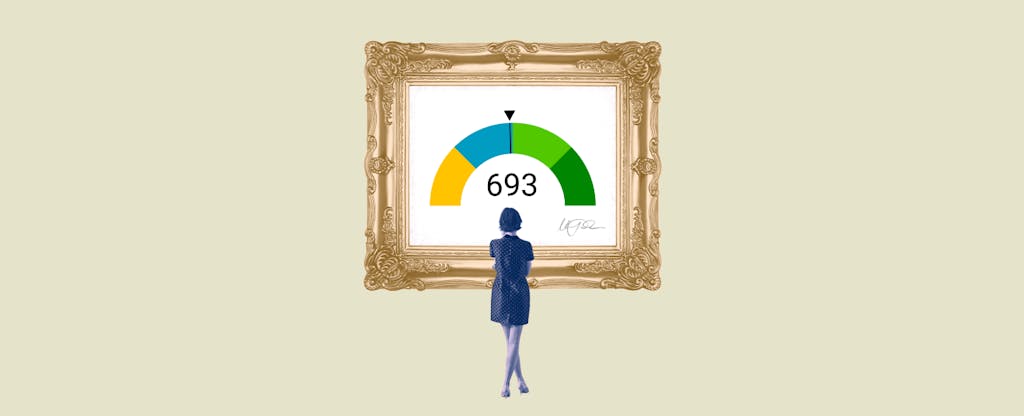

A 693 credit score auto loan is a popular loan option among consumers who have good credit but are unable to qualify for loans in the prime and super-prime credit score range. This type of loan may feature a higher interest rate than what those with credit scores in the upper tiers can receive. But it could still offer a great opportunity for an individual to purchase or refinance a car at competitive terms.

Table Of Content:

- 693 Credit Score: Is it Good or Bad?

- 693 Credit Score: What Does It Mean? | Credit Karma

- Is 693 a Good Credit Score? What It Means, Tips & More

- 693 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 693 a good credit score? | Lexington Law

- 693 Credit Score (+ #1 Way To Improve it )

- Is a 693 credit score good for a car loan? | Jerry

- 693 Credit Score: Is it Good or Bad? (Approval Odds)

- Car loan interest rates with 693 credit score in 2022

- 693 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 693 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/693-credit-score/ 42% Individuals with a 693 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan. Public records such as bankruptcies do not ...

42% Individuals with a 693 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan. Public records such as bankruptcies do not ...

2. 693 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/693 Are you in the market for a personal loan? While you might qualify for a personal loan with fair credit, you ...

Are you in the market for a personal loan? While you might qualify for a personal loan with fair credit, you ...

3. Is 693 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/693-credit-score/

What Does a 693 Credit Score Get You? ; Auto Loan with 0% Intro Rate, NO ; Lowest Auto Insurance Premiums, NO ; Personal Loan, MAYBE ; Apartment Rental, MAYBE ...

4. 693 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/693/ Nov 11, 2021 ... There is no credit score too low to get an auto loan, and you'll be able to get one when your credit score is 693. However, if you want the best ...

Nov 11, 2021 ... There is no credit score too low to get an auto loan, and you'll be able to get one when your credit score is 693. However, if you want the best ...

5. Is 693 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/693 Oct 11, 2021 ... A 693 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

Oct 11, 2021 ... A 693 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

6. 693 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/693-credit-score

7. Is a 693 credit score good for a car loan? | Jerry

https://getjerry.com/questions/is-a-693-credit-score-good-for-a-car-loan![]() Fortunately, a 683 credit score is considered Good, meaning it's very likely that you'll qualify for a decent APR on a car loan.

Fortunately, a 683 credit score is considered Good, meaning it's very likely that you'll qualify for a decent APR on a car loan.

8. 693 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/693-credit-score/ Can I get an auto loan with a 693 credit score? Most auto lenders will lend to someone with a 693 score. However, if you want to ensure you qualify for the best ...

Can I get an auto loan with a 693 credit score? Most auto lenders will lend to someone with a 693 score. However, if you want to ensure you qualify for the best ...

9. Car loan interest rates with 693 credit score in 2022

https://creditscoregeek.com/fair-credit/693/auto/ Interest rate on car loan with 693 credit score can go anywhere from 8% to 12%, but it also depends on the lender and the specific background credit history ...

Interest rate on car loan with 693 credit score can go anywhere from 8% to 12%, but it also depends on the lender and the specific background credit history ...

10. 693 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/693-credit-score/ Car Loan Options ... This is a relatively average credit score range, so an auto loan interest rates with 693 credit score are neither subpar or superb. More ...

Car Loan Options ... This is a relatively average credit score range, so an auto loan interest rates with 693 credit score are neither subpar or superb. More ...

What types of cars can I get with a 693 credit score auto loan?

You may be able to secure financing for almost any type of car you choose, depending on your lender's requirements and the terms of the loan. Generally, these loans are available for both new and used cars, trucks, and SUVs.

How long does it take to get approved for a 693 credit score auto loan?

The length of time it takes to get approved will depend on your lender and the specific details of your application. Generally speaking, however, most lenders can approve your application within 1-2 weeks after all required documents have been submitted.

What interest rates can I expect with this type of loan?

Interest rates on 693 credit score auto loans will vary depending on the lender and other factors such as your income, debt-to-income ratio (DTI), and the value of the vehicle you are purchasing. Generally speaking, however, rates should be comparable to other non-prime loan options.

Are there other types of fees associated with this loan?

Yes, there may be additional fees associated with this type of loan including an origination fee charged by some lenders as well as potential dealer documentation fees if getting financing through a dealership. It is important to read all paperwork carefully before signing any agreements so that you know exactly what fees are being charged.

Conclusion:

A 693 credit score auto loan is an ideal choice for individuals who have good credit but cannot qualify for better interest rates in the prime or super-prime range. It offers competitive terms and could be a great way for someone to purchase their next car or refinance an existing one at affordable rates.