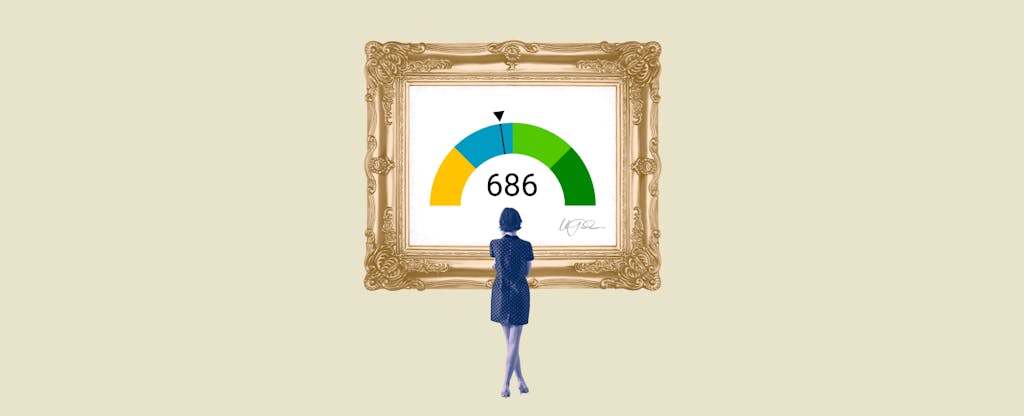

A FICO score is a three-digit numerical representation of an individual’s creditworthiness based on their credit report. A 686 FICO score is considered a ‘good’ score and will usually qualify for most loan types such as car, home, or other financing options.

Table Of Content:

- 686 Credit Score: Is it Good or Bad?

- 686 Credit Score: What Does It Mean? | Credit Karma

- Is 686 a good credit score? | Lexington Law

- Is 686 a Good Credit Score? What It Means, Tips & More

- 686 Credit Score: Is it Good or Bad? (Approval Odds)

- 686 Credit Score: Good or Bad? | Credit Card & Loan Options

- 686 Credit Score (+ #1 Way To Improve it )

- What Is the Average Credit Score in America? | Credit.com

- How a 680 credit score affects your mortgage rate | 2022

- 686 Credit Score – Is it Good or Bad? How to Improve Your 686 ...

1. 686 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/686-credit-score/ A FICO® Score of 686 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 686 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. 686 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/686 Apr 30, 2021 ... A 686 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 686 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

3. Is 686 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/686 Oct 11, 2021 ... If you have a credit score of 686, you might be asking yourself, “is 686 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 686, you might be asking yourself, “is 686 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

4. Is 686 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/686-credit-score/

A credit score of 686 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

5. 686 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/686-credit-score/ FICO scores range from 300 to 850. As you can see below, a 686 credit score is considered Good. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 686 credit score is considered Good. Credit Score, Credit Rating, % of population.

6. 686 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/686/ Nov 11, 2021 ... A credit score of 686 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

Nov 11, 2021 ... A credit score of 686 means that your credit reports show that you usually pay your bills on time. It indicates to lenders that you're a low- ...

7. 686 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/686-credit-score

8. What Is the Average Credit Score in America? | Credit.com

https://www.credit.com/credit-scores/what-is-the-average-credit-score/ Jul 28, 2021 ... Average and good may be two different things, but all of the “average” scores listed above are actually pretty good—even for the 18 to 23 age ...

Jul 28, 2021 ... Average and good may be two different things, but all of the “average” scores listed above are actually pretty good—even for the 18 to 23 age ...

9. How a 680 credit score affects your mortgage rate | 2022

https://themortgagereports.com/18447/fico-credit-score-home-buyer-mortgage-rates Nov 11, 2021 ... FICO puts a 680 credit score in the “good” range. That means a 680 credit score is high enough to qualify you for most loans. However, while 680 ...

Nov 11, 2021 ... FICO puts a 680 credit score in the “good” range. That means a 680 credit score is high enough to qualify you for most loans. However, while 680 ...

10. 686 Credit Score – Is it Good or Bad? How to Improve Your 686 ...

https://www.creditrepairexpert.org/686-credit-score/ 686 Credit Score – Is it Good or Bad? How to Improve Your 686 FICO Score. Before you can do anything to increase your 686 credit score, you need to identify ...

686 Credit Score – Is it Good or Bad? How to Improve Your 686 FICO Score. Before you can do anything to increase your 686 credit score, you need to identify ...

What is a FICO Score?

A FICO Score is a 3-digit numerical representation of an individual’s creditworthiness based on their credit report.

What does it mean to have a 686 FICO Score?

Having a 686 FICO Score means that your creditworthiness is considered to be at the ‘good’ level. This generally qualifies you to receive loans for car, home, or other financing options.

How is my FICO Score calculated?

The calculation of your FICO Score takes into consideration factors such as payment history, amounts owed, length of credit history, new credit, and types of credit used.

How long does it take for my FICO score to update after I make a payment?

Depending on when the creditor reports information to the Credit Reporting Agencies (CRA), it can take up to 30 days before any changes in your account status are reflected in your score.

Is there anything I can do to increase my 686 FICO score?

Yes! Paying bills on time, reducing outstanding balances or debt-to-credit ratio, and refraining from taking out new lines of credit are all ways that you can improve your 686 FICO score.

Conclusion:

A 686 FICO score indicates above average creditworthiness and will qualify individuals for many loan types like car loans or home loans. In order to maintain this good standing with creditors and lenders, an individual should pay bills on time and reduce their debt-to-credit ratio or refrain from taking out more lines of credit.