A Charitable Lead Annuity Trust (CLAT) is a type of trust that enables the donor to make tax-free gifts to charity. It enables the donor to pass on assets to designated charities and heirs while maximizing tax savings. The CLAT Calculator will help you calculate the income, estate, and charitable tax impact of establishing a CLAT.

Table Of Content:

- Charitable Lead Annuity Trust Calculator

- GiftLaw Calculator - Lead Annuity Trust for Term of 1-35 Years

- Charitable Lead Annuity Trust Calculator | The Institute for Justice

- Charitable Lead Annuity Trust | Gift Illustrator

- Gift Calculator | American Heart Association

- Charitable Lead Annuity Trust Gift Calculator | AACR Foundation

- Charitable Remainder Annuity Trust Calculator | Oregon State ...

- Grantor Charitable Lead Annuity Trust - Term Certain | Greenpeace

- Charitable Remainder Trust Calculator

- Now is the Time to Do the Math on Charitable Lead Trusts | Office of ...

1. Charitable Lead Annuity Trust Calculator

https://americanheart.planyourlegacy.org/calc-clat.php

Charitable Lead Annuity Trust Calculator. Please click the button below to open the calculator. Wills, Trusts, and Annuities.

2. GiftLaw Calculator - Lead Annuity Trust for Term of 1-35 Years

https://crescendointeractive.com/?pageID=49

The choice of payment frequency does affect the amount of the charitable deduction as the more frequent the payment (i.e. monthly as opposed to annually), ...

3. Charitable Lead Annuity Trust Calculator | The Institute for Justice

https://ij.plannedgiving.org/clt/calculator Charitable Lead Annuity Trust Calculator. You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust ...

Charitable Lead Annuity Trust Calculator. You can greatly reduce or even eliminate gift and estate tax on trust assets passing to family…if some trust ...

4. Charitable Lead Annuity Trust | Gift Illustrator

https://web.giftillustrator.com/Calculator/Production/clat.html

Charitable Lead Annuity Trust. Step 1: Calculate the Payments Based On: Use slider bar to select your age at the time of donation or the number of years you ...

5. Gift Calculator | American Heart Association

https://www.heart.org/en/get-involved/ways-to-give/wills-trusts-annuities/charitable-estate-planning-tools-and-resources/gift-calculator May 8, 2020 ... Charitable Remainder Annuity Trust (link opens in new window)- A great way to provide yourself or your beneficiaries with a steady, fixed amount ...

May 8, 2020 ... Charitable Remainder Annuity Trust (link opens in new window)- A great way to provide yourself or your beneficiaries with a steady, fixed amount ...

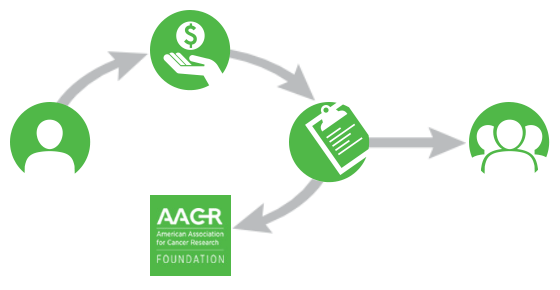

6. Charitable Lead Annuity Trust Gift Calculator | AACR Foundation

https://www.aacr.org/ways-to-give/plan-your-legacy/giving-that-provides-income/charitable-lead-trust/charitable-lead-annuity-trust-gift-calculator/ The calculator illustrates the income and tax benefits to which you may be entitled if you establish a charitable lead trust to benefit the AACR Foundation.

The calculator illustrates the income and tax benefits to which you may be entitled if you establish a charitable lead trust to benefit the AACR Foundation.

7. Charitable Remainder Annuity Trust Calculator | Oregon State ...

https://osufoundation.plannedgiving.org/crat/calculator Charitable Remainder Annuity Trust Calculator. A great way to make a gift to Oregon State University Foundation, receive fixed payments, and defer or ...

Charitable Remainder Annuity Trust Calculator. A great way to make a gift to Oregon State University Foundation, receive fixed payments, and defer or ...

8. Grantor Charitable Lead Annuity Trust - Term Certain | Greenpeace

https://greenpeace.givingplan.net/node/961

12. Income tax deduction, $752,206.40. NOTE: This calculation is provided for educational purposes only. The type of assets transferred, the actual date of ...

9. Charitable Remainder Trust Calculator

https://iqcalculators.com/calculator/charitable-remainder-trust/ In a charitable remainder uni-trust, income will be taken at least annually as a percentage of the fair value of the trust assets. Each year, a fair value of ...

In a charitable remainder uni-trust, income will be taken at least annually as a percentage of the fair value of the trust assets. Each year, a fair value of ...

10. Now is the Time to Do the Math on Charitable Lead Trusts | Office of ...

https://planyourlegacy.berkeley.edu/now-time-do-math-charitable-lead-trusts A Charitable Lead Trust (CLT) is a gift of cash or other property to an irrevocable ... CLUTs (that is, on charitable lead annuity trusts as opposed to ...

A Charitable Lead Trust (CLT) is a gift of cash or other property to an irrevocable ... CLUTs (that is, on charitable lead annuity trusts as opposed to ...

What is a Charitable Lead Annuity Trust?

A Charitable Lead Annuity Trust (CLAT) is an irrevocable trust where one or more annual annuity payments are made to charity for a term of years, after which the principal passes back to the donor or other beneficiaries. The donor receives a federal income tax deduction for the current year’s gift, plus appreciation in value since commissioning of the trust.

How does the CLAT Calculator help me?

The CLAT Calculator enables donors to assess their potential income, estate and charitable tax savings from establishing a CLAT. It provides an easy-to-use GUI that allows users to enter data quickly and accurately into its calculation engine to determine their anticipated financial benefits from utilizing this type of trust.

What types of assets can be used for funding a Charitable Lead Annuity Trust?

A variety of asset types including cash, marketable securities, property and life insurance policies can be transferred into a CLAT as contributions by gift or purchase for funding purposes.

How much money might I save by setting up a Charitable Lead Annuity Trust?

The amount of money saved depends on your individual situation; however, it could potentially result in substantial savings due to avoided taxes on principal returns as well as estate taxes associated with transferring wealth between generations. The CLAT Calculator can provide an estimate of potential costs and/or savings realized from this transaction.

Are there any additional benefits associated with setting up a Charitable Lead Annuity Trust?

In addition to tax savings available through this arrangement, donors may create ongoing relationships with non-profit organizations they otherwise would not have had access to through other charitable giving vehicles as well as create significant legacy opportunities such as memorials or scholarships named after them or their families.

Conclusion:

: Establishing a Charitable Lead Annuity Trust offers many benefits including potential tax savings along with legacy building opportunities such as naming charities or creating memorials dedicated in memory of loved ones. The CLAT calculator provides donors with invaluable insight on how they stand to benefit from this type of trust setup so that they may make informed decisions about their wealth transition planning strategies!