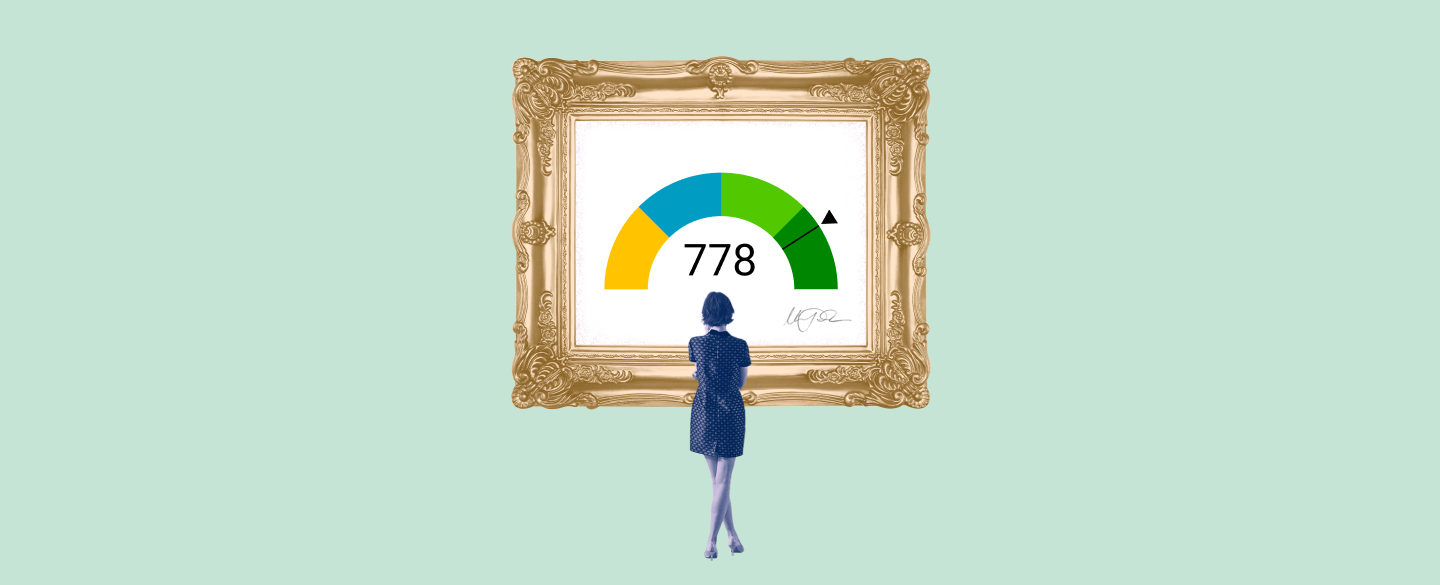

A 778 credit score is a great score on the traditional FICO scoring scale used by most lenders. It typically qualifies you for some of the best mortgage rates available and puts you in a strong financial position to purchase a home.

Table Of Content:

- 778 Credit Score: Is it Good or Bad?

- 778 Credit Score: What Does It Mean? | Credit Karma

- Is a 778 Credit Score Good? Plus How to Get It & More

- Is 778 a good credit score? | Lexington Law

- 778 Credit Score (+ #1 Way To Improve It )

- 778 Credit Score: Is it Good or Bad? (Approval Odds)

- 778 Credit Score: Good or Bad? | Credit Card & Loan Options

- 778 Credit Score - Is it Good or Bad? What does it mean in 2022?

- 778 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 778 Credit Score – Is it Good or Bad? How to Improve Your 778 ...

1. 778 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/778-credit-score/ Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 778 FICO® Score is above the average credit score.

Your score falls within the range of scores, from 740 to 799, that is considered Very Good. A 778 FICO® Score is above the average credit score.

2. 778 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/778 A very good or excellent credit score can mean you're more likely to be approved for good offers and rates when ...

A very good or excellent credit score can mean you're more likely to be approved for good offers and rates when ...

3. Is a 778 Credit Score Good? Plus How to Get It & More

https://wallethub.com/credit-score-range/778-credit-score/

A credit score of 778 should qualify you for most loans, credit cards and other lines of credit. But you won't always get the best terms. That's because a 778 ...

4. Is 778 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/778 Oct 11, 2021 ... Your 778 credit score will likely get you an average interest rate of 2.36 percent on a 30-year loan. In comparison, if you had credit in ...

Oct 11, 2021 ... Your 778 credit score will likely get you an average interest rate of 2.36 percent on a 30-year loan. In comparison, if you had credit in ...

5. 778 Credit Score (+ #1 Way To Improve It )

https://www.creditglory.com/credit-score/778-credit-score

6. 778 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/778-credit-score/ The minimum credit score is around 620 for most conventional lenders, so you should be able to qualify with no issues. See also: 10 Best Mortgage Lenders for ...

The minimum credit score is around 620 for most conventional lenders, so you should be able to qualify with no issues. See also: 10 Best Mortgage Lenders for ...

7. 778 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/778/

Nov 11, 2021 ... A credit score of 778 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

8. 778 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/excellent-credit/778/ In terms of pros, a 778 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, ...

In terms of pros, a 778 credit score shows that you are a trustworthy, reliable borrower and that you would be ideal to loan money too for mortgage loans, ...

9. 778 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/778-credit-score/ A 778 credit score is considered an excellent credit score. If you have a score in this range (FICO score 750 – 850), you're almost certain to be approved ...

A 778 credit score is considered an excellent credit score. If you have a score in this range (FICO score 750 – 850), you're almost certain to be approved ...

10. 778 Credit Score – Is it Good or Bad? How to Improve Your 778 ...

https://www.creditrepairexpert.org/778-credit-score/ This will then translate to them believing that you might not be able to afford to pay for your mortgage each month, and they ...

This will then translate to them believing that you might not be able to afford to pay for your mortgage each month, and they ...

Q1: What is the minimum credit score needed for a mortgage?

Most lenders require a minimum credit score of 620 or higher on the FICO scoring scale. However, with a 778 credit score you put yourself in an excellent position to qualify for one of the best mortgage rates available.

How can I check my current credit score?

You can use various online tools or visit your bank or lender to pull your free annual credit report from one of three major consumer reporting agencies such as Experian, TransUnion, or Equifax to find out what your current credit score is.

Are there other factors besides my credit score that lenders consider when approving mortgage applications?

Yes, lenders also take into account other factors such as your income, employment history and debt-to-income ratio when assessing your eligibility and loan amount.

Conclusion:

With a 778 credit score on the traditional FICO scoring scale, it gives you the perfect platform to secure some of the best mortgage rates available and put you in an excellent financial position to buy that new home!