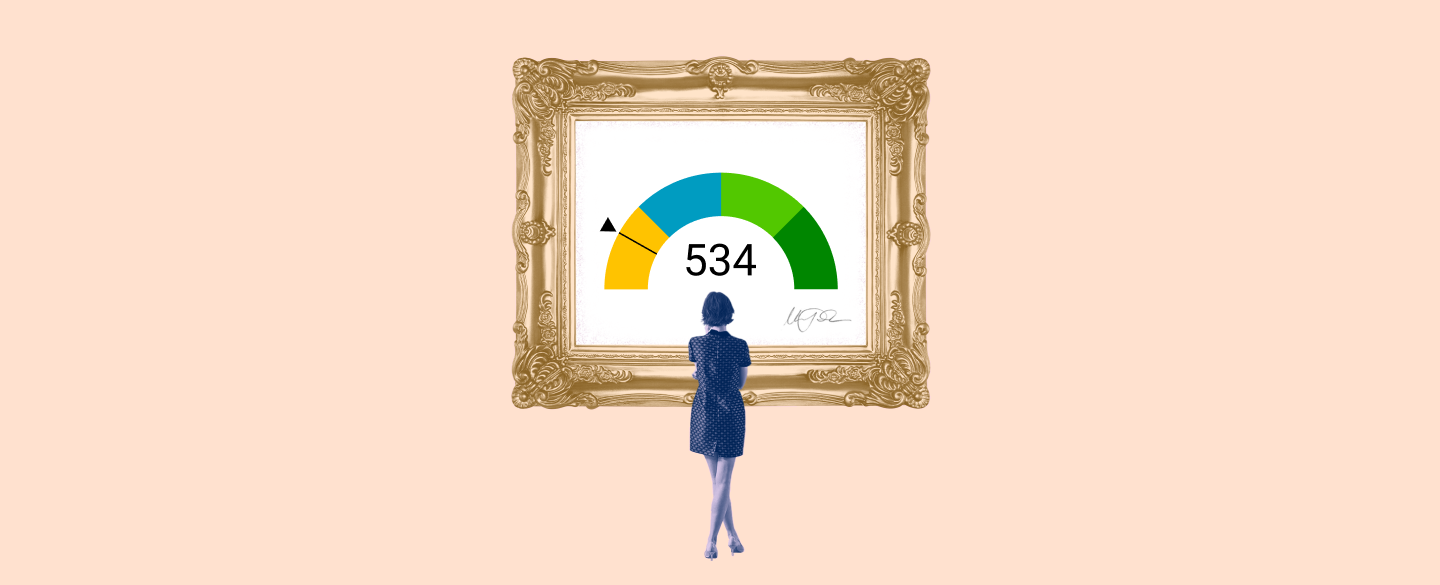

A credit score of 534 is considered to be on the lower end of the FICO (Fair Isaac Corporation) base score range, which goes from 300 to 850. This score indicates that a person's creditworthiness might be poor and lenders may not be willing to extend them any credit. However, it is possible for a person with a 534 credit score to improve their rating and gain access to credit in the future.

Table Of Content:

- 534 Credit Score: Is it Good or Bad?

- 534 Credit Score: What Does It Mean? | Credit Karma

- 534 Credit Score: Good or Bad, Loan Options & Tips

- 534 Credit Score: Is it Good or Bad? How do I Improve it?

- 534 Credit Score (+ #1 Way To Fix It )

- 534 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 534 Credit Score: Good or Bad? | Credit Card & Loan Options

- 534 Credit Score: Is it Good or Bad? (Approval Odds)

- "Where can I get a car loan with a 534 credit score? " | Jerry

- Car loan interest rates with 534 credit score in 2022

1. 534 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/534-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 534 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 534 FICO® Score is significantly below the average credit score.

2. 534 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/534 Apr 30, 2021 ... A 534 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 534 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. 534 Credit Score: Good or Bad, Loan Options & Tips

https://wallethub.com/credit-score-range/534-credit-score/

A 534 credit score is classified as "bad" on the standard 300-to-850 scale. It is 166 points away from being a “good” credit score, which many people use as ...

4. 534 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/534-credit-score

A 534 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

5. 534 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/534-credit-score

Jun 11, 2022 ... Is 534 a Good Credit Score? ... A 534 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

6. 534 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/534-credit-score-mortgage/

Frequently Asked Questions ... Can I get a conventional loan with a 534 credit score? No, the minimum credit score required for a conventional loan is a 620. Can ...

7. 534 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/534/ Nov 8, 2021 ... 534 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a ...

Nov 8, 2021 ... 534 is a bad credit score. It's rated as “poor” by every major credit scoring model. Scores in this range make it difficult to get a ...

8. 534 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/534-credit-score/ Is 534 a good credit score? FICO scores range from 300 to 850. As you can see below, a 534 credit score is considered Poor.

Is 534 a good credit score? FICO scores range from 300 to 850. As you can see below, a 534 credit score is considered Poor.

9. "Where can I get a car loan with a 534 credit score? " | Jerry

https://getjerry.com/questions/where-can-i-get-a-car-loan-with-a-534-credit-score![]() "Where can I get a car loan with a 534 credit score? " "I was told to try a credit union that specializes in bad credit loans, but I was denied. I only need ...

"Where can I get a car loan with a 534 credit score? " "I was told to try a credit union that specializes in bad credit loans, but I was denied. I only need ...

10. Car loan interest rates with 534 credit score in 2022

https://creditscoregeek.com/bad-credit/534/auto/ Find out what auto loan rates your 534 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 534.

Find out what auto loan rates your 534 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 534.

What factors go into calculating a credit score?

Credit scores are calculated based on information contained in one or more of an individual’s credit reports. This data includes payment history, length of time accounts have been open, total debt levels and types of credit used. All of these elements are taken into consideration when determining a person’s overall creditworthiness and their associated score.

How can I improve my 534 FICO Score?

Improving your 534 FICO Score requires making positive changes to your financial behavior. This includes paying all bills on time, reducing outstanding debts and using only low-risk forms of borrowing such as secured loans with collateral. Additionally, it’s important to practice sound money management by creating a budget and limiting spending as much as possible.

Will having bad credit affect my ability to get approved for a loan?

Generally speaking, yes. Lenders use credit scores to determine risk levels so having bad or poor scores makes it more difficult for you to be approved for a loan or line of credit. However, certain lenders do specialize in so-called ‘bad-credit lending’ so it is still possible for you to obtain financing through these avenues if necessary.

Are there other ways besides taking out loans that I can build my financial profile?

Yes, there are several other methods that you can employ in order to build your financial profile outside of taking out loans or lines of credit. One option is opening bank accounts with no fees attached where you can save money over time. Another option is investing small amounts regularly into stocks or mutual funds that have the potential to increase in value over time.

Is having good financial habits enough alone for me to improve my FICO Score?

It depends on how long you have been practicing good financial habits and what type of activity was present prior that period. If you had previously engaged in activities such as late payments or defaults it will take longer than someone who has always maintained a good track record when trying to raise your score.

Conclusion:

While having a 534 FICO Score might seem daunting at first glance, by employing the right tactics it is possible for individuals to turn their situation around and gain access to better terms when applying for financing products in the future. Through actively managing debts, building up savings accounts and investing wisely individuals should begin seeing improvements over time provided they remain consistent in their efforts going forward.