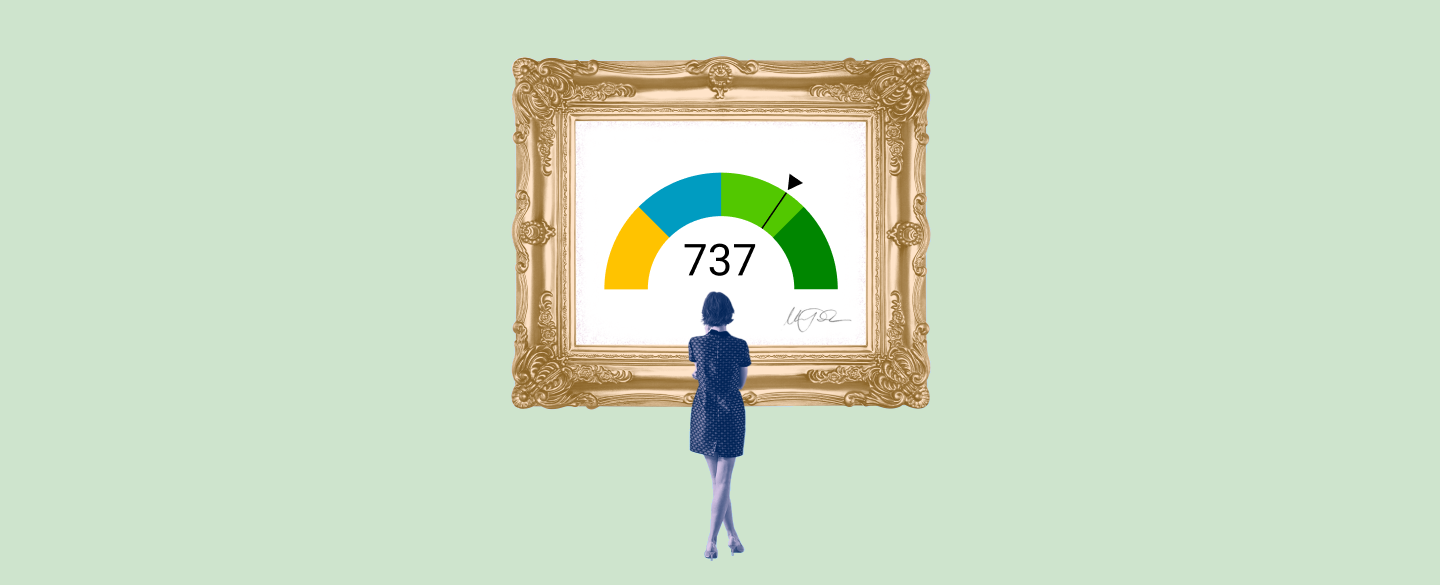

Are you looking for a car loan option with favorable terms? If so, the 737 Credit Score Car Loan may be the answer for you. This type of loan helps borrowers who have credit scores between 600 and 659 get access to financing that would be difficult to secure elsewhere. With this loan, borrowers can enjoy lower interest rates and down payment requirements compared to traditional lenders or subprime lenders.

Table Of Content:

- Is a 737 credit score good enough for a car loan? | Jerry

- 737 Credit Score: Is it Good or Bad?

- 737 Credit Score

- 737 Credit Score: What Does It Mean? | Credit Karma

- Is 737 a good credit score? | Lexington Law

- 737 Credit Score (+ #1 Way To Improve it )

- 737 Credit Score: Is it Good or Bad? (Approval Odds)

- 737 Credit Score - Is it Good or Bad? What does it mean in 2022?

- 737 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- Car loan interest rates with 737 credit score in 2022

1. Is a 737 credit score good enough for a car loan? | Jerry

https://getjerry.com/questions/is-a-737-credit-score-good-enough-for-a-car-loan![]() Feb 23, 2022 ... A 737 credit score will get you a car loan with most lenders. But, we do have one recommendation. A 737 credit score is considered good on the ...

Feb 23, 2022 ... A 737 credit score will get you a car loan with most lenders. But, we do have one recommendation. A 737 credit score is considered good on the ...

2. 737 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/737-credit-score/ 35% Individuals with a 737 FICO® Score have credit portfolios that include auto loan and 40% have a mortgage loan. Recent applications. When you apply for a ...

35% Individuals with a 737 FICO® Score have credit portfolios that include auto loan and 40% have a mortgage loan. Recent applications. When you apply for a ...

3. 737 Credit Score

https://wallethub.com/credit-score-range/737-credit-score/

A 737 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. 737 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/737 The best rates for auto loans are typically available to ... that lenders could check, such as FICO® Auto Scores.

The best rates for auto loans are typically available to ... that lenders could check, such as FICO® Auto Scores.

5. Is 737 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/737 Oct 11, 2021 ... A 737 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

Oct 11, 2021 ... A 737 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between – and 6 ...

6. 737 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/737-credit-score

Jun 11, 2022 ... A 737 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 737 Credit Score. Lenders like to ...

7. 737 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/737-credit-score/ Can I get an auto loan with a 737 credit score? ... Most auto lenders will lend to someone with a 737 score. However, if you want to ensure you qualify for the ...

Can I get an auto loan with a 737 credit score? ... Most auto lenders will lend to someone with a 737 score. However, if you want to ensure you qualify for the ...

8. 737 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/good-credit/737/ Having a 737 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy ...

Having a 737 FICO score means that you are in a good position when trying to obtain credit. You will not have to use expensive dealer finance when trying to buy ...

9. 737 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/737-credit-score/ Credit Score of 737: Car Loans ... Credit scores in this range will result in extremely low interest rates. However, with a higher score you may receive a no ...

Credit Score of 737: Car Loans ... Credit scores in this range will result in extremely low interest rates. However, with a higher score you may receive a no ...

10. Car loan interest rates with 737 credit score in 2022

https://creditscoregeek.com/good-credit/737/auto/ Those with 737 credit score and above will ordinarily meet all requirements for low interest rate auto loans and now and again may stand a chance of using the ~ ...

Those with 737 credit score and above will ordinarily meet all requirements for low interest rate auto loans and now and again may stand a chance of using the ~ ...

What are the eligibility requirements for a 737 Credit Score Car Loan?

The key requirement to qualify for a 737 Credit Score Car Loan is that the borrower must have a credit score between 600 and 659. Borrowers should also have enough income to cover monthly payments and other costs associated with the loan.

Who offers 737 Credit Score Car Loans?

737 Credit Score Car Loans are offered by many lenders, including banks, credit unions, online lenders, and other financial institutions.

What is the difference between a 737 Credit Score Car Loan and other types of car loans?

The main benefit of a 737 credit score car loan is that they offer lower interest rates than traditional or subprime loans. They also require smaller down payments than other types of loans in order to secure financing.

How long does it take to apply for a 737 Credit Score Car Loan?

It typically takes only a few minutes to complete an application form for a len737 37CreditScoreCarLoanoan and some lenders can provide approval within minutes as well. However, it may take longer if additional documentation is required from the borrower. It usually takes up to one business day for final approval and disbursement of funds once all paperwork has been submitted.

Conclusion:

A 737 Credit Score Car Loan can be an attractive option for borrowers who want access to competitively priced financing despite having less-than-perfect credit scores. With this type of loan, you can enjoy lower interest rates and more flexible repayment options than what’s available from traditional or subprime lenders.