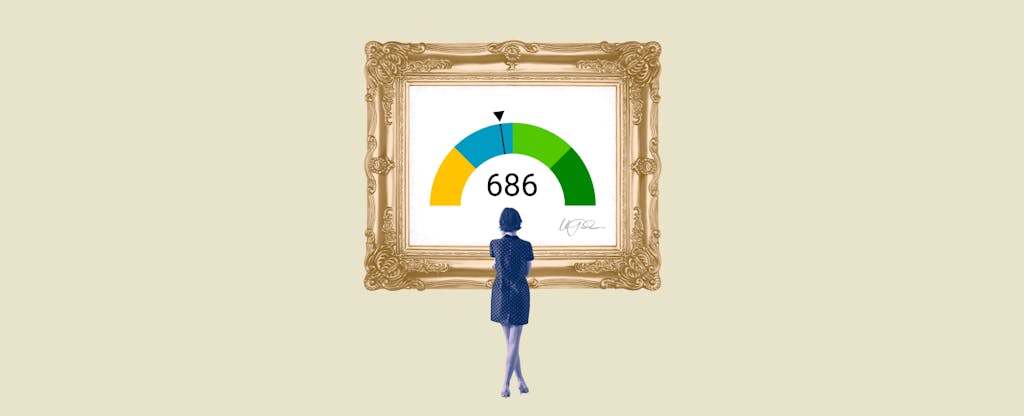

Your credit score is one of the most important factors in determining your financial health. It is a three-digit number ranging between 300 and 850 that will determine if you are eligible for loans, mortgages, and other forms of credit. One of the more common credit score ranges is 686, so it’s worth taking a closer look at what this score means and how it affects your ability to obtain financing.

Table Of Content:

- 686 Credit Score: Is it Good or Bad?

- 686 Credit Score: What Does It Mean? | Credit Karma

- 686 Credit Score: Is it Good or Bad? (Approval Odds)

- Is 686 a good credit score? | Lexington Law

- Is 686 a Good Credit Score? What It Means, Tips & More

- 686 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Is the Average Credit Score in America? | Credit.com

- 686 Credit Score (+ #1 Way To Improve it )

- 686 Credit Score – Is it Good or Bad? How to Improve Your 686 ...

- 686 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 686 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/686-credit-score/ A 686 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

A 686 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

2. 686 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/686 Apr 30, 2021 ... A 686 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

Apr 30, 2021 ... A 686 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for credit ...

3. 686 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/686-credit-score/ Is 686 a good credit score? FICO scores range from 300 to 850. As you can see below, a 686 credit score is considered Good.

Is 686 a good credit score? FICO scores range from 300 to 850. As you can see below, a 686 credit score is considered Good.

4. Is 686 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/686 Oct 11, 2021 ... If you have a credit score of 686, you might be asking yourself, “is 686 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 686, you might be asking yourself, “is 686 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

5. Is 686 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/686-credit-score/

A credit score of 686 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

6. 686 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/686/ Nov 11, 2021 ... 686 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest rates.

Nov 11, 2021 ... 686 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest rates.

7. What Is the Average Credit Score in America? | Credit.com

https://www.credit.com/credit-scores/what-is-the-average-credit-score/ Jul 28, 2021 ... Average and good may be two different things, but all of the “average” scores listed above are actually pretty good—even for the 18 to 23 age ...

Jul 28, 2021 ... Average and good may be two different things, but all of the “average” scores listed above are actually pretty good—even for the 18 to 23 age ...

8. 686 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/686-credit-score

9. 686 Credit Score – Is it Good or Bad? How to Improve Your 686 ...

https://www.creditrepairexpert.org/686-credit-score/ 686 Credit Score – Is it Good or Bad? How to Improve Your 686 FICO Score. Before you can do anything to increase your 686 credit score, you need to identify ...

686 Credit Score – Is it Good or Bad? How to Improve Your 686 FICO Score. Before you can do anything to increase your 686 credit score, you need to identify ...

10. 686 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/686-credit-score/ A credit score of 686 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 686 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

What is a 686 credit score?

A 686 credit score falls within the range of scores considered to be “Good” – usually between 670 and 739 on the FICO Score 8 scale. On this scale, scores above 670 represent good or excellent creditworthiness. This means lenders are likely to view you as a favorable applicant for loan products due to your history of managing debt well.

Does a 686 credit score qualify me for any special loans or mortgages?

With a 686 credit score, you should generally be able to qualify for most types of consumer financing such as car loans, personal loans, student loans, home equity lines of credit (HELOCs), etc. You may also qualify for certain low-interest rates from lenders though this may vary depending on other factors such as income level and overall debt-to-income ratio (DTI).

What types of risks might I face with a 686 credit score?

Generally speaking, risks associated with having a 686 credit score are minimal compared to those associated with lower scores. However, since most lenders base their decisions primarily on your past payment behavior when issuing loans or extending lines of credit – now is an ideal time for you to stay focused on consistently making payments in full and on time each month in order to improve or maintain your desired rating over time.

What can I do if my current 686credit score isn't enough?

If you find that your current rating isn't sufficient enough for quality loan products then there are steps you can take in order to strengthen your overall financial position which could increase your chances of obtaining better loan rates and terms. Such steps include increasing available funds in savings accounts, paying off high interest debts like store cards or payday loans first and then working on reducing major lines of credit such as car payments or mortgage arrangements etc., improving online presence by managing social media accounts judiciously & consistently monitoring all three major U.S. Credit Agency Reports (Equifax, Experian & TransUnion).

How often does my 686 Credit Score change?

Your 686 Credit Score is typically re-calculated every 30 days based upon new information added to your report by lenders or creditors regarding any changes in outstanding balances owed etc.. As such - it is best practice & highly recommended that individuals regularly check their reports from all three major US Credit Agencies Equifax/Experian/TransUnion so they can ensure any errors are detected quickly & disputes can be lodged with relevant agencies before any further damage occurs over long periods.

Conclusion:

The importance of understanding where you stand financially cannot be overstated; particularly when pursuing opportunities related to borrowing capital or acquiring assets like property or cars etc.. With that said - know that having a good FICO® Score 8 range i.e., between 670 – 739 should make it easier for citizens seeking access to quality financial solutions & services while providing them an opportunity towards eventual growth & stability with regards future plans and goals.