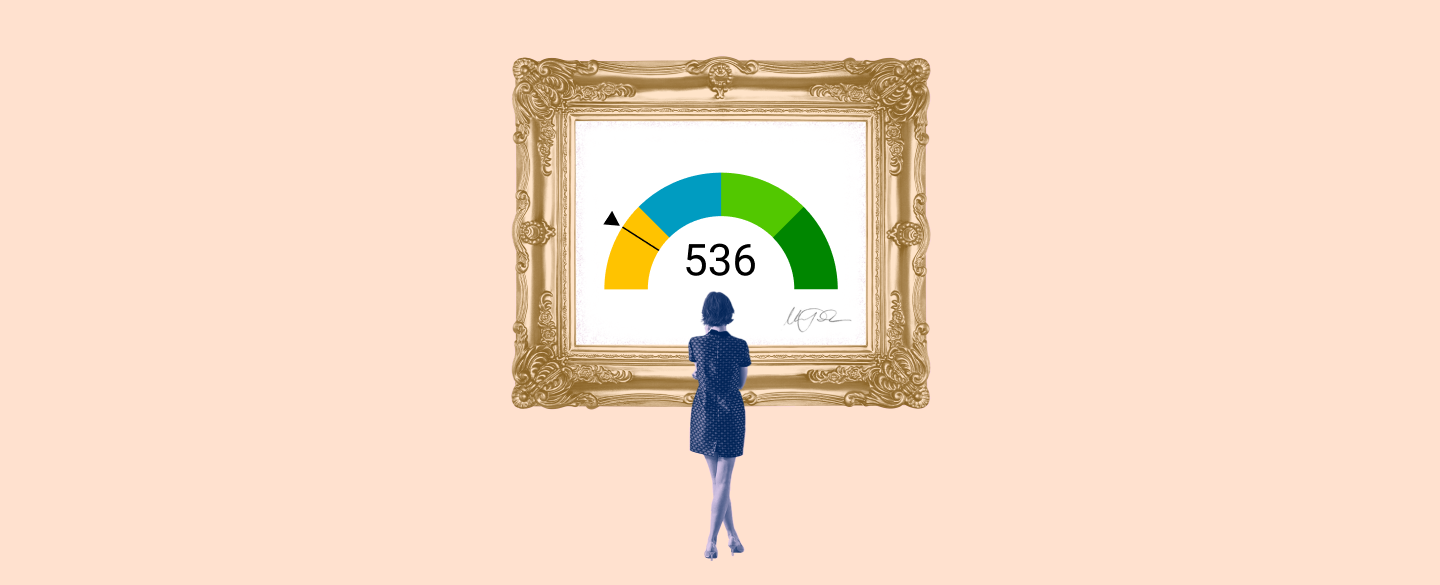

A 536 Credit Score is considered to be a poor score and will generally result in difficulty getting approved for credit cards, securing loans or other forms of credit. It's important to understand what a 536 Credit Score means and how it can affect you financially.

Table Of Content:

- 536 Credit Score: Is it Good or Bad?

- 536 Credit Score: What Does It Mean? | Credit Karma

- 536 Credit Score: Is it Good or Bad? How do I Improve it?

- 536 Credit Score: Good or Bad, Loan Options & Tips

- 536 Credit Score (+ #1 Way To Fix It )

- 536 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 536 a good credit score? | Lexington Law

- 536 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 536 Credit Score: Is it Good or Bad? (Approval Odds)

- Best Personal Loans for 536 Credit Score - CreditScoreGeek

1. 536 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/536-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 536 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 536 FICO® Score is significantly below the average credit score.

2. 536 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/536 May 4, 2021 ... A 536 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

May 4, 2021 ... A 536 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. 536 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/536-credit-score

A 536 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

4. 536 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/536-credit-score/

A 536 credit score is classified as "bad" on the standard 300-to-850 scale. It is 164 points away from being a “good” credit score, which many people use as ...

5. 536 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/536-credit-score

6. 536 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/536/

Nov 8, 2021 ... 536 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a ...

7. Is 536 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/536 Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 536 ) ...

Oct 11, 2021 ... Credit scores typically fall into five categories: very poor, fair, good, very good and exceptional. A score under 580 (such as 536 ) ...

8. 536 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/536-credit-score-mortgage/

Frequently Asked Questions ... Can I get a conventional loan with a 536 credit score? No, the minimum credit score required for a conventional loan is a 620. Can ...

9. 536 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/536-credit-score/ FICO scores range from 300 to 850. As you can see below, a 536 credit score is considered Poor. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 536 credit score is considered Poor. Credit Score, Credit Rating, % of population.

10. Best Personal Loans for 536 Credit Score - CreditScoreGeek

https://creditscoregeek.com/bad-credit/536/personal-loan/ People with 536 credit score can easily access Payday loans without having to worry about their credit and that is why some people feel is a more viable option ...

People with 536 credit score can easily access Payday loans without having to worry about their credit and that is why some people feel is a more viable option ...

What is a 536 Credit Score?

A 536 Credit Score is considered to be a very low score and is likely to result in difficulty getting approved for most forms of credit. This score falls below the average credit score range (620-680) and would make it difficult for lenders to trust that you are a reliable borrower.

What factors influence my credit score?

There are many factors that influence your credit score, such as payment history, amount of debt, length of credit history, type of credit used, new credit inquiries, etc. It's important to review all of these factors thoroughly to understand what may have caused your 536 Credit Score and ways you can improve it over time.

How can I improve my 536 Credit Score?

To improve your 536 Credit Score, start by making consistent payments on all existing debts or accounts in order to build up your payment record. Additionally, reducing the amount of debt owed will also help boost your score over time. Finally, make sure not to apply for too many new accounts at once as this could negatively impact your overall score as well.

What types of loan products am I likely to qualify for with a 536 Credit Score?

Depending on the lender you are applying with and other qualifications such as income and employment status, those with a 536 Credit Score may potentially qualify for some secured loan products such as auto loans or mortgages backed by collateral. Unsecured personal loans may not be readily available due to the high risk posed by this low score range.

Will improving my 536 Credit Score take a long time?

Generally speaking, it takes about 6 months-1 year in order for significant improvements in scores to be seen; however this timeline varies depending on individual circumstances and the steps one takes toward improving their finances and increasing their scores. Making regular payments on time can go along way towards raising your scores within this timeline!

Conclusion:

A 536 Credit Score is considered low but there are things you can do now that can help improve this number over time with persistence and dedication. Paying down debts responsibly while avoiding multiple accounts or late payments should eventually increase your score within 1 year’s time frame if managed correctly.