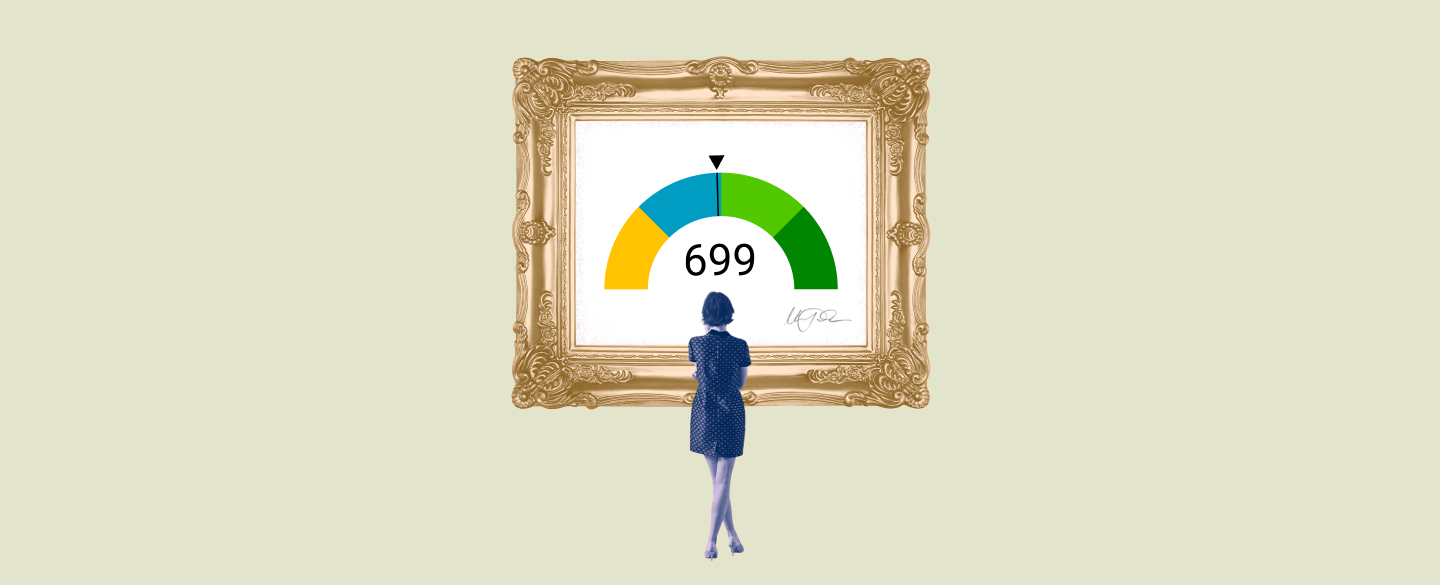

A FICO score is a numeric representation of an individual’s creditworthiness. It is generated by analyzing data from the three major credit bureaus: Equifax, Experian and TransUnion. A FICO score between 600 and 699 is considered to be fair credit – not great, but not terrible either. This range carries more risk than higher scores, but approvals are still possible with careful planning and effort.

Table Of Content:

- 699 Credit Score: Is it Good or Bad?

- Is 699 a good credit score? | Lexington Law

- 699 Credit Score: What Does It Mean? | Credit Karma

- Is 699 a Good Credit Score? What It Means, Tips & More

- 699 Credit Score (+ #1 Way To Improve it )

- Best Credit Cards if Your FICO Score is Between 650 and 699 ...

