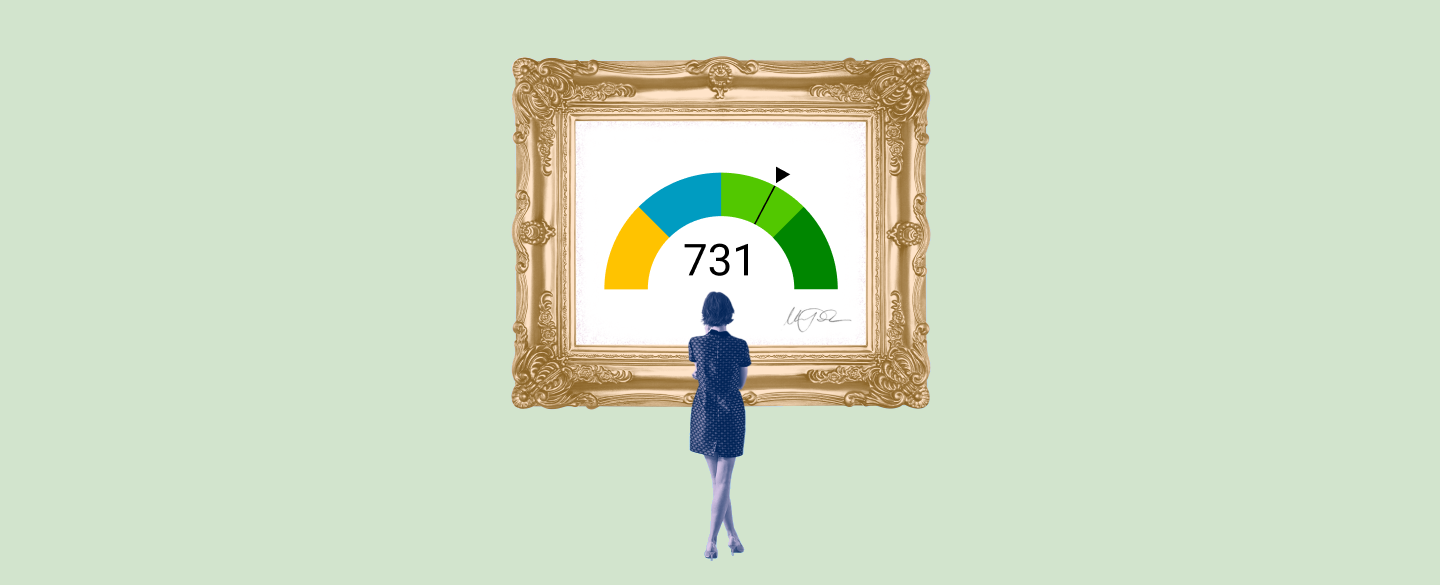

A 731 credit score is considered to be an above-average rate in the world of credit. Generally, it falls into the range of what’s deemed acceptable from a lender’s standpoint when considering one for a mortgage loan. Mortgage rates offered for this type of score can vary greatly depending on many factors such as down payment size, property type, location and more.

Table Of Content:

- 731 Credit Score: What Does It Mean? | Credit Karma

- 731 Credit Score: Is it Good or Bad?

- How Credit Scores Impact Mortgage Rates | Zillow

- 731 Credit Score

- Is 731 a good credit score? | Lexington Law

- 731 Credit Score: Good or Bad? | Credit Card & Loan Options

- 731 Credit Score (+ #1 Way To Improve it )

- 731 Credit Score: Is it Good or Bad? (Approval Odds)

- 731 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- What Is a Good Credit Score? - NerdWallet

1. 731 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/731 With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates ...

With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates ...

2. 731 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/731-credit-score/ A 731 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 731 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

3. How Credit Scores Impact Mortgage Rates | Zillow

https://www.zillow.com/mortgage-learning/mortgage-credit-scores/ The FICO scores range from 350 to 850; an 850 is the Holy Grail of credit scores and 723 is the median score in the U.S., but you can expect good mortgage ...

The FICO scores range from 350 to 850; an 850 is the Holy Grail of credit scores and 723 is the median score in the U.S., but you can expect good mortgage ...

4. 731 Credit Score

https://wallethub.com/credit-score-range/731-credit-score/

A 731 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

5. Is 731 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/731 Oct 11, 2021 ... Your 731 score will give you access to more loan options and better interest rates than people in lower ranges. However, FICO does have ranges ...

Oct 11, 2021 ... Your 731 score will give you access to more loan options and better interest rates than people in lower ranges. However, FICO does have ranges ...

6. 731 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/731/ Nov 11, 2021 ... Scores in this range are high enough to get most types of credit, but you might not qualify for the best interest rates. We'll explain what ...

Nov 11, 2021 ... Scores in this range are high enough to get most types of credit, but you might not qualify for the best interest rates. We'll explain what ...

7. 731 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/731-credit-score

Jun 11, 2022 ... A 731 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 731 Credit Score. Lenders like to ...

8. 731 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/731-credit-score/ Most lenders will approve you for a personal loan with a 731 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

Most lenders will approve you for a personal loan with a 731 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

9. 731 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/731-credit-score/ With 731 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point ...

With 731 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point ...

10. What Is a Good Credit Score? - NerdWallet

https://www.nerdwallet.com/article/finance/what-is-a-good-credit-score An unsecured credit card with a decent interest rate, or even a balance-transfer card. · A desirable car loan or lease. · A mortgage with a favorable interest ...

An unsecured credit card with a decent interest rate, or even a balance-transfer card. · A desirable car loan or lease. · A mortgage with a favorable interest ...

Is 731 an average credit score?

While 731 is not necessarily a "good" or "bad" credit score, it does fall within an above-average range when looking at the spectrum of possible scores available. The lower the credit score, the higher the risk factor, which could lead to higher interest rates on loans like mortgages.

What kind of mortgage rates will I get with a 731 credit score?

The exact rate you can expect to receive with a 731 credit score will depend on other factors such as your down payment size, type of property being purchased, and where it’s located. Generally speaking, however, you could expect to receive anywhere from a 3.5%-5% rate depending on those factors.

Are there any other available options for someone with a 731 credit rating?

Yes! There are many different types of loans available that may suit someone who has a top-tier 731 rating even better than a traditional mortgage option. Some lenders may offer features like no points or origination fees while others may specialize in flexible repayment terms.

Are there any tips for getting approved for a mortgage loan with my current 731 rating?

If you have aspirations to purchase property, then there are some important steps you should take before approaching potential lenders and applying for your loan. Make sure that all debts are up to date and that bills are being paid in full every month to show responsible financial behavior. Additionally try building your savings account and increasing your income if possible - both of these factors will only help improve your chances!

Conclusion:

With its high acceptance rate among lenders and favorable interest rates associated with it compared to lower ratings – having an above-average 731 rating is certainly beneficial when seeking out financing options for purchases like mortgages. Keep informed about changing marketplace conditions and make sure that monthly obligations are kept up with as much as possible in order to keep this rating strong over time.