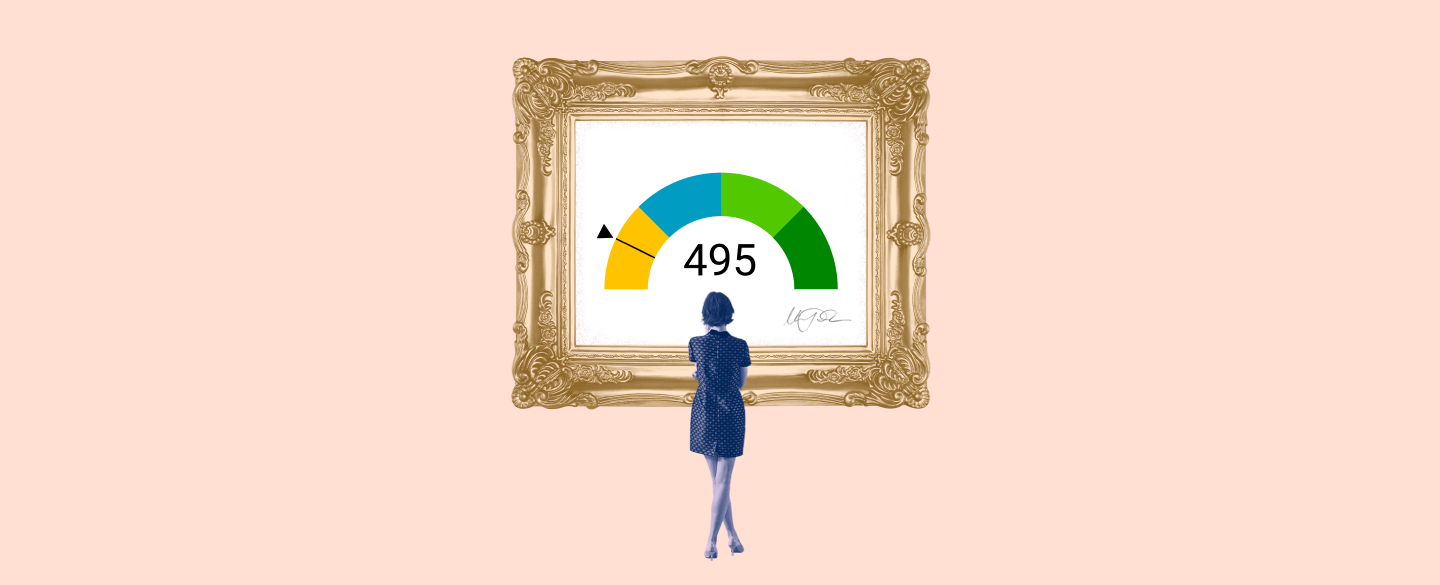

A 495 credit score is a fair credit score. It falls in the lower ranges of what is considered acceptable when looking for loans and other financial products. Having such a score can make obtaining certain types of financing more difficult and costly, so it’s important to work to improve your score.

Table Of Content:

- 495 Credit Score: Is it Good or Bad?

- 495 Credit Score: Borrowing Options & How to Fix

- 495 Credit Score (+ #1 Way To Fix It )

- 495 Credit Score: Is it Good or Bad? How do I Improve it?

- 495 Credit Score: What Does It Mean? | Credit Karma

- 495 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 495 a good credit score? | Lexington Law

- Car loan interest rates with 495 credit score in 2022

- 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

- 8 Best Loans & Credit Cards (450 to 500 Credit Score) - 2022

1. 495 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/495-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 495 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 495 FICO® Score is significantly below the average credit score.

2. 495 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/495-credit-score/

A 495 credit score is a bad credit score, unfortunately, as it's a lot closer to the lowest score possible (300) than the highest credit score (850).

3. 495 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/495-credit-score

Jun 11, 2022 ... Is 495 a Good Credit Score? ... A 495 FICO® Score is considered “Poor”. It means you've had past payment problems, including collection accounts, ...

4. 495 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/495-credit-score

A 495 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

5. 495 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/495 Apr 30, 2021 ... A 495 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 495 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

6. 495 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/495/ Feb 18, 2022 ... 495 is a bad credit score. It's rated as either “poor” or “very poor” by every major credit scoring model. Scores in this range make it ...

Feb 18, 2022 ... 495 is a bad credit score. It's rated as either “poor” or “very poor” by every major credit scoring model. Scores in this range make it ...

7. Is 495 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/495 Oct 11, 2021 ... A score under 580 (such as 495 ) usually falls into the “very poor” category. Having a 495 score likely means you've had a history of poor ...

Oct 11, 2021 ... A score under 580 (such as 495 ) usually falls into the “very poor” category. Having a 495 score likely means you've had a history of poor ...

8. Car loan interest rates with 495 credit score in 2022

https://creditscoregeek.com/bad-credit/495/auto/ Those with 495 score tend to have the most problems when applying and trying to obtain a vehicle loan. It does not matter the type or price of the vehicle they' ...

Those with 495 score tend to have the most problems when applying and trying to obtain a vehicle loan. It does not matter the type or price of the vehicle they' ...

9. 12 Best Loans & Credit Cards for 400 to 450 Credit Scores (2022 ...

https://www.badcredit.org/how-to/loans-credit-cards-for-400-to-450-credit-score/ Consumers with very poor credit scores between 400 and 450 often have their credit applications rejected, according to FICO, a credit scoring agency.

Consumers with very poor credit scores between 400 and 450 often have their credit applications rejected, according to FICO, a credit scoring agency.

10. 8 Best Loans & Credit Cards (450 to 500 Credit Score) - 2022

https://www.cardrates.com/advice/450-500-credit-score/ Sep 24, 2019 ... 8 Best Loans & Credit Cards for a 450 to 500 Credit Score · 1. Fingerhut Credit Account · 2. Capital One Platinum Secured Credit Card · 3. Brink's ...

Sep 24, 2019 ... 8 Best Loans & Credit Cards for a 450 to 500 Credit Score · 1. Fingerhut Credit Account · 2. Capital One Platinum Secured Credit Card · 3. Brink's ...

What does a 495 credit score mean?

A 495 credit score is a fair credit score and is on the lower end of the accepted range for obtaining loans or other financial products.

How can I improve my 495 credit score?

There are several strategies you can use to help improve your 495 credit score, such as making sure you pay all bills on time, checking your reports regularly for errors, and keeping your utilization ratio low. Additionally, you may want to look into debt consolidation or setting up automatic payments with lenders.

What kind of interest rate will I get with a 495 credit score?

With a 495 credit score, you may be offered higher interest rates than borrowers with higher scores due to increased risk. However, rates vary widely depending on various factors such as income level, loan type, and location.

Conclusion:

Maintaining good financial health is important no matter what your current situation is. Understanding your 495 credit score gives you the opportunity to make smart decisions about how best to improve it going forward. Taking steps towards boosting this number may allow access to better loan options at more favorable terms in the future.