- Credit score ranges & what they mean | Chase

- Can I get a car loan with a 699 credit score? | Jerry

- What Is the Average Credit Score in America? | Credit.com

- US Credit Quality Rising … The Beat Goes On

1. 699 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/699-credit-score/ A 699 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 699 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. Is 699 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/699 Oct 11, 2021 ... If you have a credit score of 699, you might be asking yourself, “is 699 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 699, you might be asking yourself, “is 699 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

3. 699 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/699 Apr 30, 2021 ... A 699 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 699 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. Is 699 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/699-credit-score/

A credit score of 699 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

5. 699 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/699-credit-score

6. Best Credit Cards if Your FICO Score is Between 650 and 699 ...

https://www.moneyunder30.com/credit-cards/credit-score-650-699 Overview of the Best Credit Cards for 650-699 Credit Score. Credit card, Best for. Capital One QuicksilverOne Cash Rewards Credit Card, Cash rewards. Petal® 1 " ...

Overview of the Best Credit Cards for 650-699 Credit Score. Credit card, Best for. Capital One QuicksilverOne Cash Rewards Credit Card, Cash rewards. Petal® 1 " ...

7. Credit score ranges & what they mean | Chase

https://www.chase.com/personal/credit-cards/education/credit-score/credit-score-ranges-and-what-they-mean

Fair credit score (VantageScore: 650 - 699; FICO: 580–669) ... The average VantageScore for U.S. borrowers falls at 673, which is included in this range, so this ...

8. Can I get a car loan with a 699 credit score? | Jerry

https://getjerry.com/questions/can-i-get-a-car-loan-with-a-699-credit-score![]() A 699 credit score puts you in the prime range of borrowers, which lowers your perceived risk. Because your risk is lower, you should find more lenders willing ...

A 699 credit score puts you in the prime range of borrowers, which lowers your perceived risk. Because your risk is lower, you should find more lenders willing ...

9. What Is the Average Credit Score in America? | Credit.com

https://www.credit.com/credit-scores/what-is-the-average-credit-score/ Jul 28, 2021 ... Here are the average 2020 FICO scores in America, broken down by age: 18 to 23: 674; 24 to 39: 680; 40 to 55: 699; 56 to 74: 736; 75 and up: ...

Jul 28, 2021 ... Here are the average 2020 FICO scores in America, broken down by age: 18 to 23: 674; 24 to 39: 680; 40 to 55: 699; 56 to 74: 736; 75 and up: ...

10. US Credit Quality Rising … The Beat Goes On

https://www.fico.com/blogs/us-credit-quality-rising-beat-goes Sep 13, 2016 ... FICO just published new research – including the latest FICO® Score distribution – showing US consumer credit quality continues its ...

Sep 13, 2016 ... FICO just published new research – including the latest FICO® Score distribution – showing US consumer credit quality continues its ...

What does it mean to have a FICO score of 699?

A 699 FICO score indicates that the individual has a fair credit rating. While this isn’t the highest of scores, lenders may still approve some loans or other forms of financing, albeit usually with stricter terms.

How can I improve my 699 FICO score?

Improving your FICO score requires making responsible financial decisions and paying bills on time each month. You should also strive to reduce your debt-to-income ratio by either reducing debt or increasing income. Additionally, you should ensure that all negative items on your credit report (such as late payments) have been resolved before attempting to apply for new financing.

Is a 699 FICO score good enough for auto loan approval?

Approval for an auto loan with a 699 FICO score is possible, though you may have to shop around for a lender who will offer you competitive rates based on this rating. You may also need to provide additional documentation in order to prove your financial stability in order to secure approval.

Can I get approved for a mortgage with a 699 FICO score?

Yes – having a 699 FICO score increases the likelihood of securing mortgage approval, though interest rates offered may be higher than those given to borrowers who have higher scores or better financial profiles. You should discuss your options further with your lender before making any decisions about applying for mortgages.

Will having a 699 FICO score hurt me when applying for jobs?

No – employers generally cannot access this information when vetting job applicants so having a 699 FICO score will not negatively affect their decision-making process.

Conclusion:

In conclusion, having a 699 FICO score means that although there are risks associated with getting approved for loans or financing, it is still possible if you plan ahead and make sure all negative items on your credit report are resolved beforehand. With careful strategy and effort put into managing finances responsibly, anyone can work towards improving their overall creditworthiness over time!