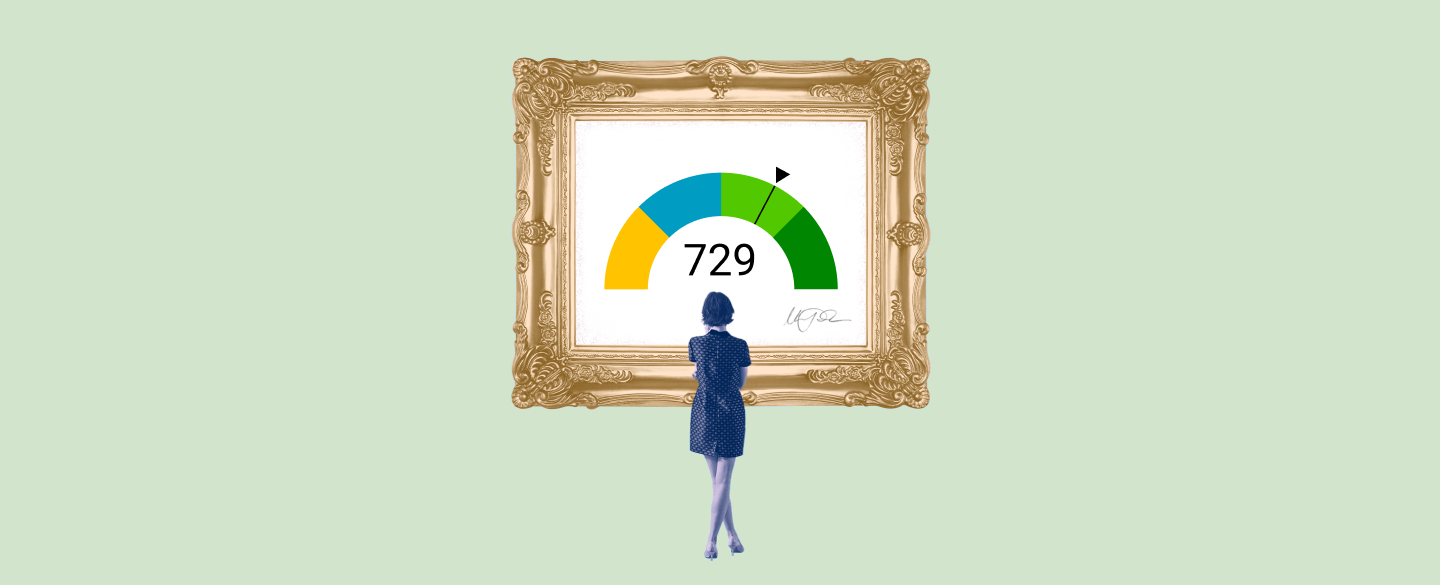

A 729 credit score is a great indication of good credit health. It means that you regularly pay your bills on time, manage debt responsibly, and stick to healthy financial habits. A 729 credit score can get you access to competitive interest rates on mortgages and auto loans, as well as streamlined approval for credit cards and other forms of borrowing.

Table Of Content:

- 729 Credit Score: Is it Good or Bad?

- 729 Credit Score: What Does It Mean? | Credit Karma

- 729 Credit Score

- Is 729 a good credit score? | Lexington Law

- Is 729 a Good Credit Score? | Fiscal Tiger

- 729 Credit Score (+ #1 Way To Improve it )

- 729 Credit Score: Is it Good or Bad? (Approval Odds)

- 725-749 Credit Score | Is 729 Credit Score Enough for a Loan?

- 729 Credit Score – Is it Good or Bad? How to Improve Your 729 ...

- What Credit Score is Needed to Buy a House? | SmartAsset.com

1. 729 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/729-credit-score/ A FICO® Score of 729 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 729 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. 729 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/729 Apr 2, 2021 ... A 729 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

Apr 2, 2021 ... A 729 credit score is considered a good credit score by many lenders. ... “Good” score range identified based on 2021 Credit Karma data. A credit ...

3. 729 Credit Score

https://wallethub.com/credit-score-range/729-credit-score/

A 729 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. Is 729 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/729 Oct 11, 2021 ... If you have a credit score of 729, you might be asking yourself, “is 729 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 729, you might be asking yourself, “is 729 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

5. Is 729 a Good Credit Score? | Fiscal Tiger

https://www.fiscaltiger.com/how-good-is-a-credit-score-of-729/ Jun 7, 2021 ... Your credit score of 729 officially ranks as “Good.” It's a score that has seen improvement over “Very Poor” and “Fair” scores, ...

Jun 7, 2021 ... Your credit score of 729 officially ranks as “Good.” It's a score that has seen improvement over “Very Poor” and “Fair” scores, ...

6. 729 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/729-credit-score

7. 729 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/729-credit-score/ Is 729 a good credit score? FICO scores range from 300 to 850. As you can see below, a 729 credit score is considered Good.

Is 729 a good credit score? FICO scores range from 300 to 850. As you can see below, a 729 credit score is considered Good.

8. 725-749 Credit Score | Is 729 Credit Score Enough for a Loan?

https://obryanlawoffices.com/life-after-bankruptcy/restoring-credit/credit-score-ranges/729-credit-score/ Scores vary from 300 to 850 on the FICO scale. A credit score of 729 is considered Good, as seen above. Most lenders will lend to customers who have good credit ...

Scores vary from 300 to 850 on the FICO scale. A credit score of 729 is considered Good, as seen above. Most lenders will lend to customers who have good credit ...

9. 729 Credit Score – Is it Good or Bad? How to Improve Your 729 ...

https://www.creditrepairexpert.org/729-credit-score/ How to Improve Your 729 FICO Score. Before you can do anything to increase your 729 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 729 FICO Score. Before you can do anything to increase your 729 credit score, you need to identify what part of it needs to be improved, ...

10. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house What interest rate can I get with my credit score? · Excellent (760-850) – Your credit score will have no impact on your interest rate. · Very good (700-760) – ...

What interest rate can I get with my credit score? · Excellent (760-850) – Your credit score will have no impact on your interest rate. · Very good (700-760) – ...

What is a 729 credit score?

A 729 credit score is an excellent rating in the FICO scoring model range of 300 to 850, indicating a higher-than-average level of trustworthiness when it comes to managing debt and making timely payments.

How does it affect my ability to get loan or credit card?

Having a 729 credit score can give you access to competitive interest rates on mortgages and auto loans, as well as streamlined approval for credit cards and other forms of borrowing.

What kind of financial habits are needed for a high credit score?

Maintaining healthy financial habits such as paying bills on time, keeping balances low relative to their available limit, limiting new applications for loan or credit products, avoiding judgements against you from creditors are all key components that contribute to a higher score.

What other benefits come with having a 729credit score?

Having a 729credit score can help demonstrate your reliability when airlines need proof of income for airfare purchase or car rental companies need proof of identity before renting vehicles. Many insurance providers also use the credit rating system as part of their process when determining premium costs.

Is there anything I should avoid if I want to keep my 729 credit score intact?

You should avoid actions like missing payments or maxing out your available limits which can negatively impact your overall score. Also be wary of taking out too much debt in too short amount of time as this may have an adverse effect on your rating.

Conclusion:

With the right strategies in place, maintaining a high FICO Score is achievable over the long term by understanding how lenders view consumer behavior. Understanding how FICO Scores work can help you leverage better finance management practices and achieve the desired results over time.