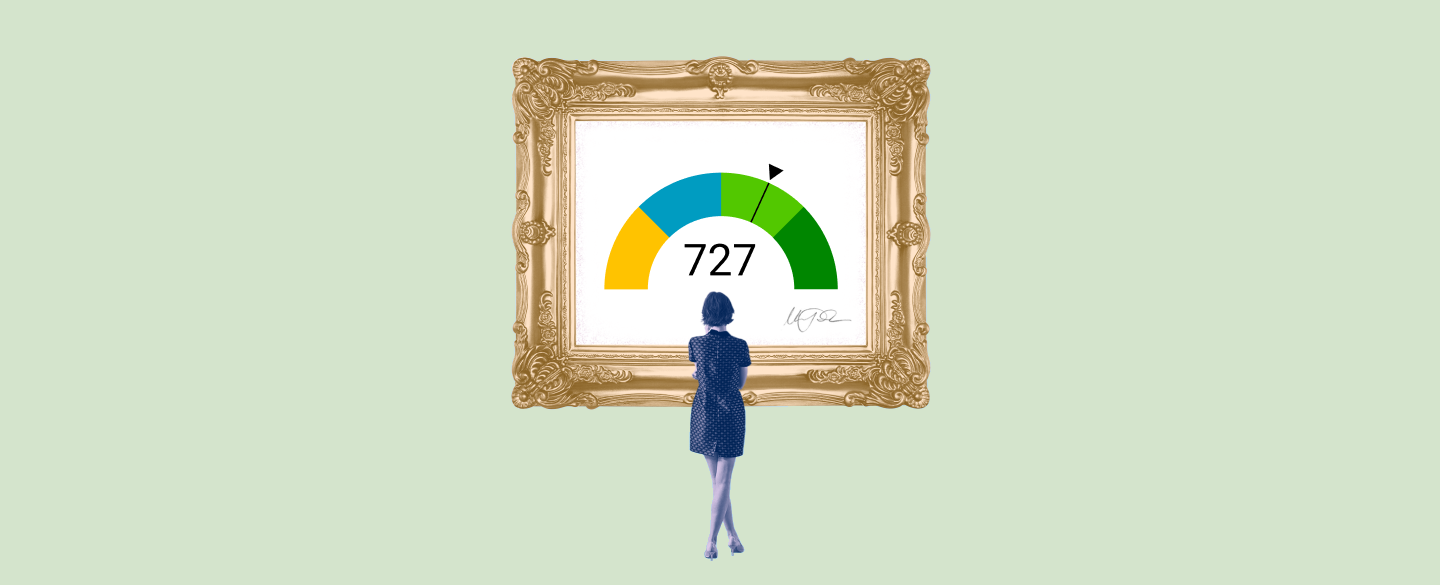

The FICO score is a numerical representation of your creditworthiness and financial health. The higher the score, the more attractive you are to lending institutions like banks. A FICO score of 727 is generally considered to be very good and indicates that you have a strong track record of managing debt responsibly.

Table Of Content:

- 727 Credit Score: Is it Good or Bad?

- 727 Credit Score: What Does It Mean? | Credit Karma

- 727 Credit Score

- 727 Credit Score (+ #1 Way To Improve it )

- Is 727 a good credit score? | Lexington Law

- What Is A Good Credit Score? – Forbes Advisor

- 727 Credit Score: Good or Bad? | Credit Card & Loan Options

- 727 Credit Score: Is it Good or Bad? (Approval Odds)

- 727 Credit Score – Is it Good or Bad? How to Improve Your 727 ...

- 727 Credit Score - Is it Good or Bad? What does it mean in 2022?

1. 727 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/727-credit-score/ A FICO® Score of 727 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 727 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. 727 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/727 Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

3. 727 Credit Score

https://wallethub.com/credit-score-range/727-credit-score/

A 727 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. 727 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/727-credit-score

5. Is 727 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/727 Oct 11, 2021 ... If you have a credit score of 727, you might be asking yourself, “is 727 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 727, you might be asking yourself, “is 727 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

6. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

7. 727 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/727/ Nov 11, 2021 ... A credit score of 727 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 727 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

8. 727 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/727-credit-score/ Is 727 a good credit score? FICO scores range from 300 to 850. As you can see below, a 727 credit score is considered Good.

Is 727 a good credit score? FICO scores range from 300 to 850. As you can see below, a 727 credit score is considered Good.

9. 727 Credit Score – Is it Good or Bad? How to Improve Your 727 ...

https://www.creditrepairexpert.org/727-credit-score/ How to Improve Your 727 FICO Score. Before you can do anything to increase your 727 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 727 FICO Score. Before you can do anything to increase your 727 credit score, you need to identify what part of it needs to be improved, ...

10. 727 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/good-credit/727/ If you are wondering if 727 credit score is “good” or “bad”, then you have no need to worry. The answer is that credit score under 727 is considered a good ...

If you are wondering if 727 credit score is “good” or “bad”, then you have no need to worry. The answer is that credit score under 727 is considered a good ...

What does a 727 FICO score indicate?

A FICO score of 727 reflects a strong track record of managing debt responsibly. Generally speaking, it is considered to be very good and will make you attractive to potential lenders such as banks.

How do I improve my FICO score?

There are several ways you can improve your creditworthiness and subsequently your FICO score, including paying off existing debts, keeping low balances on credit cards, not applying for too many new lines of credit too quickly, and refraining from taking out large loans without carefully considering the terms.

Can I get approved for a loan with a 727 FICO score?

The answer is likely yes. Most lenders require a minimum of a 660-720 credit score in order to qualify for an unsecured loan; being at or above 727 gives you an advantage in most cases. However, it's important to remember that other factors will affect whether or not you're approved such as income level and other debts/obligations.

How often should I check my FICO Score?

It's recommended that you check your credit report at least once per year, as this can give you an accurate picture of where your current creditworthiness stands. Additionally, if something changes in regards to your financial situation (for example if you take on new debt), it's advisable to periodically check your reports afterwards so that any unexpected discrepancies don't become major issues down the line.

Is there anything else I should be aware of when it comes to my 727 FICO Score?

Yes! While having a high FICO Score is beneficial in terms of obtaining potential loans or other forms of financing, it also means that creditors may view you as higher risk because they know they may have trouble collecting payment from someone with excellent repayment habits. Therefore, it's important to know what interest rates and repayment terms certain creditors are offering so that you can make sure whatever deal/loan arrangement you enter into is fair for both parties.

Conclusion:

Having a high FICO Score like 727 puts you in an enviable position when it comes time to pursue financing or other forms of funding such as loans; however, it also pays to understand the implications that come with having excellent repayment history so that whatever agreement reached between yourself and creditors is equitable.