Why Dave Ramsey Book For Beginners Is Necessary?

Best dave ramsey book for beginners is one of the most important steps in taking control of your finances. It can be overwhelming to figure out where to start when it comes to money management, but this book provides a great foundation. Dave Ramsey provides readers with practical advice on how to save money, get out of debt, and invest for the future. This book is essential for anyone who wants to get their finances in order and take control of their financial future.

Our Top Picks For Best Dave Ramsey Book For Beginners

Best Dave Ramsey Book For Beginners Guidance

The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Most people have no clue how to get their finances in order. It’s no wonder that money is one of the top sources of stress in America. If you’re feeling overwhelmed by your finances, The Total Money Makeover: Classic Edition by Dave Ramsey is a great place to start.

The book is a step-by-step guide to getting your finances in order, with Ramsey’s trademark humor and common sense advice. Ramsey provides practical advice on topics like budgeting, saving for retirement, and avoiding debt. He also debunks common financial myths and provides motivation to stay on track.

If you’re looking for a comprehensive guide to Financial Fitness, The Total Money Makeover: Classic Edition is a great choice.

Common Questions on The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Why We Like This

1. The Total Money Makeover: Classic Edition is a great pick for those looking to whip their finances into shape.

2. The book provides a proven plan for financial fitness, so you can be sure to see results.

3. With clear and concise advice, The Total Money Makeover: Classic Edition is easy to follow and implement.

4. By following the plan laid out in the book, you can be debt free and on your way to financial freedom.

5. The Total Money Makeover: Classic Edition is a must read for anyone serious about taking control of their finances.

Additional Product Information

| Height | 9.5 Inches |

| Length | 7.67 Inches |

| Weight | 1.40875385418 Pounds |

Clever Fox Budget Planner – Undated – Expense Tracker Notebook. Monthly Budgeting Journal, Finance Planner & Accounts Book to Take Control of Your Money. Start Anytime. A5 Size Royal Blue Hardcover

The Clever Fox Budget Planner is an excellent way to take control of your finances and achieve your financial goals. This budgeting journal has a hardcover with an elastic band, a pen holder, a pocket for bills and receipts, 3 bookmarks, and thick 120gsm no-bleed paper. This finance planner is A5 size, measuring 58 inches wide and 83 inches long. The Clever Fox Budget Planner comes with 86 bonus stickers and a detailed user guide with step-by-step instructions.

Common Questions on Clever Fox Budget Planner – Undated – Expense Tracker Notebook. Monthly Budgeting Journal, Finance Planner & Accounts Book to Take Control of Your Money. Start Anytime. A5 Size Royal Blue Hardcover

• What is the Clever Fox Budget Planner?The Clever Fox Budget Planner is a monthly budgeting journal, finance planner, and accounts book that helps you take control of your money. It has a royal blue hardcover and an A5 size. You can start using it anytime.

• How does the Clever Fox Budget Planner help you take control of your money?

The Budget Planner has a section for income, expenses, and debts. This lets you easily see where your money is going and where you need to cut back. It also has a notes section where you can track your progress and make changes to your budget.

• What size is the Clever Fox Budget Planner?

The Planner is A5 size.

Why We Like This

• 1. Keep your finances organized and spend well• 2. Set monthly goals and budget• 3. Track your progress throughout the year• 4. Perfect portable size• 5. Guaranteed to keep your finances organized

Additional Product Information

| Color | Royal Blue |

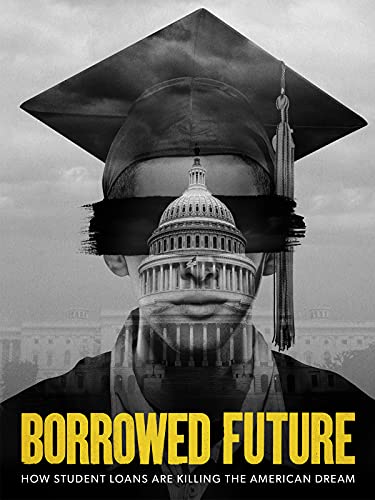

Borrowed Future

Borrowed Future is a term that is used to describe the situation where an individual or organization has borrowed money in order to finance future growth. This can be done in order to fund investment projects, expand operations or simply cover day-to-day expenses. The idea is that the borrowed money will be repaid with interest over time, providing a return on investment for the lender.

There are a number of reasons why an entity might choose to borrow money for future growth. For example, they may not have the cash on hand to finance the project upfront, or they may want to take advantage of low interest rates. Whatever the reason, borrowed money can be a useful tool for businesses and individuals alike.

Of course, there is always the risk that the borrower will default on the loan, meaning that they will be unable to repay the money. In this case, the lender may be left out of pocket and the borrower’s future growth prospects could be hampered. As such, it is important to carefully consider whether borrowing is the right choice before entering into any agreements.

Common Questions on Borrowed Future

• What is the author’s thesis?The author’s thesis is that the future is not something to be feared, but something to be embraced.

• What are the author’s qualifications?

The author is a qualified futurist and has a degree in public policy.

• What are the main points of the book?

The main points of the book are that the future is uncertain, but not necessarily bad; and that we can use our imaginations to create a better future.

• What are the implications of the author’s thesis?

The implications of the author’s thesis are that we need to be proactive in shaping our future, and that we should not be afraid to embrace change.

