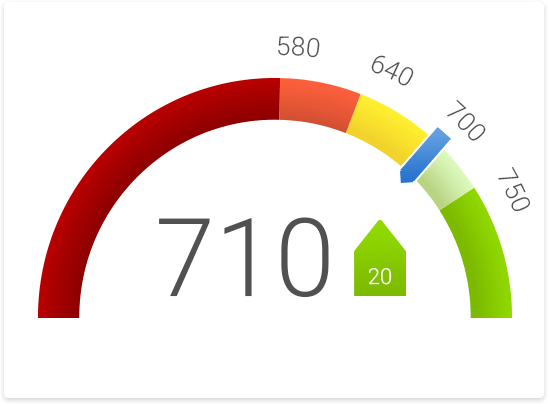

Your score falls within the range of scores, from 580 to 669, considered Fair. A 637 FICO® Score is below the average credit score.

2. 637 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/637 Apr 30, 2021 ... A 637 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 637 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 637 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/637-credit-score/

A credit score of 637 isn't “good.” It's not even “fair.” Rather, a 637 credit score is actually considered “bad,” according to the standard 300 to 850 ...

4. Can I get a car loan with a credit score of 637? | Jerry

https://getjerry.com/questions/can-i-get-a-car-loan-with-a-credit-score-of-637![]() Feb 25, 2022 ... Don't panic, though—you'll definitely be able to get an auto loan with a score of 637. Since a 637 credit score is categorized as nonprime, your ...

Feb 25, 2022 ... Don't panic, though—you'll definitely be able to get an auto loan with a score of 637. Since a 637 credit score is categorized as nonprime, your ...

5. 637 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/637-credit-score

Jun 11, 2022 ... A 637 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 637 Credit Score. Lenders ...

6. Is 637 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/637 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

7. 637 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/637-credit-score-mortgage/

If your credit score is a 637 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

8. 637 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/637-credit-score/ Is 637 a good credit score? FICO scores range from 300 to 850. As you can see below, a 637 credit score is considered Fair.

Is 637 a good credit score? FICO scores range from 300 to 850. As you can see below, a 637 credit score is considered Fair.

9. Credit Score Ranges: What Can a 637 Credit Score Get You ...

https://www.budgetandthebees.com/637-credit-score/ Oct 27, 2020 ... Is 637 a good credit score? 637 is considered to be a poor score. However, the average credit score in the United States is 687. So, if you're ...

Oct 27, 2020 ... Is 637 a good credit score? 637 is considered to be a poor score. However, the average credit score in the United States is 687. So, if you're ...

10. 637 Credit Score – Is it Good or Bad? How to Improve Your 637 ...

https://www.creditrepairexpert.org/637-credit-score/ Before you can do anything to increase your 637 credit score, you need to identify what part of it needs to be ... How to Improve Your 637 FICO Score.

Before you can do anything to increase your 637 credit score, you need to identify what part of it needs to be ... How to Improve Your 637 FICO Score.

How can my 637 credit score affect me?

A 637 credit score can cause difficulties when it comes to applying for loans, making large purchases or even buying a house. Lenders might not extend full terms and conditions due to the fact that this credit score is seen as being in the fair range. It is important to strive for higher scores to have more access to better loan terms and conditions.

What other factors influence my 637 credit score?

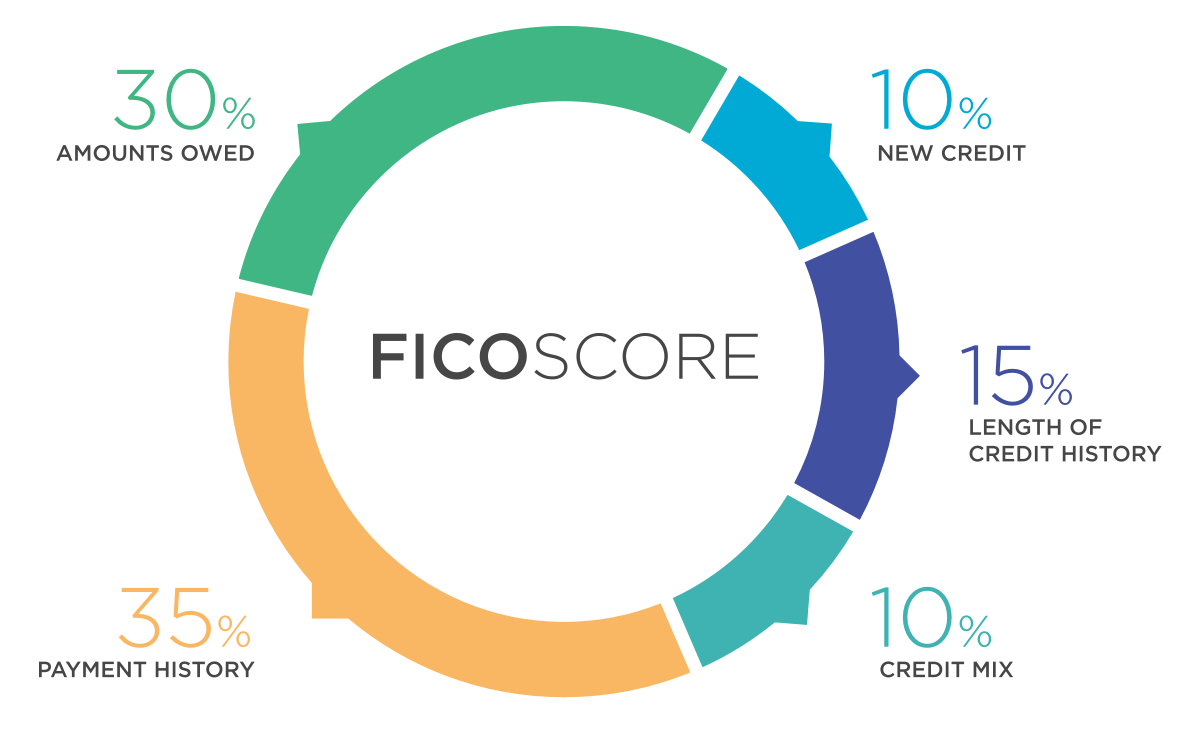

The factors that contribute to your 637 credit score include payment history, the amount of money owed, length of borrowing history, types of accounts owned, new applications for credit etc. Understanding what contributes positively or negatively towards your credit points can help you make appropriate changes in order to reach a better ranking.

What kind of products are available with a 637 credit score?

There are different types of products available depending on what type of borrowing needs you have with this type of credit rating. This includes lines of credits, personal loans, debt consolidation loans and secured cards among others. It’s advisable to do research before deciding which product would best suit your needs as lenders offer different terms and interest rates based on a person's risk profile.

What are some ways I can improve my 637 Credit Score?

Some ways that you can improve your 637 Credit Score include reducing existing debt levels, making all payments on time and in full each month, check your records regularly for mistakes and review them at least once every year using one or more free services such as Experian or Equifax's annual reports. Additionally reviewing any existing loans could result in saving money by switching over from high-interest rate loans into lower interest ones.

Is having a 627 Credit Score bad?

Having a 627 Credit Score partially falls within the average category but having higher scores will help improve chances for getting approved for loan requests and will lead you closer towards achieving financial stability.

Conclusion:

Overall, having a 627 Credit Score may present some difficulties when it comes to loan applications but there are still some possibilities available based on individual situations such as types of accounts owned, length borrowing history etc.; however striving towards achieving higher scores should remain an ultimate goal for future success in obtaining higher rated financial products with much better terms/conditions from lenders.