Why Conservative Etf Portfolio Is Necessary?

A best conservative ETF portfolio is essential in creating an investment strategy that reduces risk while still having the potential to provide reasonable returns. Conservative portfolio management helps gain control of volatility and allows for mitigation of risk through diversification. It also shields investors from the effects of a volatile stock market by reducing their exposure to losses during times of turbulence or unexpected events, such as economic downturns or recessions. By emphasizing more conservative investments like bonds and cash, these portfolios help protect investors’ capital from any swift, sudden market drops due to political turmoil or sudden shifts in consumer confidence. Additionally, it provides an opportunity for steady growth over time by focusing on products with low fees such as ETFs (Exchange Traded Funds).

Our Top Picks For Best Conservative Etf Portfolio

Best Conservative Etf Portfolio Guidance

Leather Portfolio Folder Padfolio, Business Padfolio Organizer Document Planner Portfolio Binder Storage Pocket for Legal Pad Holder Paperwork Phone Men Women

Leather Portfolio Folder Padfolio is the perfect business and storage solution forLegal Pad Holder Paperwork and Phone belongings. Crafted from high-quality faux leather, this stylish folder promises to be lightweight yet durable, resistant to dirt and deformity, and is sure to help you stay organized and efficient in your work. The sizeable 12″x9.5″ organizer features 2 pockets, 2 card holders, a penloop, and a multifunctional pocket so that you can easily transport and store documents, envelopes, cards, and much more. Also designed with an 85″ x 11″ horizontal pocket on its right side, this padfolio is able to securely carry items such as an iPad, notepad, and files, as well as office supplies like paper clips, scissors and so on. This sleek and minimalist portfolio is the perfect companion for professionals and aspiring businesspersons alike, while also making an ideal present to any loved ones at any type of special occasion. Whether it’s used for gift-wrapping or protective storage, Leather Portfolio Folder Padfolio is sure to bring a classic touch to any situation.

Common Questions on Leather Portfolio Folder Padfolio, Business Padfolio Organizer Document Planner Portfolio Binder Storage Pocket for Legal Pad Holder Paperwork Phone Men Women

• What do you get with this Leather Portfolio Folder Padfolio?You get a padfolio organizer document planner portfolio binder with storage pockets for a legal pad, paperwork, and your phone.

• Is this Leather Portfolio Folder Padfolio suitable for both men and women?

Yes, it is perfect for both men and women.

• How secure is the Leather Portfolio Folder Padfolio?

It features secure metal closure snaps to keep your belongings safe and secure.

• What materials is the Leather Portfolio Folder Padfolio made of?

It is made from high-quality genuine leather for durability.

• Does the Leather Portfolio Folder Padfolio come with a warranty?

Yes, it comes with a one year warranty.

Why We Like This

• 1. High quality faux leather material for durability and resistance• 2. Perfect size for organizing documents, letters, cards and other stuff• 3. Multifunctional design for holding iPad, notepad and office supplies• 4. Classic and stylish design with minimal pockets and hidey holes• 5. Ideal gift for friends and business colleagues

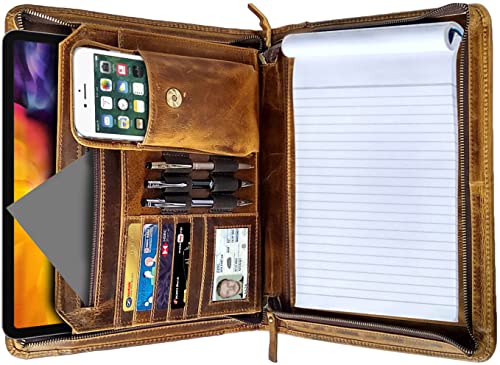

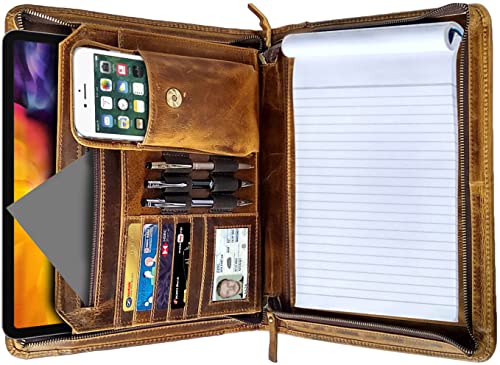

Business Leather Padfolio Leather Portfolio | Professional Organizer Gift for Men & Women | Durable Leather Padfolio | Easy to Carry with A Zippered Closure | Many Slots, Compartments & Holders

