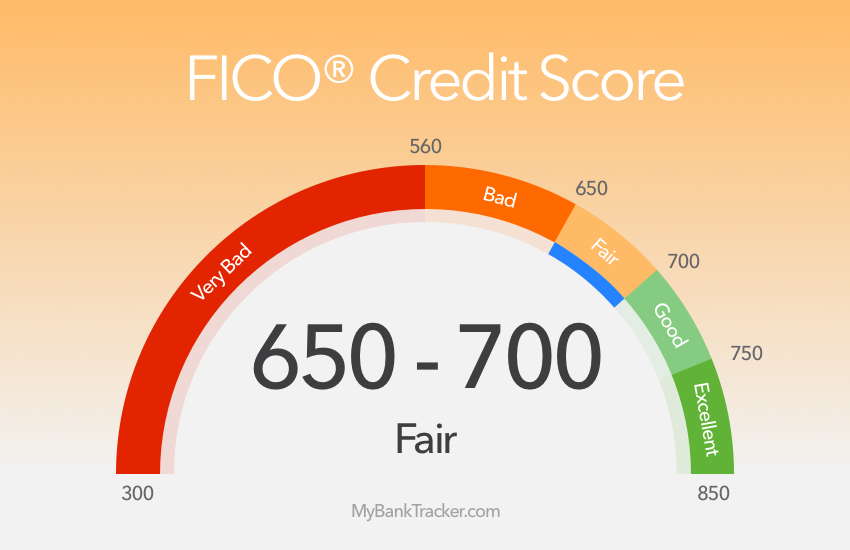

A 698 credit score is considered to be a good credit score. It is within the range of scores known as fair credit and may make you eligible for certain types of credit cards. Credit cards that offer features such as rewards programs and low annual fees often require a credit score of around 698 or higher to qualify.

Table Of Content:

- Best Credit Cards if Your FICO Score is Between 650 and 699 ...

- 698 Credit Score: Is it Good or Bad?

- Is 698 a Good Credit Score? What It Means, Tips & More

- 698 Credit Score: What Does It Mean? | Credit Karma

- Top Credit Cards for Fair Credit Scores of 650-700

- Is 698 a good credit score? | Lexington Law

- Best Credit Cards for Fair Credit of July 2022 - NerdWallet

- 698 Credit Score: Good or Bad? | Credit Card & Loan Options

- What's the Average Credit Score in Each State? | Equifax

- The Best Credit Cards for Fair and Average Credit of July 2022

1. Best Credit Cards if Your FICO Score is Between 650 and 699 ...

https://www.moneyunder30.com/credit-cards/credit-score-650-699 Check out this roundup of the best credit cards for average credit scores. These cards offer the best features you can get for scores 650-699.

Check out this roundup of the best credit cards for average credit scores. These cards offer the best features you can get for scores 650-699.

2. 698 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/698-credit-score/ 42% Individuals with a 698 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan. Public records such as bankruptcies do not ...

42% Individuals with a 698 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan. Public records such as bankruptcies do not ...

3. Is 698 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/698-credit-score/

WalletHub's Rating: No – Based on the rate at which people with 698 credit scores get approved for credit cards that require "good credit" or better, ...

4. 698 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/698 Apr 30, 2021 ... A 698 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

Apr 30, 2021 ... A 698 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

5. Top Credit Cards for Fair Credit Scores of 650-700

https://www.mybanktracker.com/credit-cards/credit-score/top-credit-cards-650-700-credit-score-173381 Jun 9, 2022 ... Read our review of the best credit cards for credit scores from 650 - 700 to find cards with low interest rates, low fees, ...

Jun 9, 2022 ... Read our review of the best credit cards for credit scores from 650 - 700 to find cards with low interest rates, low fees, ...

6. Is 698 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/698 Oct 11, 2021 ... As 698 is a good credit score, you should not be limited in your loan options. You'll likely easily qualify for most credit cards, ...

Oct 11, 2021 ... As 698 is a good credit score, you should not be limited in your loan options. You'll likely easily qualify for most credit cards, ...

7. Best Credit Cards for Fair Credit of July 2022 - NerdWallet

https://www.nerdwallet.com/best/credit-cards/fair-credit Jun 29, 2022 ... If you're getting your credit on track and your FICO score is in the mid-600s, here are our picks for the best credit cards for fair credit.

Jun 29, 2022 ... If you're getting your credit on track and your FICO score is in the mid-600s, here are our picks for the best credit cards for fair credit.

8. 698 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/698/ Nov 11, 2021 ... A credit score of 698 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 698 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

9. What's the Average Credit Score in Each State? | Equifax

https://www.equifax.com/personal/education/credit/score/average-credit-score-state/

Credit scores help lenders decide whether to grant you credit. The average credit score in the United States is 698, based on VantageScore® data from February ...

10. The Best Credit Cards for Fair and Average Credit of July 2022

https://www.cnbc.com/select/best-credit-cards-for-fair-average-credit/ Jul 1, 2022 ... After all, your primary goal when signing up for a credit card should be to improve your score with responsible financial behavior, so it bumps ...

Jul 1, 2022 ... After all, your primary goal when signing up for a credit card should be to improve your score with responsible financial behavior, so it bumps ...

What is the average credit score?

The average credit score in the United States is 687 according to Experian, which means that a 698 credit score could be above average.

What type of rewards can I get with a 698 credit score?

Rewards typically depend on the type of card you get. If you have a good 698 credit score, you may be able to get cards with generous rewards programs such as cash back, airline miles, or points systems.

Are there any fees associated with these types of cards?

Yes, some cards may offer an annual fee or other fees associated with services like balance transfers. It’s important to do your research and look at all of the costs associated with different cards before selecting one.

Is my information secure when I use this type of card?

Yes, most major issuers provide secure systems for using their cards online or in stores. You may want to look at consumer reviews before applying for any card account just to make sure it’s safe and secure.

Conclusion:

A 698 credit score can open up many options in terms of finding the best rewards-based card for your needs. Researching different offerings from issuers like banks and other financial companies will help you find the perfect match for your budget and lifestyle needs. Don’t forget to take time assessing all related costs before making any commitments!