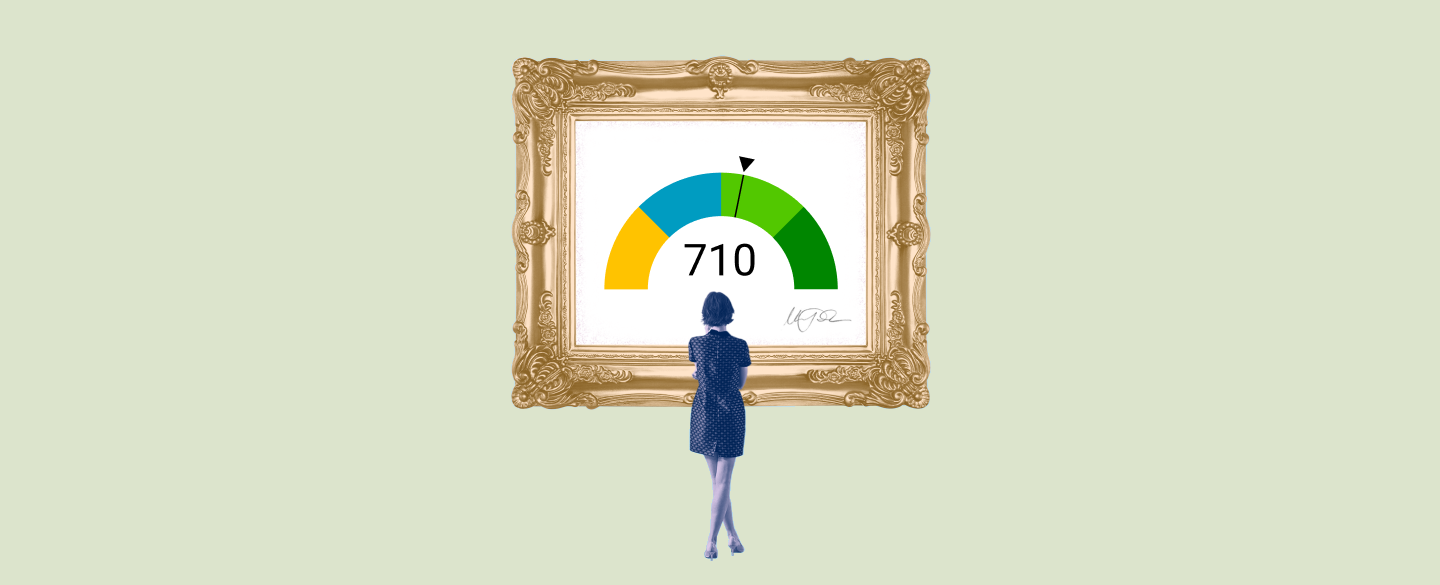

A FICO score is a numerical representation of an individual’s creditworthiness. It ranges from 300 to 850, with higher scores indicating better credit. A score of 710 is considered excellent and above average. This score usually gets you the best interest rates and terms from lenders.

Table Of Content:

- 710 Credit Score: Is It Good or Bad? - NerdWallet

- 710 Credit Score: Is it Good or Bad?

- 710 Credit Score: What Does It Mean? | Credit Karma

- 710 Credit Score

- 4 Hacks to Raise Your Credit Score – Caro Federal Credit Union

- Is 710 a Good Credit Score to Get a Car Loan? | Green Light Auto ...

- The credit score you need to take out a mortgage

- 710 Credit Score (+ #1 Way To Improve it )

- How To Get A 760 Credit Score

- Is 710 a good credit score? | Lexington Law

1. 710 Credit Score: Is It Good or Bad? - NerdWallet

https://www.nerdwallet.com/article/finance/710-credit-score Feb 24, 2022 ... A 710 credit score falls into the “good” band of a typical 300-850 range and will qualify you for some credit cards and loans but may not ...

Feb 24, 2022 ... A 710 credit score falls into the “good” band of a typical 300-850 range and will qualify you for some credit cards and loans but may not ...