A business leather padfolio is an excellent way for professionals to stay organized on the go. Built to last, high-quality Rustic Town Leather Portfolio is constructed from top grain buffalo leather and boasts a padding all around for extra edge and protection. It comes with a wrap-around zippered closure and an inner zippered pocket to keep your documents, cards, and electronics safe and secure. This padfolio contains four large pockets, four business card slots, one ID slot, three pen holders, a mobile/calculator pocket, and document protectors for ultimate organization. Also designed for convenience is a universal iPad/tablet sleeve (up to 12.9 inch) so you can easily access your most important device wherever you may be. The durable construction of this stylish portfolio ensures that it will hold up in even the most challenging of situations and is easy to maintain; simply wipe away any dirt or stains with a wet cloth or tissue. A perfect gift for the hardworking professional in your life, this rustic town leather portfolio will without doubt impress not just at workplace and career job fairs but also in interviews, client meetings, and more. Whether you need to stay organized for presentations, conferences, or daily tasks, Rustic Town’s

Common Questions on Business Leather Padfolio Leather Portfolio | Professional Organizer Gift for Men & Women | Durable Leather Padfolio | Easy to Carry with A Zippered Closure | Many Slots, Compartments & Holders

• What type of leather is used to make this Business Leather Padfolio?This Business Leather Padfolio is made from top-grain cowhide leather.

• What is the size of the Business Leather Padfolio?

The Business Leather Padfolio measures 13.5″ x 11″ and is 3″ thick when closed.

• Are there any compartments for extra storage in the padfolio?

Yes, the Business Leather Padfolio comes with multiple slots, compartments, and holders for added convenience.

• Does the padfolio feature a closure system?

Yes, the Padfolio features an easy-to-use zippered closure.

• Is this padfolio comfortable and practical to carry around?

Yes, the Business Leather Padfolio is lightweight, durable, and very convenient to carry around.

Why We Like This

• 1. Premium Top Grain Leather: Durable and stylish construction ensures a professional appeal.• 2. Versatility: Multiple slots, compartments and holders accommodate all your documents and devices.• 3. Universal iPad Sleeve: Carry your iPad or tablet up to 12.9 inches with ease and full protection.• 4. Durable Construction and Easy Maintenance: Thick hardbound cover and strong stitching make for a long lasting product that is easy to clean.• 5. Perfect Business Gift: The perfect gift for business colleagues, clients, or recent college graduates.

Additional Product Information

| Color | Brown |

| Height | 13.5 Inches |

| Length | 11.5 Inches |

| Weight | 2.20462262 Pounds |

Bear Market Trading Strategies

A bear market is a period when securities prices are falling, reflecting a sentiment of pessimism and negative investor sentiment. Knowing how to approach bear markets is essential for long-term investment success. Traders must be ready for the different market conditions brought about by a bear market, and know the strategies that can help them survive the downturn.

Although a bear market may take some time to recover, with the right strategies you can protect your investments. Diversification is important, as holding a variety of investments can help to hedge against losses from specific asset classes. Investing in defensive stocks, such as those in basic industries, can be helpful as well; these typically perform better in bear markets. Cash reserves should be considered to provide liquidity in the event you decide to purchase assets at lower prices during the downturn.

Another strategy, short selling, can also be beneficial during a bear market. This involves selling securities, such as stocks and bonds, that you do not currently own and later repurchasing them at a lower price. Although potentially risky, this strategy enables traders to profit as the value of the security they sold declines.

Going against the herd by taking a contrarian stance can be another way to take advantage of a bear market.

Common Questions on Bear Market Trading Strategies

• What is a bear market ?A bear market is a market condition in which prices are falling and investors have a pessimistic view on future prices.

• What are the common strategies used during a bear market trading?

Common strategies used during a bear market trading include short selling, hedging and diversifying, going long on defensive stocks, purchasing put options, and investing in inverse exchange-traded funds (ETFs).

• Are there risks associated with bear market trading?

Yes, there are inherent risks with bear market trading such as increased volatility, market slippage, and liquidity risk.

• How can an investor protect their portfolio when the market falls?

