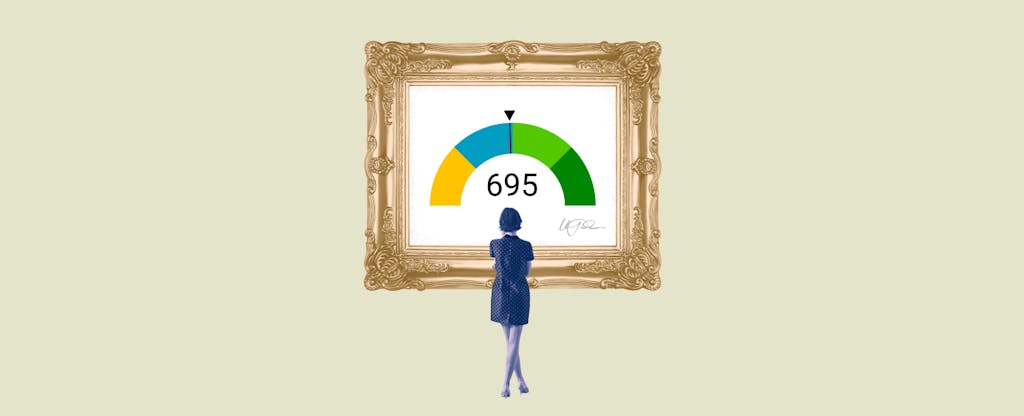

A credit score of 695 is considered to be a good credit score. It indicates that you have a strong credit history and are likely to receive favorable loan terms with lenders. With an excellent credit score, you may not only qualify for the best loans and interest rates, but may also have an easier time obtaining approval for new lines of credit.

Table Of Content:

- 695 Credit Score: Is it Good or Bad?

- 695 Credit Score: Is It Good or Bad? - NerdWallet

- Is 695 a good credit score? | Lexington Law

- 695 Credit Score: What Does It Mean? | Credit Karma

- Is 695 a Good Credit Score? What It Means, Tips & More

- 695 Credit Score (+ #1 Way To Improve it )

- 695 Credit Score: Is it Good or Bad? (Approval Odds)

- Average U.S. Consumer Credit Score Is 695 – Here Are 5 Ways To ...

- Is a 695 credit score good for a car loan? | Jerry

- Average Credit Score in America: 2021 Report - ValuePenguin

1. 695 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/695-credit-score/ A 695 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 695 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. 695 Credit Score: Is It Good or Bad? - NerdWallet

https://www.nerdwallet.com/article/finance/695-credit-score-is-it-good-or-bad Feb 17, 2022 ... A 695 credit score is at the low end of the “good” band (690-719) on a credit score range of 300 to 850. A misstep could easily send your ...

Feb 17, 2022 ... A 695 credit score is at the low end of the “good” band (690-719) on a credit score range of 300 to 850. A misstep could easily send your ...

3. Is 695 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/695 Oct 11, 2021 ... If you have a credit score of 695, you might be asking yourself, “is 695 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 695, you might be asking yourself, “is 695 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

4. 695 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/695 Apr 30, 2021 ... A 695 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 695 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

5. Is 695 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/695-credit-score/

Jan 18, 2019 ... A credit score of 695 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, ...

6. 695 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/695-credit-score

7. 695 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/695-credit-score/ Is 695 a good credit score? FICO scores range from 300 to 850. As you can see below, a 695 credit score is considered Good.

Is 695 a good credit score? FICO scores range from 300 to 850. As you can see below, a 695 credit score is considered Good.

8. Average U.S. Consumer Credit Score Is 695 – Here Are 5 Ways To ...

https://www.thestreet.com/personal-finance/average-us-consumer-credit-score-is-695-here-are-5-ways-to-get-yours-above-800-13262491 Aug 21, 2015 ... - The national average FICO score is at an all-time high at 695, compared to 688 in October 2005. Ethan Dornhelm, FICO's principal scientist in ...

Aug 21, 2015 ... - The national average FICO score is at an all-time high at 695, compared to 688 in October 2005. Ethan Dornhelm, FICO's principal scientist in ...

9. Is a 695 credit score good for a car loan? | Jerry

https://getjerry.com/questions/is-a-695-credit-score-good-for-a-car-loan![]() Feb 23, 2022 ... A 695 is considered a good credit score, meaning that you will likely be approved if you apply. To learn more about credit scores and loans, ...

Feb 23, 2022 ... A 695 is considered a good credit score, meaning that you will likely be approved if you apply. To learn more about credit scores and loans, ...

10. Average Credit Score in America: 2021 Report - ValuePenguin

https://www.valuepenguin.com/average-credit-score

What is a 695 credit score?

A 695 credit score is considered to be good. This means that you have a strong credit history which typically results in lower interest rates on loans and lines of credit.

How can I improve my 695 credit score?

To improve your 695 credit score, it's important to pay all bills on time, keep your debt utilization ratio low, and check your free annual report for any errors or inaccuracies. Additionally, making sure not to open too many new accounts or close existing ones can help maintain an excellent payment history.

Can I get approved with a 695 credit score?

Generally speaking, having a 695 FICO® Score makes it relatively easy to qualify for most types of financing, including personal loans and mortgages. However, some lenders may require higher FICO® Scores due to their specific requirements or policies.

Conclusion:

A 695 FICO® Score puts you in good standing with the majority of lenders who offer financing. Having an excellent payment history will make it easier to qualify for some of the best loan terms available; however, it’s also important to manage your debt carefully and remain proactive about maintaining your high credit rating by checking your free annual report regularly for errors or inaccuracies that could affect your score negatively.