Boost Loans, is a digital lending platform that provides fast and easy online loans at competitive interest rates. The company has been in business since 2019 and offers a wide array of loan solutions designed to meet your financial needs. Boost Loans reviews have shown that customers are happy with the services they receive and appreciative of how quickly their loan applications are processed.

Table Of Content:

- Online Installment Loans & Cash Advance - BoostFinance.com

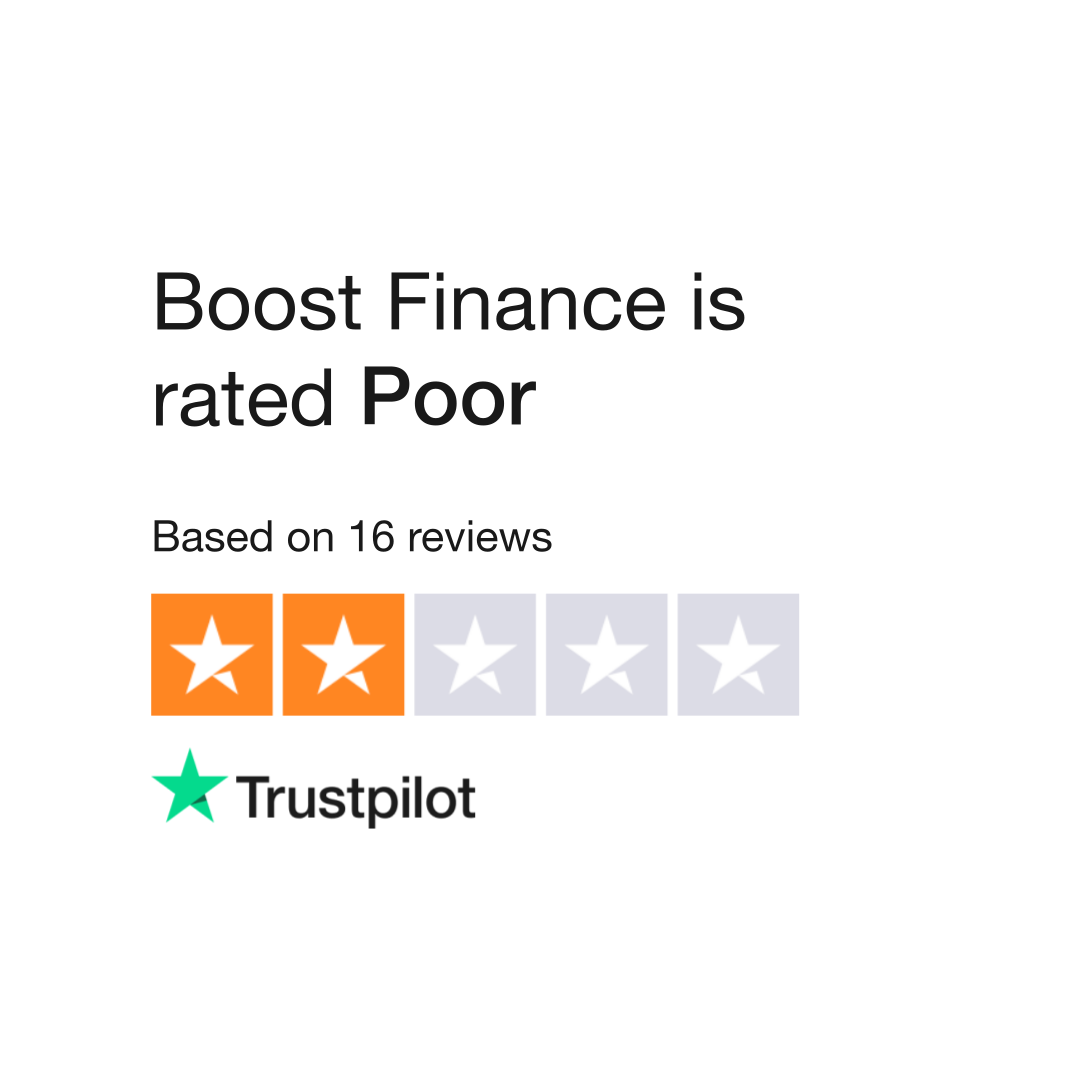

- Boost Finance | Reviews | Better Business Bureau® Profile

- Read Customer Service Reviews of boost-finance.co

- Boost Finance | Better Business Bureau® Profile

- Experian Boost Review: What the Credit Booster Can and Can't Do

- Experian Boost - Improve Your Credit Scores Instantly for Free

- boost loans Reviews | Contact boost loans - Financial Services - 4 ...

