FHA Loans Gainesville FL is an affordable loan program offering housing loans for those meeting the specific income-to-debt ratio established by the Florida Housing Finance Corporation. Offering low closing costs and a lower down payment than conventional mortgages, FHA loans are designed to help homebuyers achieve financial stability.

Table Of Content:

- FHA Loan Requirements in Gainesville, FL

- Mortgage Lender | Chris Doering Mortgage | Gainesville, FL

- FHA Loan Limits for FLORIDA

- FHA Home Loan in Gainesville, Florida - USA Home Financing

- Homeownership Assistance: Florida | HUD.gov / U.S. Department of ...

- Gainesville, Ocala FHA Mortgage Loan Application - FHA Mortgage ...

- Contact HUD: Florida | HUD.gov / U.S. Department of Housing and ...

- The Full List of Florida FHA Loan Requirements: Important FHA ...

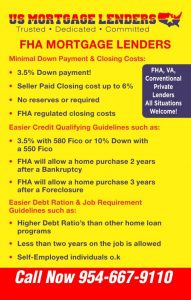

- Gainesville FL FHA Mortgage 3.5% W/580C /10% Dwn W/Min+ ...

- Condominiums

1. FHA Loan Requirements in Gainesville, FL

https://gainesvillemortgageloans.com/fha-loan-requirements/ FHA Loan Requirements in Gainesville, FL · Credit Requirements. FHA typically requires a 580 credit score. · Income Requirements. You will need to have two years ...

FHA Loan Requirements in Gainesville, FL · Credit Requirements. FHA typically requires a 580 credit score. · Income Requirements. You will need to have two years ...

2. Mortgage Lender | Chris Doering Mortgage | Gainesville, FL

https://mygatormortgage.com/ Chris Doering Mortgage is North Central Florida's expert for home refinancing, FHA, VA, jumbo, or conventional loans and more! Contact us to get started.

Chris Doering Mortgage is North Central Florida's expert for home refinancing, FHA, VA, jumbo, or conventional loans and more! Contact us to get started.

3. FHA Loan Limits for FLORIDA

https://www.fha.com/lending_limits_state?state=FLORIDA Lending Limits for FHA Loans in FLORIDA Counties. FHA mortgage lending limits in FLORIDA vary based on a variety of housing types and ... GAINESVILLE, FL.

Lending Limits for FHA Loans in FLORIDA Counties. FHA mortgage lending limits in FLORIDA vary based on a variety of housing types and ... GAINESVILLE, FL.

4. FHA Home Loan in Gainesville, Florida - USA Home Financing

https://usahomefinancing.com/fha-loan/gainesville-florida-fha-home-loans/

FHA loans provide a great opportunity to buy a home in Gainesville, Florida. One of the reasons that FHA loans are so popular is because of the low down ...

5. Homeownership Assistance: Florida | HUD.gov / U.S. Department of ...

https://www.hud.gov/states/florida/homeownership/buyingprgms

Florida Housing Finance Corporation - call (800) 814-HOME (4663) for info on first-time homebuyer programs, lower interest rate loans and purchase ...

6. Gainesville, Ocala FHA Mortgage Loan Application - FHA Mortgage ...

https://www.fhamortgagesource.com/gainesville-ocala-fha-mortgage-loan-application/ The entire FHA application & closing process here in Florida takes about 3 weeks to a month to complete. Gainesville and Ocala home buyers that want to start ...

The entire FHA application & closing process here in Florida takes about 3 weeks to a month to complete. Gainesville and Ocala home buyers that want to start ...

7. Contact HUD: Florida | HUD.gov / U.S. Department of Housing and ...

https://www.hud.gov/states/florida/offices

In Florida, offices are located in Jacksonville and Miami. For questions about FHA loans or programs, contact our FHA Resource Center:.

8. The Full List of Florida FHA Loan Requirements: Important FHA ...

https://www.sccu.com/about-sccu/articles/blog/2022/the-full-list-of-florida-fha-loan-requirements Jan 24, 2022 ... FHA Required Documents · 1) Minimum of two established credit accounts (for example, loans or credit cards) and not have any delinquent federal ...

Jan 24, 2022 ... FHA Required Documents · 1) Minimum of two established credit accounts (for example, loans or credit cards) and not have any delinquent federal ...

9. Gainesville FL FHA Mortgage 3.5% W/580C /10% Dwn W/Min+ ...

https://www.fhamortgageprograms.com/florida/gainesville-fl-fha-mortgage-lenders/ GAINESVILLE FLORIDA FHA MORTGAGE LOANS ARE EASY TO QUALIFY FOR BECAUSE YOU CAN: · Purchase a Florida home 12 months after a chapter 13 Bankruptcy · Purchase a ...

GAINESVILLE FLORIDA FHA MORTGAGE LOANS ARE EASY TO QUALIFY FOR BECAUSE YOU CAN: · Purchase a Florida home 12 months after a chapter 13 Bankruptcy · Purchase a ...

10. Condominiums

https://entp.hud.gov/idapp/html/condlook.cfm

Condominiums. The Condominiums page allows users to search for FHA-approved condominium projects by location, name, or status. These properties are not for ...

What type of properties are eligible for FHA loans?

FHA Loans Gainesville FL are available on single family homes, multi-family homes, manufactured homes and condominiums, as long as they meet certain criteria.

What are the credit score requirements for an FHA loan in Gainesville?

The minimum credit score for an FHA loan in Gainesville is 620. Other requirements may apply based on each borrower's unique situation.

Are there limits on what I can borrow with an FHA Loan?

Yes, there are limits on how much you can borrow with an FHA Loan in Gainesville. Depending on housing prices in your area, you could qualify for a loan up to $314,827 for a single-family home.

Do I have to pay any out of pocket expenses to get an FHA Loan?

There may be some out of pocket expenses required such as repairs or cosmetic improvements needed prior to closing, but generally no down payment is required with FHA loans.

What is the process like if I am interested in taking out an FHA Loan in Gainesville?

Once you have met the eligibility requirements and have chosen a lender approved by the Florida Housing Finance Corporation, you will need to provide necessary documentation regarding income and employment history so that the lender can determine whether or not you qualify for the loan amount requested and establish a payment plan if applicable.

Conclusion:

With its competitive interest rates and flexible credit score requirements, FHA Loans Gainesville FL offers borrowers from all walks of life access to secure home financing options with minimal down payments and closing costs. Whether you're looking for your first home or refinancing an existing mortgage, these unique loans make it easier than ever before!