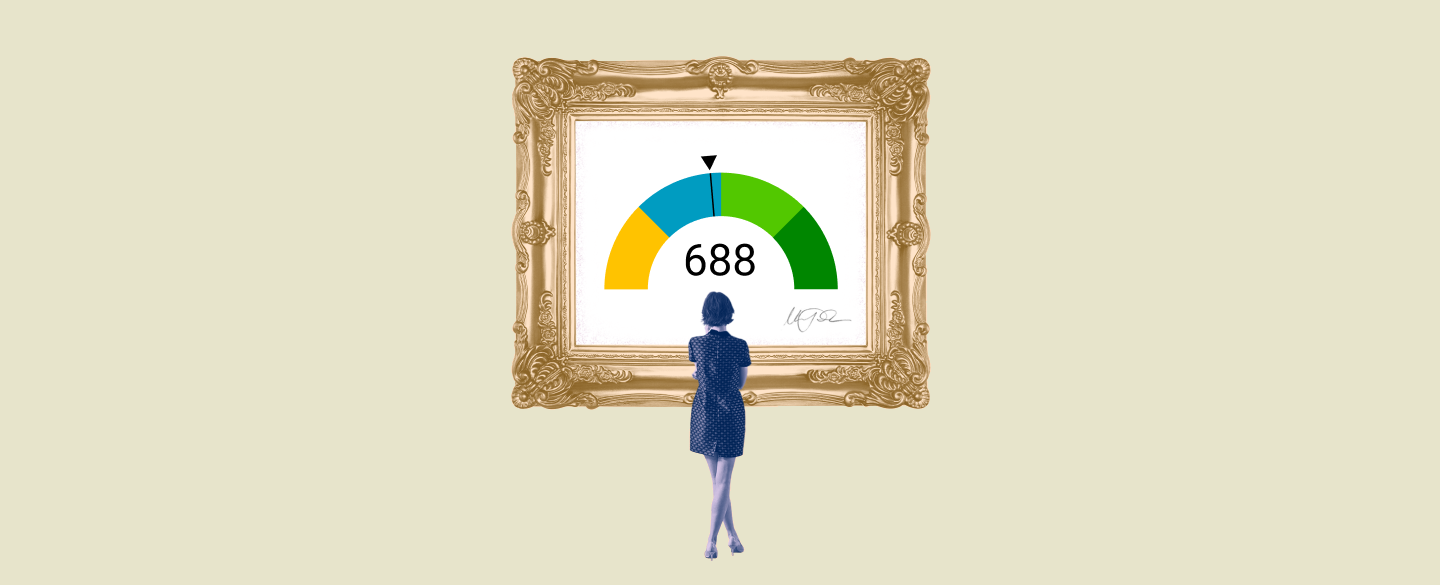

A FICO score is a three-digit numeric representation of an individual’s creditworthiness and is considered one of the most important factors in determining whether a person can be approved for a loan or other types of credit. A 688 FICO score, in particular, is a very respectable score and puts an individual in the good range, though it may not be high enough to qualify them for the absolute best loan terms and rates.

Table Of Content:

- 688 Credit Score: Is it Good or Bad?

- Is 688 a good credit score? | Lexington Law

- 688 Credit Score: What Does It Mean? | Credit Karma

- Is 688 a Good Credit Score? What It Means, Tips & More

- 688 Credit Score (+ #1 Way To Improve it )

- What is a Good Credit Score? | Credit Score Ranges Explained

- 688 Credit Score: Is it Good or Bad? (Approval Odds)

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- 688 Credit Score: Good or Bad? | Credit Card & Loan Options

- 688 Credit Score – Is it Good or Bad? How to Improve Your 688 ...

1. 688 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/688-credit-score/ A 688 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

A 688 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great ...

2. Is 688 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/688 Oct 11, 2021 ... If you have a credit score of 688, you might be asking yourself, “is 688 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 688, you might be asking yourself, “is 688 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

3. 688 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/688 Apr 30, 2021 ... A 688 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 688 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. Is 688 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/688-credit-score/

A credit score of 688 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

5. 688 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/688-credit-score

6. What is a Good Credit Score? | Credit Score Ranges Explained

https://credit.org/blog/what-is-a-good-credit-score-infographic/ In the United States, the average FICO Score is 711 and the average VantageScore is 688. Generally, a 680 credit score or above is considered a good credit ...

In the United States, the average FICO Score is 711 and the average VantageScore is 688. Generally, a 680 credit score or above is considered a good credit ...

7. 688 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/688-credit-score/ FICO scores range from 300 to 850. As you can see below, a 688 credit score is considered Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 688 credit score is considered Good. Credit Score, Credit Rating, % of population.

8. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

9. 688 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/688/ Nov 11, 2021 ... A credit score of 688 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 688 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

10. 688 Credit Score – Is it Good or Bad? How to Improve Your 688 ...

https://www.creditrepairexpert.org/688-credit-score/ How to Improve Your 688 FICO Score. Before you can do anything to increase your 688 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 688 FICO Score. Before you can do anything to increase your 688 credit score, you need to identify what part of it needs to be improved, ...

What does a 688 FICO score mean?

A 688 FICO score means that an individual's creditworthiness falls into the good range. It is considered a very respectable score and should allow the individual to qualify for loans and other forms of credit at competitive terms and rates.

Are there higher scores than 688?

Yes, there are higher scores than 688 FICO score. Scores typically range from 300-850, so there are still 162 points above it that constitute an even better creditworthiness rating.

Is it possible to raise my 688 FICO score?

It is possible to raise your 688 FICO score if you take steps to improve your financial situation such as paying bills on time, reducing excessive debt, and refraining from applying for multiple new lines of credit.

Does having a 688 FICO score guarantee I will get approved for loans or other forms of credit?

While having a 688 FICO score is considered good enough to qualify someone for loans and other forms of credit, it does not guarantee approval as there may be additional considerations that lenders take into account when making their decision.

Conclusion:

Having a 688 FICO Score puts individuals in the good range when it comes to their overall creditworthiness which usually allows them to qualify for decent loan terms and rates. However, this does not guarantee approval as lenders may still consider additional factors before making their decision. If individuals want to take steps towards improving their rating even further, they can do so by paying down debt or avoiding taking out too many lines of credit all at once.