- Boost Credit Line

- Experian Boost Review: Who Should Use It? – Forbes Advisor

- I Tried Experian Boost Three Times – Here's How It's Helped My ...

1. Online Installment Loans & Cash Advance - BoostFinance.com

https://www.boostfinance.com/ Apply for an Installment Loan with Boost Finance to get your money today. ... We may review your credit attributes in order to determine your eligibility ...

Apply for an Installment Loan with Boost Finance to get your money today. ... We may review your credit attributes in order to determine your eligibility ...

2. Boost Finance | Reviews | Better Business Bureau® Profile

https://www.bbb.org/us/tx/texarkana/profile/payday-loans/boost-finance-1015-90026929/customer-reviews Their fees are outrageous. I received a loan for $400. Made my first payment of $125 and as I attempted to pay off the full amount of my loan, they charged me ...

Their fees are outrageous. I received a loan for $400. Made my first payment of $125 and as I attempted to pay off the full amount of my loan, they charged me ...

3. Read Customer Service Reviews of boost-finance.co

https://www.trustpilot.com/review/boost-finance.co

4. Boost Finance | Better Business Bureau® Profile

https://www.bbb.org/us/tx/texarkana/profile/payday-loans/boost-finance-1015-90026929 This organization is not BBB accredited. Payday Loans in Texarkana, TX. See BBB rating, reviews, complaints, & more.

This organization is not BBB accredited. Payday Loans in Texarkana, TX. See BBB rating, reviews, complaints, & more.

5. Experian Boost Review: What the Credit Booster Can and Can't Do

https://www.businessinsider.com/personal-finance/experian-boost-reviewJun 4, 2020 ... Experian Boost is a free service and using it can't hurt your credit score, so there's no harm in giving it a try. The chances are that some of ...

6. Experian Boost - Improve Your Credit Scores Instantly for Free

https://www.experian.com/consumer-products/score-boost.html You got a boost. *Credit score calculated based on FICO® Score 8 model. Your lender or insurer ...

You got a boost. *Credit score calculated based on FICO® Score 8 model. Your lender or insurer ...

7. boost loans Reviews | Contact boost loans - Financial Services - 4 ...

https://www.hellopeter.com/boost-loans boost loans reviews, customer feedback & support. Contact & review boost loans.

boost loans reviews, customer feedback & support. Contact & review boost loans.

8. Boost Credit Line

https://www.boostcreditline.com/Faq.aspx

Boost offers consumer installment loans, which are also known as personal loans. An installment or personal loan is a loan that is repaid over time with a ...

9. Experian Boost Review: Who Should Use It? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/experian-boost-review/ Jun 25, 2022 ... Finance, CBS News Radio and more. I'm currently based in Paris, France where I am pursuing my master's degree in communication studies. Follow ...

Jun 25, 2022 ... Finance, CBS News Radio and more. I'm currently based in Paris, France where I am pursuing my master's degree in communication studies. Follow ...

10. I Tried Experian Boost Three Times – Here's How It's Helped My ...

https://www.bankrate.com/finance/credit-cards/experian-boost-helped-my-credit/ Jan 27, 2021 ... You might be wondering how exactly Experian Boost works and whether ... Any opinions, analyses, reviews or recommendations expressed in this ...

Jan 27, 2021 ... You might be wondering how exactly Experian Boost works and whether ... Any opinions, analyses, reviews or recommendations expressed in this ...

What types of loans can I get from Boost Loans?

Boost Loans offer personal loans, business expansion loans, debt consolidation loans, and auto refinance loans. All loans come with competitive interest rates and flexible repayment options.

How long does it take to get approved?

Most loan applications for Boost Loans go through an automated decision process within minutes on working days; however, manual verification may require additional time.

Is there any penalty for early repayment?

No, there is no penalty associated with paying off your loan balance in full before the due date set by the lender. In fact, it can save you money in the long run as you will avoid accumulating extra interest charges.

Does Boost Loans require collateral for its loan products?

No, all Boost Loan products are unsecured which means that no collateral or security is required for approval. Customers should note however that missed payments could result in credit damage or affect future borrowing ability.

Does Boost Loans charge any fees?

Yes. Besides interest, customers may be required to pay origination fees and late payment penalties depending on the type of loan product selected and their own circumstances.

Conclusion:

Boost Loans offers an extensive range of loan options with competitive interest rates backed up by excellent customer service reviews. With quick application processing times and flexible repayment options available for each product, customers can be sure that they’re making smart financial decisions when taking out a Boost Loan.