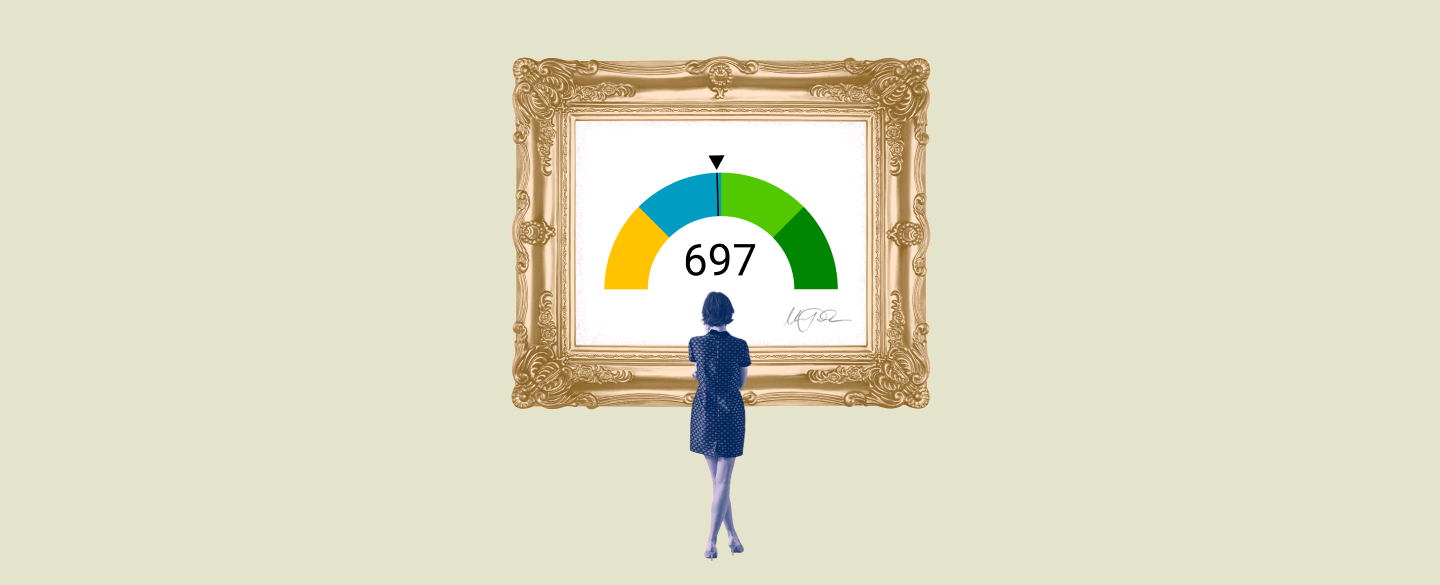

Having a 697 credit score is considered good. This score can open the door to many opportunities credit-wise, such as getting credit cards with low interest rates or even qualifying for a home loan. It’s important to understand what this score means and the factors that go into it in order to make sure you maintain it.

Table Of Content:

- 697 Credit Score: Is it Good or Bad?

- Is 697 a Good Credit Score? What It Means, Tips & More

- 697 Credit Score: What Does It Mean? | Credit Karma

- Is 697 a good credit score? | Lexington Law

- 697 Credit Score (+ #1 Way To Improve it )

- 697 Credit Score: Good or Bad? | Credit Card & Loan Options

- 697 Credit Score: Is it Good or Bad? (Approval Odds)

- Is a 697 credit score good? - Quora

- What Is A Good Credit Score? | Equifax®

- 697 Credit Score – Is it Good or Bad? How to Improve Your 697 ...

1. 697 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/697-credit-score/ A 697 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 697 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. Is 697 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/697-credit-score/

A credit score of 697 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

3. 697 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/697 Apr 30, 2021 ... A 697 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

Apr 30, 2021 ... A 697 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

4. Is 697 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/697 Oct 11, 2021 ... If you have a credit score of 697, you might be asking yourself, “is 697 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 697, you might be asking yourself, “is 697 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

5. 697 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/697-credit-score

6. 697 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/697/ Nov 11, 2021 ... 697 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest ...

Nov 11, 2021 ... 697 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest ...

7. 697 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/697-credit-score/ Is 697 a good credit score? FICO scores range from 300 to 850. As you can see below, a 697 credit score is considered Good.

Is 697 a good credit score? FICO scores range from 300 to 850. As you can see below, a 697 credit score is considered Good.

8. Is a 697 credit score good? - Quora

https://www.quora.com/Is-a-697-credit-score-good

A 697 FICO score is good, but by raising your score into the Very good range, you could qualify for lower interest rates and better borrowing terms.

9. What Is A Good Credit Score? | Equifax®

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

What is a Good Credit Score? Reading time: 3 minutes. Highlights: Credit scores are calculated using information in your credit reports.

10. 697 Credit Score – Is it Good or Bad? How to Improve Your 697 ...

https://www.creditrepairexpert.org/697-credit-score/ 697 Credit Score – Is it Good or Bad? How to Improve Your 697 FICO Score. Before you can do anything to increase your 697 credit score, you need to identify ...

697 Credit Score – Is it Good or Bad? How to Improve Your 697 FICO Score. Before you can do anything to increase your 697 credit score, you need to identify ...

What does a 697 credit score mean?

A 697 credit score is typically classified as "Good" and usually falls within the range of 670-739. This type of credit score is considered favorable by most lenders and can give you access to exclusive offers and competitive terms on loans, mortgages, auto financing, and more.

Does having a 697 credit score grant me access to all loan offers?

Although having a 697 credit score is one factor that will be taken into account when applying for most loan products, it isn't the only one. Your other financial factors such as income, debt-to-income ratio, employment history, etc., will also be taken into consideration by lenders when reviewing your eligibility for any particular loan product.

What are some steps I can take to maintain my 697 credit score?

There are some simple steps you can take to maintain your current level of creditworthiness with this impressive score range. Paying bills on time each month is essential since payment history makes up 35% of your FICO Score calculation. You should also reduce borrowed balances when possible since amounts owed accounts for 30% of your FICO Score calculation and limit new applications for credit since hard inquiries make up 10% of your FICO Score calculation. Lastly, monitoring your accounts regularly for signs of fraud or mistakes is key in maintaining a strong financial standing overall.

Conclusion:

Maintaining a good level of financial health isn’t always easy but doing so can open many doors when it comes to accessing the best loans products with favorable terms and conditions available in today’s marketplace. Having a 697 credit score may grant you these benefits but understanding what goes into calculating this number as well as actively keeping up with changes in regards to your finances is key in keeping this status alive!