Investors can take steps to protect their portfolios when the market falls by diversifying their investments, focus on quality companies, or use defensive strategies like stop losses and hedging.

• How long can a bear market last?

A bear market can last anywhere from several months to several years. It all depends on the underlying economic conditions and investor sentiment at the time.

Why We Like This

• 1. Comprehensive coverage of bear market trading strategies for both novice and experienced traders.• 2. Step by step instructions for risk management, chart analysis and technical indicators.• 3. Expert advice on navigating volatile markets, including short selling, hedging and spread trading.• 4. Real time market data and news updates to help investors stay informed and make informed decisions.• 5. Access to a network of experienced traders who can provide valuable insights into bear market trading.

A Teenager’s Guide to Investing in the Stock Market: Invest Hard Now | Play Hard Later

Investing in the stock market can be a daunting but rewarding experience, especially for young adults getting their financial feet wet. When it comes to investing, the old adage “invest hard now, play hard later” rings true. Starting to invest at a young age is a smart move, as compound interest helps build wealth faster over time. Taking the time to learn and understand the stock market can provide long term benefits that go beyond simply making money.

The investing landscape has changed drastically since the days of pouring through ledger books and waiting for paper share certificates in the mail. The combination of online access, sophisticated tools, and a wide variety of stock options make investing more accessible than ever before. Even still, making the leap from being a novice investor to a person with an established portfolio takes knowledge and experience.

This guide provides a helpful overview for young investors, breaking down how to begin investing into manageable steps. Since the stock market rewards knowledge with greater profits, it pays off financially to educate oneself about the investing process before getting started. Before taking the plunge, some reflection can go a long way. For teens, the stock market can provide a foundation for a financially healthy future, but there are both opportunities and dangers addresseing. Understanding

Common Questions on A Teenager’s Guide to Investing in the Stock Market: Invest Hard Now | Play Hard Later

• What are the risks associated with investing in the stock market?Investing in the stock market involves a degree of risk, including potential loss of capital. Investors should have an understanding of their risk tolerance and invest accordingly. Additionally, investors should research companies they are considering investing in and be aware of the potential of fraud or instability.

Why We Like This

1. Easy to understand instructions and resources for teens to start investing in the stock market.

2. Proven strategies and tips from experienced investors to maximize profitability.

3. A comprehensive guide on the fundamentals of stock market trading and investing.

4. Guidance on how to create and manage a portfolio for long term growth.

5. Strategies to help teens identify and analyze potential investments.

Additional Product Information

| Height | 8.5 Inches |

| Length | 5.5 Inches |

Leather-Portfolio-Folder with Zipper for Women/Men, Business Padfolio with Hidden Handle, 13.5×10.1In Conference Organizer Notepad Folder, Tablet Sleeve, Presentation Slot, Calculator, Card Storage

This Leather-Portfolio-Folder with Zipper for Women/Men is the perfect accessory for any Professional. It comes equipped with a hidden handle for easy carrying, 13.5×10.1 inch conference organizer notepad folder, tablet sleeve and presentation slot. It also features a business calculator, multiple business card slots, phone pouch and pad compartment for extra organization. The sleek design allows for the portfolio to fit in any handbag or backpack, maintaining an impressive amount of storage.

The perfect gift for graduates, businessmen and rising professionals, it demonstrates a belief in success and carries all the supplies one may need for a successful future. From tickets and documents to resumes, pens and other items, this premium leather portfolio is designed to outshine competitors. With KaiRuiYing, quality and satisfaction are always guaranteed.

Common Questions on Leather-Portfolio-Folder with Zipper for Women/Men, Business Padfolio with Hidden Handle, 13.5×10.1In Conference Organizer Notepad Folder, Tablet Sleeve, Presentation Slot, Calculator, Card Storage

• What is the size of this Leather-Portfolio-Folder with Zipper for Women/Men?The Leather-Portfolio-Folder with Zipper for Women/Men is 13.5×10.1In.

• Does this Leather-Portfolio-Folder with Zipper for Women/Men have a hidden handle?

Yes, it comes with a hidden handle.

• What other items come with the Leather-Portfolio-Folder?

This Leather-Portfolio-Folder includes a notepad folder, tablet sleeve, presentation slot, calculator, and card storage.

• Is there a way to store your business cards in this Leather-Portfolio-Folder?