2. 710 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/710-credit-score/ A 710 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 710 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

3. 710 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/710 Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

4. 710 Credit Score

https://wallethub.com/credit-score-range/710-credit-score/

A 710 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

5. 4 Hacks to Raise Your Credit Score – Caro Federal Credit Union

https://smartcaro.org/4-hacks-to-raise-your-credit-score/ Sep 4, 2019 ... The average credit score in the United States ranges between 670 and 710. According to Experian, a “good” credit score is anything that falls ...

Sep 4, 2019 ... The average credit score in the United States ranges between 670 and 710. According to Experian, a “good” credit score is anything that falls ...

6. Is 710 a Good Credit Score to Get a Car Loan? | Green Light Auto ...

https://www.greenlightautocredit.com/credit-information/is-710-a-good-credit-score/ You're in luck! A 710 credit rating is considered “Good.” That means you are likely to have more success finding a great deal. Let's go through the basics of ...

You're in luck! A 710 credit rating is considered “Good.” That means you are likely to have more success finding a great deal. Let's go through the basics of ...

7. The credit score you need to take out a mortgage

https://www.cnbc.com/2019/07/15/median-credit-score-mortgage.html Jul 15, 2019 ... FICO credit scores range from 300 to 850, and the national average is 704. Any score between 700 and 749 is typically deemed “good,” while ...

Jul 15, 2019 ... FICO credit scores range from 300 to 850, and the national average is 704. Any score between 700 and 749 is typically deemed “good,” while ...

8. 710 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/710-credit-score

9. How To Get A 760 Credit Score

https://www.cnbc.com/select/how-to-get-a-760-credit-score/ Aug 6, 2021 ... With the average FICO Score reaching 710 in 2020 (a record high), the takeaway is that if your credit score isn't yet at 760 you certainly ...

Aug 6, 2021 ... With the average FICO Score reaching 710 in 2020 (a record high), the takeaway is that if your credit score isn't yet at 760 you certainly ...

10. Is 710 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/710 Oct 11, 2021 ... If you have a credit score of 710, you might be asking yourself, “is 710 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 710, you might be asking yourself, “is 710 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

What does a FICO Score of 710 mean?

A 710 FICO score is generally considered excellent, which includes being in the top 20% of all consumer credit ratings for that range. This high rating typically translates into gaining access to lower interest rates when applying for loans or lines of credit.

How is a FICO Score calculated?

Your FICO Score is calculated based on your payment history, outstanding debt utilization, length of your credit history, amount of new credit applications in the past 12 months, and types of current account usage and payment patterns. The emphasis will be placed on your payment history first and foremost when calculating your score.

What factors can cause a decrease in my FICO Score?

Factors that can result in a drop in your score include late payments on bills, maxing out credit cards or other revolving accounts, exceeding the total available balance limit on loan accounts, having too many hard inquiries into your credit report within a given time period (usually 12 months), or having collections reported against you that go unpaid for an extended period of time.

How can I improve my FICO Score?

You can improve your score by paying all bills on time each month, increasing diversification in account types such as adding installment lines for longer-term loans/lines of credits as opposed to only revolving accounts like credit cards, reducing overall debt utilization ratio by using amounts towards paying down balances rather than just making minimum payments each month, and avoiding too many hard inquiries into your report within a given year's time frame (usually 12 months).

Will my FICO Score always remain at 710?

Your score may fluctuate depending upon how active you are with managing your financial obligations as well as reporting accuracy from the bureaus who calculate them establish criteria monthly and provide updated information to Credit Agencies. Foundational changes such as providing additional diversification across different account types could also have an impact on maintaining this level over long-term periods; however short-term fluctuations are expected due to market conditions and changing standards with creditors/lenders.

Conclusion:

In conclusion, reaching and maintaining a 710 FICO Score requires being diligent about staying current with all financial obligations as well as monitoring reports regularly for any errors or inaccuracies which could influence their accuracy overall. Taking proactive steps that promote good habits regarding managing finances responsibly will increase chances for applicants in achieving this rating initially as well as holding onto it long term before needing to make any further adjustments along the way.