• What are the benefits of reading the book?

The benefits of reading the book are that it can help change our perspectives on the future, and give ustools to shape a better future.

Why We Like This

Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth– and How You Can Too

We often hear about overnight successes, but the truth is that most millionaires are made through years of patient, consistent effort. This is what the Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth– and How You Can Too. book is all about. It chronicles the stories of 25 different individuals who have made it to seven figures through patience, hard work, and dedication.

One of the major themes throughout the book is that it takes time to build wealth. The majority of the interviewees started in their 20s or 30s, and it took them 10-15 years to reach millionaire status. This is a great reminder that there are no shortcuts to wealth-building, and that if we want to achieve financial independence, we need to be patient and consistent with our saving and investing habits.

Another important takeaway is that we need to have a written plan for our finances if we want to be successful. Without a specific plan and goals to focus on, it’s easy to get sidetracked and make poor financial decisions. But if we take the time to sit down and figure out where we want to be financially, it becomes much easier to make the right choices that will get us there.

If you’re

Common Questions on Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth– and How You Can Too

Why We Like This

1. Baby Steps Millionaires is a step by step guide to building wealth.

2. The book includes case studies of ordinary people who have become millionaires.

3. Baby Steps Millionaires reveals the secrets to building wealth.

4. The book provides a simple, step by step system for building wealth.

5. Baby Steps Millionaires is the perfect guide for anyone who wants to build wealth.

Dave Ramsey’s Complete Guide To Money

Dave Ramsey is a financial expert and radio show host who has helped millions of people get out of debt and learn how to manage their money. His book, “The Complete Guide to Money,” is a step-by-step guide that covers everything from setting up a budget to investing for retirement.

Ramsey’s approach to personal finance is based on the philosophy of “live like no one else now so you can live like no one else later.” In other words, he advocates for making sacrifices early on in order to be able to enjoy a more comfortable lifestyle down the road.

One of the most unique things about Ramsey’s advice is that he doesn’t believe in using credit cards. He believes that people should only spend money that they have, and that credit cards just delay the pain of paying for something. While this may not be the most convenient approach, it does help people stay out of debt and avoid paying interest.

Ramsey also advocates for what he calls the ” Debt Snowball ” method of paying off debt. This involves making a list of all of your debts, from the smallest to the largest, and then making payments on the smallest debt first while making minimum payments on the rest. Once the smallest debt is paid off, you move on

Common Questions on Dave Ramsey’s Complete Guide To Money

• What is the best way to save money?The best way to save money is to create a budget and stick to it. You can also create a savings plan to help you reach your financial goals.

• What is the best way to spend money?

The best way to spend money is to make sure you are spending it on things that are important to you and that will help you reach your financial goals.

• What are some tips for creating a budget?

Some tips for creating a budget include setting realistic goals, knowing your income and expenses, and tracking your progress.

• What should you do if you find yourself spending more money than you planned?

If you find yourself spending more money than you planned, you should take a look at your budget and see where you can cut back. You may also want to consider ways to increase your income.

• What are some common money mistakes people make?

Some common money mistakes people make include not saving enough, overspending, and not having a budget.

Why We Like This

• 1. Ramsey’s Complete Guide To Money is a great resource for those who are looking to get their finances in order.• 2. The book provides readers with a step by step plan to help them get out of debt and build wealth.• 3. Ramsey’s Complete Guide To Money is packed with useful information and tips on how to save money and make wise financial decisions.• 4. The book is easy to read and understand, making it a great choice for those who are new to personal finance.• 5. Ramsey’s Complete Guide To Money is an excellent resource for anyone who wants to take control of their finances and build a bright future.

Additional Product Information

| Height | 9.2 Inches |

| Length | 6.3 Inches |

| Weight | 1.57850979592 Pounds |

Benefits of Dave Ramsey Book For Beginners

Dave Ramsey is a popular financial author and radio host who offers sage advice on how to get out of debt and build wealth. His book, The Total Money Makeover: A Proven Plan for Financial Fitness, has sold millions of copies and helped countless people improve their financial lives.

Buying Guide for Best Dave Ramsey Book For Beginners

Are you looking for the best Dave Ramsey book for beginners? If so, then this buying guide is for you!

When it comes to personal finance, Dave Ramsey is one of the most well-known and respected names out there. His books have helped countless people get out of debt and build wealth.

If you’re new to Dave Ramsey’s teachings, then we highly recommend starting with his book The Total Money Makeover. In this book, Ramsey outlines his proven plan for getting out of debt and building wealth. He also includes real-life success stories from people who have used his methods to achieve financial freedom.

Another great option for beginners is Ramsey’s book Financial Peace University. This book goes into detail about Ramsey’s methods for managing money, eliminating debt, and investing for the future. It also includes helpful tools and resources that you can use to get started on your own financial journey.

No matter which book you choose, you’re sure to find valuable information and guidance from Dave Ramsey that can help you take control of your finances and build a bright future.

Conclusion

If you are looking for a guide to help you get started on your financial journey, the Dave Ramsey book is the best place to start. The book is full of simple, concise information that will help you understand the basics of budgeting, saving, and investing. You will also find inspiration and motivation from Dave Ramsey’s story of overcoming debt and becoming financially free. Best of all, the book is affordable and easy to read.