Yes, there is a card storage slot in the Leather-Portfolio-Folder.

• Is this Leather-Portfolio-Folder suitable for both men and women?

Yes, this Leather-Portfolio-Folder is suitable for both men and women.

Why We Like This

• 1. Professional business padfolio with multiple business card slots, calculator, phone pouch, and pad compartment for organization.• 2. Innovative design featuring a hidden handle for convenient portability.• 3. Compact size for easy transport in handbags, backpacks, and more.• 4. Perfect gift for graduates, lawyers, business professionals, and more.• 5. Ultimate satisfaction guarantee for quality and service.

Additional Product Information

| Color | Black |

| Height | 1.2598425184 Inches |

| Length | 13.5826771515 Inches |

Benefits of Conservative Etf Portfolio

If you are an investor looking for a way to diversify your portfolio, then a conservative ETF portfolio could be the perfect fit. Exchange-traded funds (ETFs) offer investors access to a wide variety of companies and markets in one package. By blending different types of investments within an ETF, investors can reduce their risk while still maintaining exposure to traditional investment classes such as stocks and bonds.

A conservative ETF portfolio includes low-risk investments that provide slow but steady returns over time. These investments generally focus on safe sectors like utilities or government debt, which tend not to be volatile – meaning there’s less potential for huge gains or losses due to market movements or any other kind of changes that can happen in the investment world outside the investor’s control.. Such portfolios may also invest into some more liquid assets such as blue chip stocks which pay low dividends but come with good liquidity value associated with them so they can easily convert into cash if needed by investor later on during investing period

Another key benefit is cost savings; since most exchange–traded funds track indexes, it means lower transaction costs compared with building out individual stock positions due to increased buying power from shared fund vehicles rather than trading each asset separately as standalone position would have been more expensive comparatively . Ultimately this helps save money from unnecessary taxes and fees incurred when making multiple trades all at once instead investing through share portofolio materials

Finally , having access through many different asset classes ensures higher diversification among other advantages including tax efficiency without breaking pocket strings attached when taking wagers against single risky positions because no model based upon prediction will guarantee targeting specific results together even though only creating wealth sustainably underpins organic approach towards initiating modest financial strides altogether .

Buying Guide for Best Conservative Etf Portfolio

If you’re looking for a conservative Exchange-Traded Fund (ETF) portfolio, there are many options to consider. ETFs offer an easy way to manage your investments, since you can purchase and track one or more of these funds for long-term returns. ETFs are appropriate if you’re looking for a portfolio that minimizes risks by investing in stable, blue chip stocks across different sectors. Here’s our guide on the best conservative ETF portfolios available.

1) Vanguard Balanced Index Fund: This fund is composed of 60% large U.S.-based stocks and 40% bonds with an average maturity of seven years or less – perfect for those who want a mix of growth potential combined with income production. It has low fees and offers broad diversification across industries — making this fund ideal as part of a balanced portfolio focused on predictable returns rather than capital appreciation potential through individual stock selection.

2) iShares Core S&P 500 Index: This ETF holds the largest 100 U.S.-based companies in its basket, giving investors access to some well established companies like Microsoft and Apple at an attractive price point ($60 per share). With no sales load fee and focusing primarily towards large cap US equities, this is another great option for those wanting safe returns from their investments within the same country they reside in & use as their currency base point when purchasing goods & services .

3 )Vanguard Total International Stock: This diverse portfolio includes both developed markets such as Europe and emerging markets such as Latin America – giving investors exposure to international stocks without major geographical risk concentration since it requires careful selection process between regions & countries including current political climates along with desired economic outcomes / stability offerings too . Low fees make this option even better suited than most other international stock-ETF combinations duely noted …

4 )SPDR Gold Shares Trust: Adding gold into your investment mix must be done very strategically so as not over concentrate wealth/risk locations accordingly namely due excessive volatility yet historically outperformance trends versus other asset classes initiatives utilized tracking also dependent upon current year monetary policy outlook’s , pending any new laws passed by whichever governing body serves it’s citizens faithfully doing so while maintaining balance objectives along further pathways identified moving forward ..investors find that GOLD shares help add value within their existing retirement foundational plans experienced return performance exceeding market general conditions etal specific correlations thriving endlessly at partially kept completely secure points realized throughout future venture bournes hereonforth anywhere planetside aligned be!

