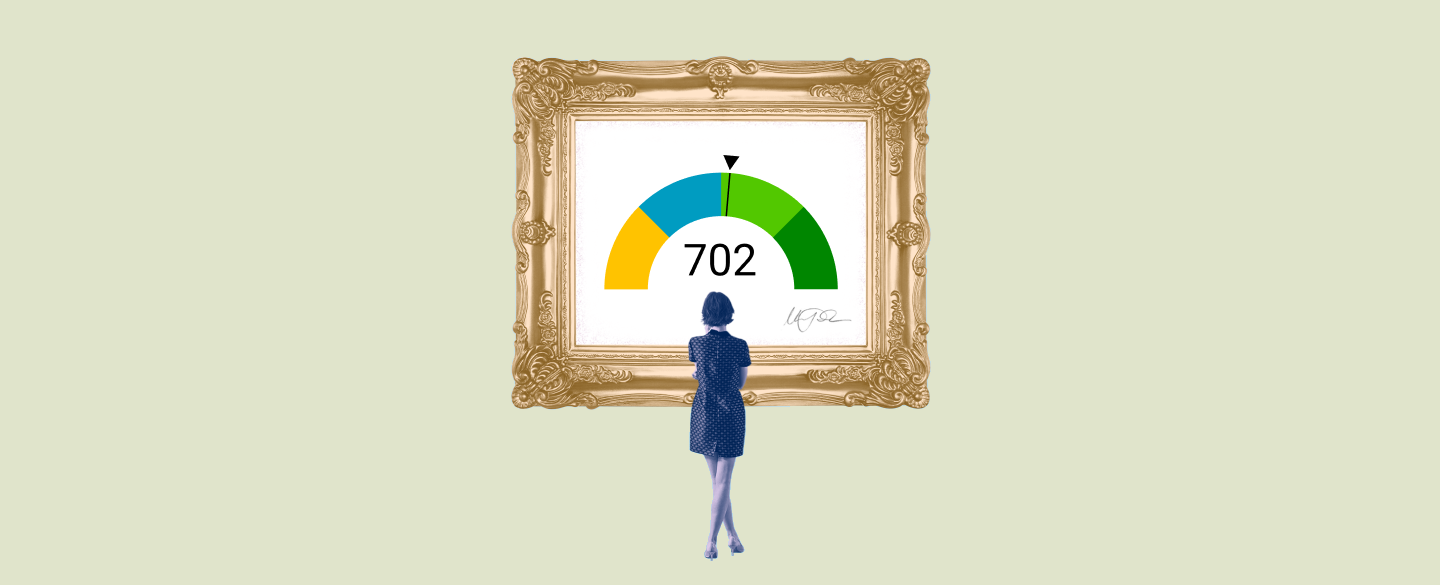

A FICO score is a credit score developed by the Fair Isaac Corporation. It ranges from 300 to 850 and indicates the likelihood of you paying back any loan or credit card debt. A FICO score of 702 falls within the good range, meaning you will find it easier to get approved for loans and access credit with favorable terms.

Table Of Content:

- 702 Credit Score: Is it Good or Bad?

- 702 Credit Score: What Does It Mean? | Credit Karma

- 702 Credit Score: Good or Bad? | Credit Card & Loan Options

- 702 Credit Score

- 702 Credit Score (+ #1 Way To Improve it )

- Is 702 a good credit score? | Lexington Law

- 702 Credit Score: Is it Good or Bad? (Approval Odds)

- The credit score you need to take out a mortgage

- 5 Reasons People With 700+ Credit Scores Still Get Rejected

- Home buying with a 700 credit score | How much can I borrow?

1. 702 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/702-credit-score/ A 702 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 702 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. 702 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/702 Apr 1, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

Apr 1, 2021 ... “Good” score range identified based on 2021 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and ...

3. 702 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/702/ Nov 11, 2021 ... A credit score of 702 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 702 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

4. 702 Credit Score

https://wallethub.com/credit-score-range/702-credit-score/

A 702 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, ...

5. 702 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/702-credit-score

Jun 11, 2022 ... A 702 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 702 Credit Score. Lenders like to ...

6. Is 702 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/702 Oct 11, 2021 ... If you have a credit score of 702, you might be asking yourself, “is 702 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 702, you might be asking yourself, “is 702 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

7. 702 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/702-credit-score/ Is 702 a good credit score? FICO scores range from 300 to 850. As you can see below, a 702 credit score is considered Good.

Is 702 a good credit score? FICO scores range from 300 to 850. As you can see below, a 702 credit score is considered Good.

8. The credit score you need to take out a mortgage

https://www.cnbc.com/2019/07/15/median-credit-score-mortgage.html Jul 15, 2019 ... FICO credit scores range from 300 to 850, and the national average is 704. Any score between 700 and 749 is typically deemed “good,” while ...

Jul 15, 2019 ... FICO credit scores range from 300 to 850, and the national average is 704. Any score between 700 and 749 is typically deemed “good,” while ...

9. 5 Reasons People With 700+ Credit Scores Still Get Rejected

https://www.forbes.com/sites/nickclements/2016/11/28/5-reasons-people-with-700-credit-scores-still-get-rejected/

Nov 28, 2016 ... Just because you have an excellent credit score doesn't mean you will get approved for a credit card or loan. Your credit score is just one ...

10. Home buying with a 700 credit score | How much can I borrow?

https://themortgagereports.com/68809/tips-for-buying-a-house-with-a-700-credit-score Nov 30, 2021 ... Learn how to buy a house with a 700 credit score, including the best mortgage types and tips to get the lowest mortgage rate.

Nov 30, 2021 ... Learn how to buy a house with a 700 credit score, including the best mortgage types and tips to get the lowest mortgage rate.

What is a good FICO Score?

Generally, a good FICO Score is considered to be anything around 670-739. With a score of 702, your creditworthiness should be seen favorably by lenders.

What could having a good FICO Score mean for me?

Having a higher Fico score can make it much easier to get approved for loans and access other forms of credit, such as cards with lower interest rates and fewer fees. It also means that lenders may be willing to offer you larger amounts than those who have lower scores.

How can I improve my FICO Score?

One way would be to make sure your payments are on time each month – late payments can have an adverse effect on your score. You should also pay attention to how much debt you’re carrying – making sure it’s below 30% of your available limit can help maintain or improve your credit rating. Additionally, you should use only a small portion (10–20%) of any revolving balances such as credit cards or lines of credit.

Conclusion:

Your FICO score has the potential to open many doors in terms of accessing more favorable lending options and better rates when borrowing money or using lines of credit. Keeping up with these tips and sticking to timely payments is essential if you want to maintain or even increase your current score.