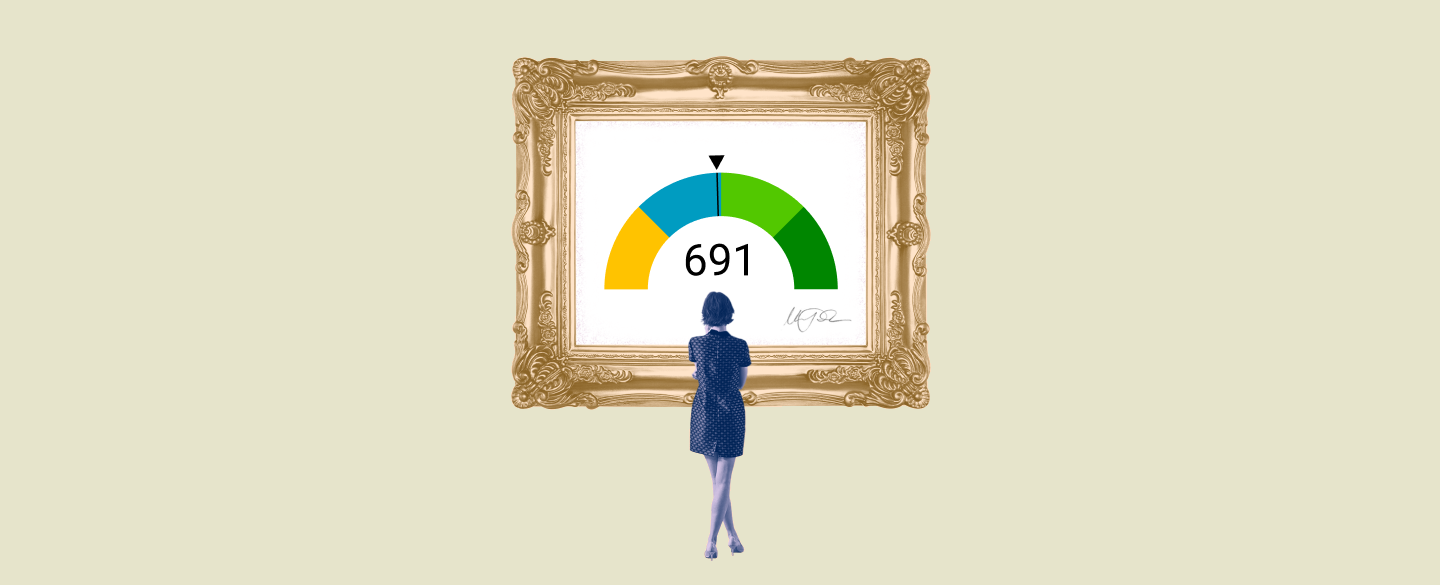

A 691 credit score mortgage rate is a type of loan offered to borrowers with financial history that indicates an ability to repay the loan. Borrowers with a 691 credit score typically fall in the range of “fair” credit and can still qualify for some favorable mortgage rates, though they may be subject to special requirements from lenders.

Table Of Content:

- Is 691 a good credit score? | Lexington Law

- 691 Credit Score: Is it Good or Bad?

- 691 Credit Score: What Does It Mean? | Credit Karma

- Is 691 a Good Credit Score? What It Means, Tips & More

- 691 Credit Score (+ #1 Way To Improve it )

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- Credit Score Requirements to Buy a House | 2022 Guide

- What Is a Good Credit Score? - NerdWallet

- 691 Credit Score: Is it Good or Bad? (Approval Odds)

- What Is A Good Credit Score? | Equifax®

1. Is 691 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/691 Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 691, you have a high probability of ...

Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 691, you have a high probability of ...

2. 691 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/691-credit-score/ A 691 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 691 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

3. 691 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/691 What credit card can I get with a 691 credit score? Auto loan rates for fair credit; Mortgage rates for fair credit ...

What credit card can I get with a 691 credit score? Auto loan rates for fair credit; Mortgage rates for fair credit ...

4. Is 691 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/691-credit-score/

What Does a 691 Credit Score Get You? ; Favorite Store's Credit Card, YES ; Airline/Hotel Credit Card, NO ; Best Mortgage Rates, NO ; Auto Loan with 0% Intro Rate ...

5. 691 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/691-credit-score

Jun 11, 2022 ... A 691 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 691 Credit Score. Lenders like to ...

6. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house While a specific credit score doesn't guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, let's ...

While a specific credit score doesn't guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, let's ...

7. Credit Score Requirements to Buy a House | 2022 Guide

https://themortgagereports.com/18621/mortgage-credit-score-minimum-gina-pogol

To a mortgage lender, FICO scores of 670 and above are considered 'good.' Although the best interest rates typically go to ...

8. What Is a Good Credit Score? - NerdWallet

https://www.nerdwallet.com/article/finance/what-is-a-good-credit-score An unsecured credit card with a decent interest rate, or even a balance-transfer card. · A desirable car loan or lease. · A mortgage with a favorable interest ...

An unsecured credit card with a decent interest rate, or even a balance-transfer card. · A desirable car loan or lease. · A mortgage with a favorable interest ...

9. 691 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/691-credit-score/ Most lenders will approve you for a personal loan with a 691 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

Most lenders will approve you for a personal loan with a 691 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

10. What Is A Good Credit Score? | Equifax®

https://www.equifax.com/personal/education/credit/score/what-is-a-good-credit-score/

It's important to remember that everyone's financial and credit situation is different, and there's no "magic number" that may guarantee better loan rates and ...

What kind of mortgage rate is associated with a 691 credit score?

Mortgage rates associated with a 691 credit score are considered “fair” but may still qualify for some favorable mortgage rates, depending on the lender's particular requirements.

Are there any special requirements associated with obtaining a 691 credit score mortgage rate?

Yes, borrowers should keep in mind that lenders may require additional documentation or precautions when granting loans to borrowers falling into this range.

How else can I improve my chances of getting better mortgage rates?

There are several ways you can improve your chances of getting better mortgage rates, such as increasing your income, paying off any existing debts or improving your overall financial health by managing accounts responsibly.

Conclusion:

A 691 credit score does not necessarily disqualify you from obtaining a desirable mortgage rate. It is important to understand the lender's requirements and take steps to build a strong financial profile before applying for a loan. With the right approach and preparation, there could be opportunities available even at this level of credit rating.