A 706 Credit Score is a great way to show potential creditors that you are responsible with your finances. This score is considered very good on the FICO scoring range and will likely result in favorable loan or credit card terms from lenders. It can take a bit of work to maintain a high credit score, but it’s worth it in the end!

Table Of Content:

- 706 Credit Score: Is it Good or Bad?

- 706 Credit Score: What Does It Mean? | Credit Karma

- 706 Credit Score

- Is 706 a good credit score? | Lexington Law

- Average FICO score hits all-time high

- 706 Credit Score (+ #1 Way To Improve it )

- Average U.S. FICO Score Ticks Up to 706

- 706 Credit Score: Good or Bad? | Credit Card & Loan Options

- 706 Credit Score: Is it Good or Bad? (Approval Odds)

- Credit Score Ranges - How It Matters To Your Finances?

1. 706 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/706-credit-score/ A 706 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 706 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. 706 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/706 Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

Apr 2, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

3. 706 Credit Score

https://wallethub.com/credit-score-range/706-credit-score/

A 706 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

4. Is 706 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/706 Oct 11, 2021 ... If you have a credit score of 706, you might be asking yourself, “is 706 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 706, you might be asking yourself, “is 706 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

5. Average FICO score hits all-time high

https://www.cnbc.com/2019/09/10/average-fico-score-hits-all-time-high.html Sep 10, 2019 ... FICO scores range from 300 to 850. A good score generally is above 700, and those over 760 are considered excellent. More from Personal Finance:

Sep 10, 2019 ... FICO scores range from 300 to 850. A good score generally is above 700, and those over 760 are considered excellent. More from Personal Finance:

6. 706 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/706-credit-score

7. Average U.S. FICO Score Ticks Up to 706

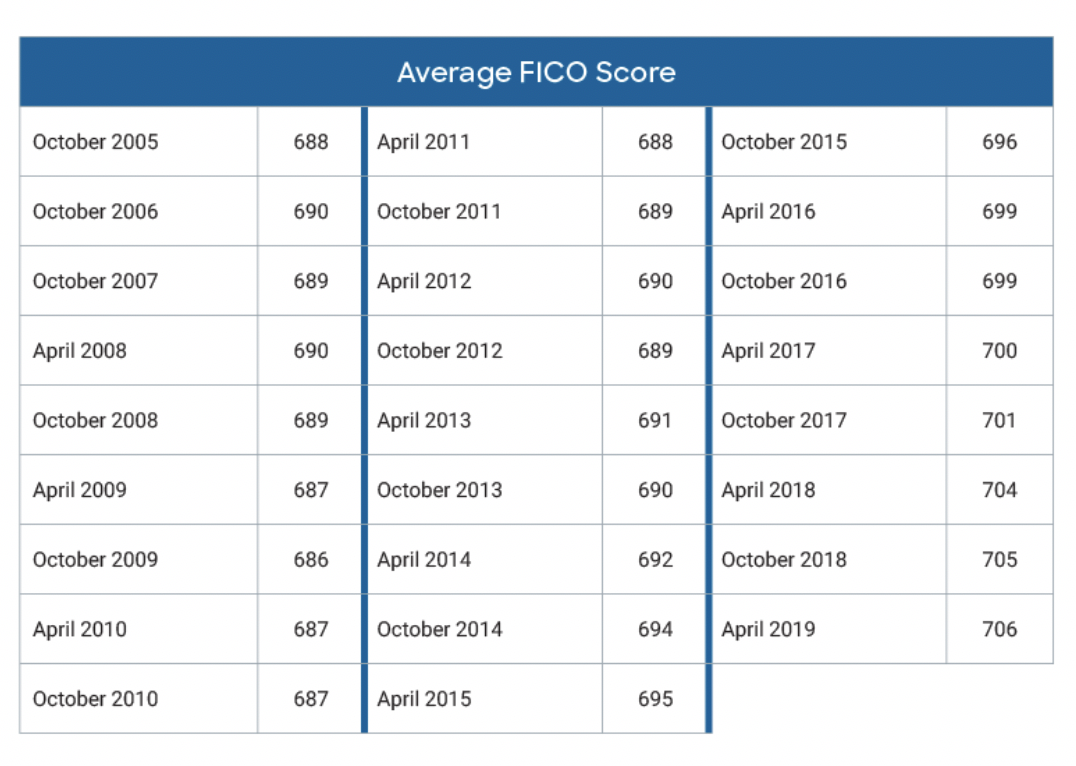

https://www.fico.com/blogs/average-us-fico-score-ticks-706 Sep 10, 2019 ... The latest data is in, and the average U.S. FICO® Score now sits at 706. Since bottoming out at 686 in Oct 2009, there have been nine ...

Sep 10, 2019 ... The latest data is in, and the average U.S. FICO® Score now sits at 706. Since bottoming out at 686 in Oct 2009, there have been nine ...

8. 706 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/706/ Nov 11, 2021 ... A credit score of 706 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 706 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

9. 706 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/706-credit-score/ FICO scores range from 300 to 850. As you can see below, a 706 credit score is considered Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 706 credit score is considered Good. Credit Score, Credit Rating, % of population.

10. Credit Score Ranges - How It Matters To Your Finances?

https://www.nfcc.org/blog/the-range-of-poor-to-excellent-credit-scores-and-what-it-means-for-your-finances/ Sep 10, 2020 ... But, this should give you a good general idea of what to aim for. ... A poor credit score is a score between 300 and 579. ... A fair credit score is ...

Sep 10, 2020 ... But, this should give you a good general idea of what to aim for. ... A poor credit score is a score between 300 and 579. ... A fair credit score is ...

What is a 706 credit score?

A 706 credit score is an excellent rating on the FICO scoring model. It places you well within the “good” range and indicates that you have very good creditworthiness. Most lenders and creditors will offer you favorable loan or credit card terms if you maintain this level of creditworthiness.

What factors affect my 706 credit score?

Your 706 credit score can be affected by several different factors, including payment history, debt-to-credit ratio, length of credit history, types of accounts used, etc. Regularly monitoring these factors can help ensure that your score remains high.

How long does it take to build up a 706 Credit Score?

Building up a good Credit Score takes time and effort, as well as dedication to making timely payments and keeping debt levels low. Overall, though, consistently maintaining responsible financial habits should result in higher scores over time.

What kinds of benefits come with having a good 706 Credit Score?

Having a high 706Credit Score allows lenders to see that you are responsible with your finances and are less risky when it comes to lending money or granting access to revolving lines of credits. As such, many lenders may offer more favorable terms when approving loans or issuing new cards than they would have otherwise offered you had your score been lower.

Conclusion:

A 706 Credit Score is an excellent rating on the FICO scoring model that shows potential creditors that you are financially responsible. It may take some time and effort to maintain this level but doing so could result in greater access to more favorable loan/credit card terms from lenders going forward. Taking the necessary steps today can help secure a healthy financial future for tomorrow!