Frequently Asked Question

What are the best conservative ETFs to include in a portfolio?

The best conservative ETFs to include in a portfolio depend on the investor’s goals and the level of risk they are comfortable with. Generally, conservative ETFs will be those that invest in blue-chip stocks, government bonds, and other low-risk investments. Some popular ETFs to consider include the iShares Core S&P 500 ETF (IVV), the Vanguard Total Bond Market ETF (BND), and the iShares Core U.S. Aggregate Bond ETF (AGG). Additionally, investors may consider sector-specific ETFs such as the Vanguard Real Estate ETF (VNQ) and the iShares U.S. Utilities ETF (IDU).

What types of risks should I be aware of when investing in conservative ETFs?

When investing in conservative ETFs, it is important to be aware of the following types of risks: 1. Market Risk: This is the risk that the ETF’s holdings will decrease in value due to changes in the overall market. 2. Interest Rate Risk: This is the risk that rising interest rates may reduce the value of the ETF’s holdings.3. Currency Risk: This is the risk that changes in the exchange rate between two currencies could reduce the value of the ETF’s holdings.4. Credit Risk: This is the risk that the ETF’s holdings may default on their payments and significantly reduce the value of the ETF.5. Liquidity Risk: This is the risk that the ETF may not be able to quickly and easily sell its holdings due to a lack of buyers.6. Tax Risk: This is the risk that the ETF may be subject to higher taxes due to changes in the tax code.

How should I choose an ETF portfolio for conservative investors?

Conservative investors should choose an ETF portfolio that is focused on low-risk securities, such as those that invest in high-quality bonds and/or dividend-paying stocks. Investors should also look for ETFs with a track record of consistent performance and low overall volatility. Additionally, investors may want to look for ETFs with a low expense ratio, as this will help reduce the impact of fees on their returns over the long run. Lastly, investors should consider their long-term goals and make sure the portfolio is well-diversified to reduce risk and maximize returns.

What criteria should I use when evaluating different conservative ETF portfolios?

1. Risk Profiles: When evaluating conservative ETF portfolios, it’s important to consider the risk profiles of each portfolio. Evaluate the portfolio’s expected volatility and drawdown, and compare it to your own risk tolerance. 2. Investment Objectives: Consider the investment objectives of each portfolio. Do the investments align with your financial goals? 3. Fees: Evaluate the fees associated with each portfolio, including the expense ratio and any commissions and trading costs. 4. Performance: Review the historical performance of the portfolio over different time frames. Consider the portfolio’s returns relative to the benchmark index. 5. Diversification: Assess the portfolio’s diversification across asset classes, sectors and countries. Look for a portfolio with a good balance of investments to minimize risk. 6. Tax Efficiency: Consider the tax implications of the portfolio, including the tax efficiency of the investments and the potential for generating capital gains taxes.

What due diligence should I do before investing in any given conservative ETF portfolio?

1. Review the ETF’s investment objectives and strategies: Make sure the investment objectives and strategies of the ETF align with your own risk tolerance and financial goals. 2. Understand the ETF’s holdings: Determine what components are part of the ETF and whether they are suitable for your portfolio. 3. Analyze the ETF’s performance: Research and compare the ETF’s performance to similar investments over the short, medium and long term to determine if it meets your expectations. 4. Understand the associated fees: Determine the fees associated with the ETF and whether they are appropriate for your investment goals. 5. Assess the ETF’s liquidity: Determine the ETF’s liquidity and how quickly you can buy and sell the ETF without incurring large transaction costs. 6. Review the ETF provider: Research the ETF provider to make sure they have a good reputation and a track record of success.

Conclusion

Thank you for giving me the opportunity to present our best conservative ETF Portfolio. I believe that this portfolio can help you fulfill your need for a low-risk, high-return investment strategy without compromising on overall wealth accumulation potential. I trust that it has become clear why we believe this portfolio is an excellent choice for investors looking to maximize returns and minimize risk.

The portfolios contain carefully selected ETFs from multiple asset classes, allowing investors to benefit from both high reward and low correlation, while managing their exposure through monthly rebalancing of underlying investments. Our model also incorporates precise coverage of top market segments to ensure consistent returns over longer terms..

Our experienced professionals are available to provide any additional information and assistance needed in order to make an informed decision about investing in our Best Conservative ETF Portfolio.