716 Credit Loan is an online lending platform that provides flexible loans to help you manage your finances. Whether you’re looking for a loan to cover unexpected expenses, consolidate debt, or simply take care of a large upcoming purchase, 716 Credit Loan is the place to turn. We can provide you with the funds you need on terms and conditions that are tailored to meet your needs.

Table Of Content:

- Credit 716 - We help people with credit issues get a new car.

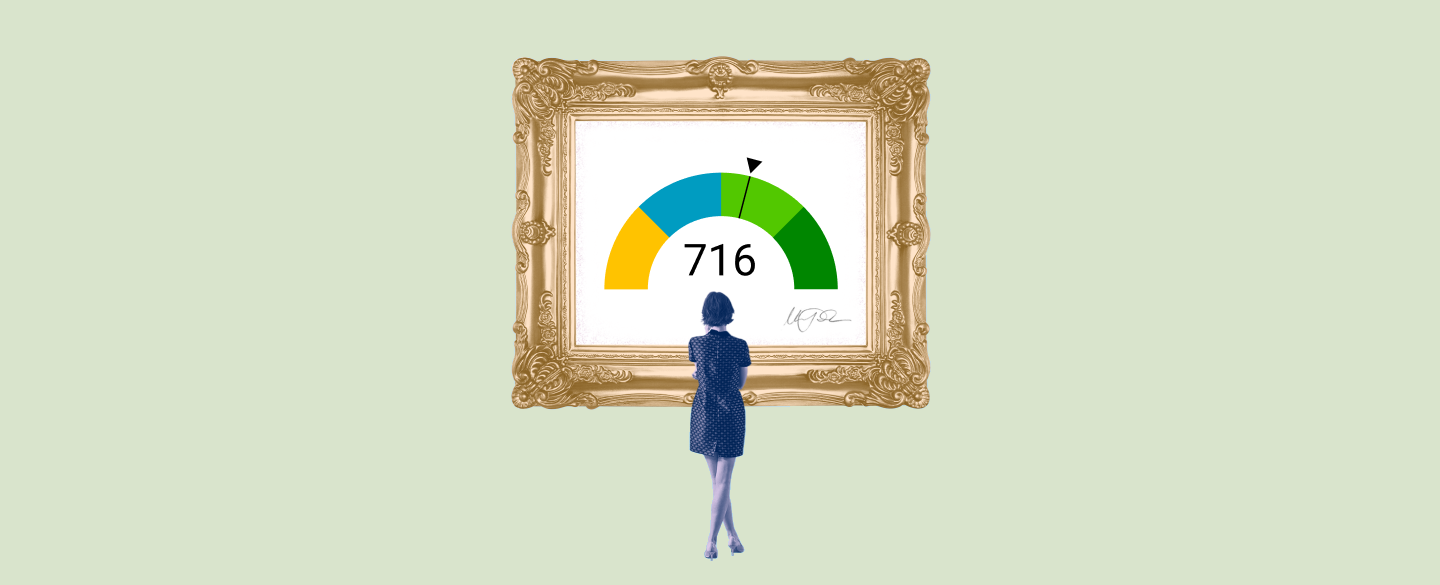

- 716 Credit Score: Is it Good or Bad?

- 716 Credit Score

- 716 Credit Score (+ #1 Way To Improve it )

- 716 Credit Score: What Does It Mean? | Credit Karma

- 716 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 716 a good credit score? | Lexington Law

- 716 Credit Score: Is it Good or Bad? (Approval Odds)

- Average U.S. FICO® Score at 716, Indicating Improvement in ...

- Western Division Federal Credit Union

1. Credit 716 - We help people with credit issues get a new car.

https://credit716.com/

Credit 716 - We help people with credit issues get a new car. We are a Buffalo-based company helping people with credit issues get financed.

2. 716 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/716-credit-score/ A FICO® Score of 716 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an ...

A FICO® Score of 716 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an ...

3. 716 Credit Score

https://wallethub.com/credit-score-range/716-credit-score/

A 716 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. 716 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/716-credit-score

Jul 1, 2022 ... A 716 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 716 Credit Score. Lenders like to ...

5. 716 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/716 Good credit scores can mean better credit opportunities, like credit card approvals or favorable loan terms. But knowing ...

Good credit scores can mean better credit opportunities, like credit card approvals or favorable loan terms. But knowing ...

6. 716 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/716/ Nov 11, 2021 ... Learn what a credit score of 716 means, if it's good or bad, and what loans and credit cards you're eligible for.

Nov 11, 2021 ... Learn what a credit score of 716 means, if it's good or bad, and what loans and credit cards you're eligible for.

7. Is 716 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/716 Oct 11, 2021 ... Your 716 score will give you access to more loan options and better interest rates than people in lower ranges. However, FICO does have ranges ...

Oct 11, 2021 ... Your 716 score will give you access to more loan options and better interest rates than people in lower ranges. However, FICO does have ranges ...

8. 716 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/716-credit-score/ Most lenders will approve you for a personal loan with a 716 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

Most lenders will approve you for a personal loan with a 716 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

9. Average U.S. FICO® Score at 716, Indicating Improvement in ...

https://www.fico.com/blogs/average-us-ficor-score-716-indicating-improvement-consumer-credit-behaviors-despite-pandemic Aug 17, 2021 ... FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic. The FICO Score is a broad-based, independent standard ...

Aug 17, 2021 ... FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic. The FICO Score is a broad-based, independent standard ...

10. Western Division Federal Credit Union

https://www.westerndivision.org/

How does 716 Credit Loan work?

With 716 Credit Loan, you can apply for a loan right from the comfort of your own home. Our application process is fast and efficient – in just minutes you will be able to know if your loan has been approved and be on your way to getting exactly what you need. Once approved, funds can be deposited directly into your bank account within one business day.

How much money can I get with a 716 Credit Loan?

The amount of credit that will be offered depends on many factors such as credit history, income level, type of loan requested, and other criteria used by lenders to evaluate requests for credit. Typically, the maximum amount available ranges up to $35,000 depending on individual qualifications.

When do I have to pay back my loan?

Depending on the type of loan you get from 716 Credit Loan, repayment periods will vary. Short-term loans generally come with shorter repayment plans while longer-term loans typically require longer repayment periods according to their duration. Repayment plans are also determined by how much money you borrow as well as your credit score or income bracket.

Are there any fees associated with taking out a 716 Credit Loan?

Yes, there may be additional fees associated with taking out a loan through our platform which include application fees and origination fees which are determined by the lender offering the loan product. It is important that all prospective borrowers review all terms and costs associated with their loan requests before proceeding with their application.

Conclusion:

At 716 Credit Loans we strive to make finding financing easy and fast - no matter where life takes you! With convenient terms tailored specifically for each borrower's unique situation, managing finances responsibly can become easier than ever before! Get started today by applying for a local or online personal loan from our secure platform so that you never miss out on life’s great opportunities!