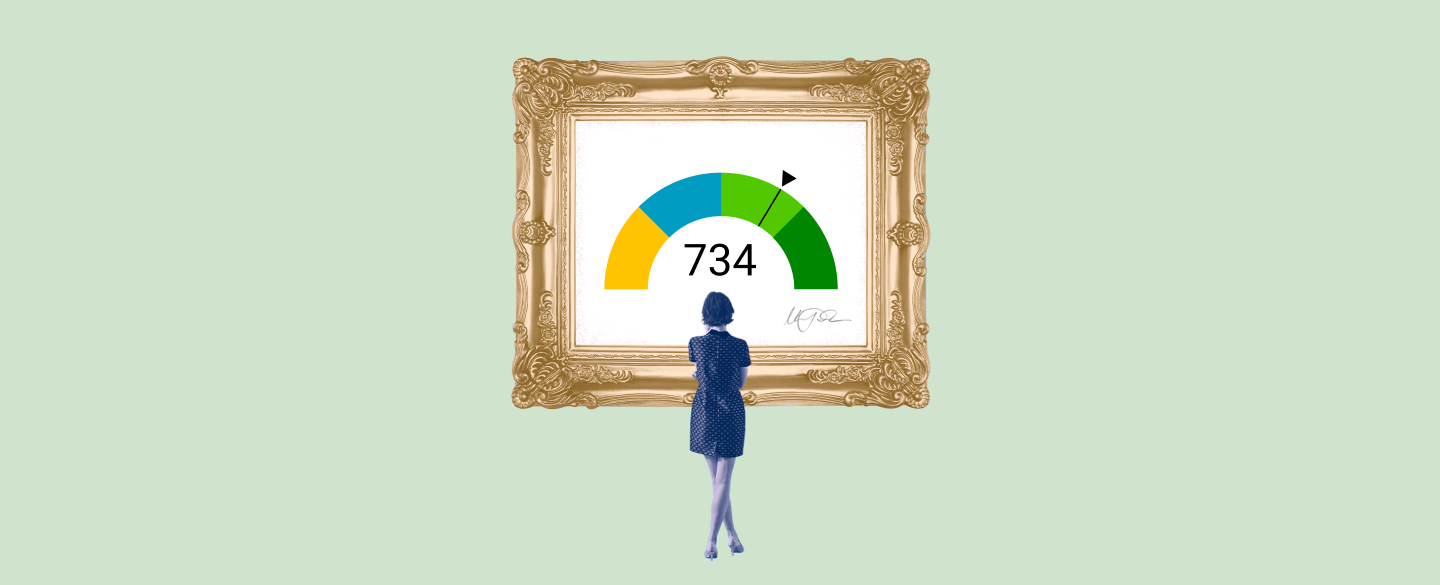

A 734 credit score is a great score that indicates you are financially responsible. It means you are likely to be approved for loans and credit cards because lenders view you as creditworthy. You can rest assured that your credit score will bring many financial benefits to you.

Table Of Content:

- 734 Credit Score: Is it Good or Bad?

- 734 Credit Score: What Does It Mean? | Credit Karma

- 734 Credit Score

- Is 734 a good credit score? | Lexington Law

- Is a 734 credit score good for a car loan? | Jerry

- 734 Credit Score (+ #1 Way To Improve it )

- 734 Credit Score: Is it Good or Bad? (Approval Odds)

- 734 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Is A Good Credit Score? – Forbes Advisor

- Car loan interest rates with 734 credit score in 2022

1. 734 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/734-credit-score/ A FICO® Score of 734 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 734 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. 734 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/734 Apr 28, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

Apr 28, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

3. 734 Credit Score

https://wallethub.com/credit-score-range/734-credit-score/

A 734 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. Is 734 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/734 Oct 11, 2021 ... If you have a credit score of 734, you might be asking yourself, “is 734 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 734, you might be asking yourself, “is 734 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

5. Is a 734 credit score good for a car loan? | Jerry

https://getjerry.com/questions/is-a-734-credit-score-good-for-a-car-loan![]() Feb 23, 2022 ... A 734 credit score is considered good, meaning you'll qualify for an average interest rate of 3.64% for new car loans and 5.35% for used car ...

Feb 23, 2022 ... A 734 credit score is considered good, meaning you'll qualify for an average interest rate of 3.64% for new car loans and 5.35% for used car ...

6. 734 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/734-credit-score

7. 734 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/734-credit-score/ FICO scores range from 300 to 850. As you can see below, a 734 credit score is considered Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 734 credit score is considered Good. Credit Score, Credit Rating, % of population.

8. 734 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/734/

Nov 11, 2021 ... 734 is a good credit score. Scores in this range are high enough to get most types of credit, but you might not qualify for the best ...

9. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

10. Car loan interest rates with 734 credit score in 2022

https://creditscoregeek.com/good-credit/734/auto/ Find out what auto loan rates your 734 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 734.

Find out what auto loan rates your 734 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 734.

What does it mean if I have a 734 credit score?

A 734 credit score is an excellent rating, indicating that you have a good track record when it comes to borrowing money. Your high score suggests that lenders view you as being very responsible with your finances and are likely to approve any loans or credit cards you apply for.

How can I use my 734 credit score?

Having a 734 credit score means that lenders see you as a reliable borrower and are more likely to offer you better loan terms than someone with a lower score. You may also be eligible for lower interest rates on the loans or cards you do get approved for.

Does having a 734 credit score guarantee approval of loan applications?

No, having an excellent score does not guarantee approval of all loan applications. Lenders consider other factors such as income level and debt-to-income ratio before approving any loan application. However, your high credit score does significantly increase your chances of being approved for loans and getting the best terms possible.

Conclusion:

A 734 Credit Score is an excellent rating which reflects positively on your financial reputation. Having this exceptional rating means that lenders are more likely to approve your loan requests at competitive interest rates, making it easier to meet your financial needs without breaking the bank.