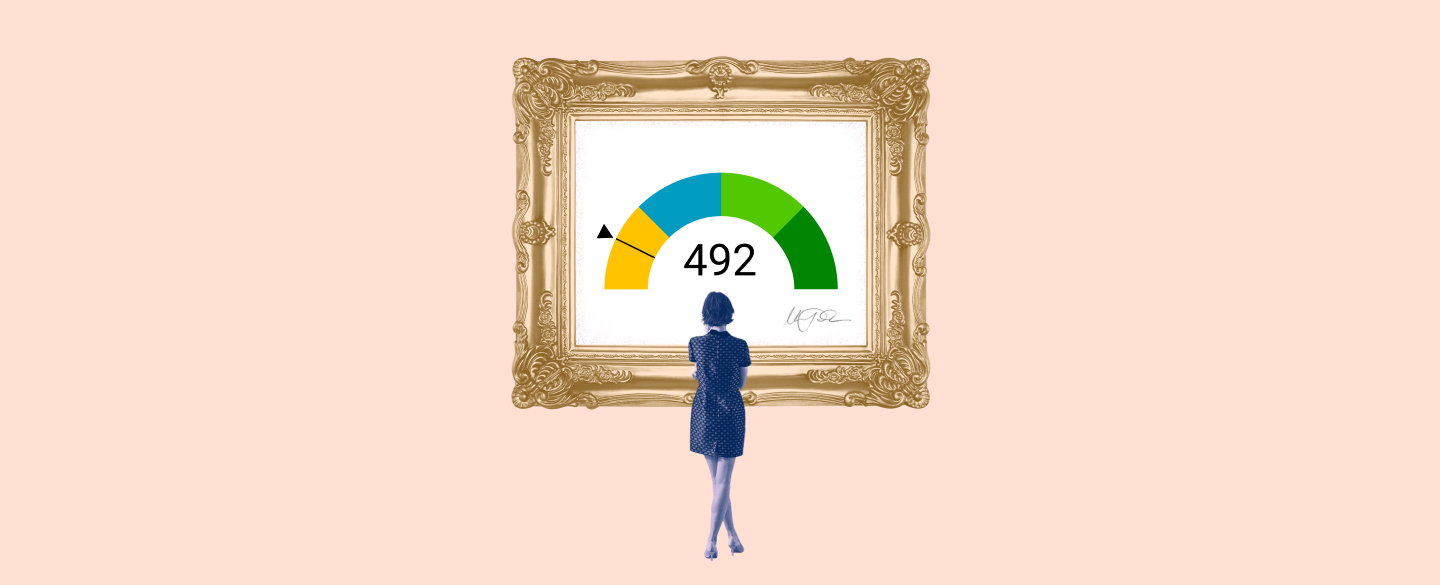

A credit score is used by lenders to assess the creditworthiness of an individual. A score of 492 is considered a very poor score and indicates high levels of financial risk. Individuals with this score may find it difficult to gain access to loan products, as a result of their low creditworthiness.

Table Of Content:

- 492 Credit Score: Is it Good or Bad?

- 492 Credit Score: Borrowing Options & How to Fix

- 492 Credit Score: Is it Good or Bad? How do I Improve it?

- 492 Credit Score: What Does It Mean? | Credit Karma

- Is 492 a good credit score? | Lexington Law

- 492 Credit Score: Good or Bad? | Credit Card & Loan Options

- Car loan interest rates with 492 credit score in 2022

- 492 Credit Score: Is it Good or Bad? (Approval Odds)

- Best Personal Loans for 492 Credit Score - CreditScoreGeek

- 492 Credit Score – Is it Good or Bad? How to Improve Your 492 ...

1. 492 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/492-credit-score/ Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 492 FICO® Score is significantly below the average credit score.

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 492 FICO® Score is significantly below the average credit score.

2. 492 Credit Score: Borrowing Options & How to Fix

https://wallethub.com/credit-score-range/492-credit-score/

A 492 credit score is a bad credit score, unfortunately, as it's a lot closer to the lowest score possible (300) than the highest credit score (850).

3. 492 Credit Score: Is it Good or Bad? How do I Improve it?

https://www.joinharvest.com/credit-scores/492-credit-score

A 492 credit score is a poor credit score. It makes it very difficult to qualify for credit or even apply for an apartment but it can absolutely be ...

4. 492 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/492 May 4, 2021 ... A 492 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

May 4, 2021 ... A 492 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

5. Is 492 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/492 Oct 11, 2021 ... So, what does having a credit score of 492 mean for you? Essentially, when it comes to applying for loans, you're unlikely to qualify for many.

Oct 11, 2021 ... So, what does having a credit score of 492 mean for you? Essentially, when it comes to applying for loans, you're unlikely to qualify for many.

6. 492 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/492/ Feb 18, 2022 ... 492 is a bad credit score. It's rated as either “poor” or “very poor” by every major credit scoring model. Scores in this range make it ...

Feb 18, 2022 ... 492 is a bad credit score. It's rated as either “poor” or “very poor” by every major credit scoring model. Scores in this range make it ...

7. Car loan interest rates with 492 credit score in 2022

https://creditscoregeek.com/bad-credit/492/auto/ Find out what auto loan rates your 492 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 492.

Find out what auto loan rates your 492 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 492.

8. 492 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/492-credit-score/ FICO scores range from 300 to 850. As you can see below, a 492 credit score is considered Poor. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 492 credit score is considered Poor. Credit Score, Credit Rating, % of population.

9. Best Personal Loans for 492 Credit Score - CreditScoreGeek

https://creditscoregeek.com/bad-credit/492/personal-loan/ People with 492 credit score can easily access Payday loans without having to worry about their credit and that is why some people feel is a more viable option ...

People with 492 credit score can easily access Payday loans without having to worry about their credit and that is why some people feel is a more viable option ...

10. 492 Credit Score – Is it Good or Bad? How to Improve Your 492 ...

https://www.creditrepairexpert.org/492-credit-score/ Before you can do anything to increase your 492 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

Before you can do anything to increase your 492 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

Is a 492 credit score good?

No, a 492 credit score is considered poor and indicates that you are highly likely to default on any loan products you apply for.

What types of loan products will I be able to access with a 492 credit score?

Depending on the lender, individuals with scores this low may not be able to access any loan products at all. It's possible that some lenders may offer secured loans or payday loans at very high rates of interest - however, these should usually be avoided if other options are available.

How can I improve my 492 credit score?

Improving your credit score takes time and commitment - it’s important to ensure you make payments promptly each month and stay within your agreed borrowing limits. Also consider getting on the electoral roll and using a 'credit builder' card or loan if you’re having difficulties gaining access to more traditional lending sources.

What factors influence credit scores?

Credit scoring systems take into account several different factors when calculating an individual's overall credit rating - such as payment history, current debt levels, length of borrowing history and type of borrowing being undertaken. Additionally, there are also non-payment related factors which can impact an individual's overall rating - such as address or employment history.

Conclusion:

Individuals with a 492 credit score are likely to face significant challenges when attempting to secure finance through traditional means due to their low level of financial risk attached with them. That said, it’s still possible for those in this position to make improvements over time by making payments on time each month and utilising specialist services where necessary.