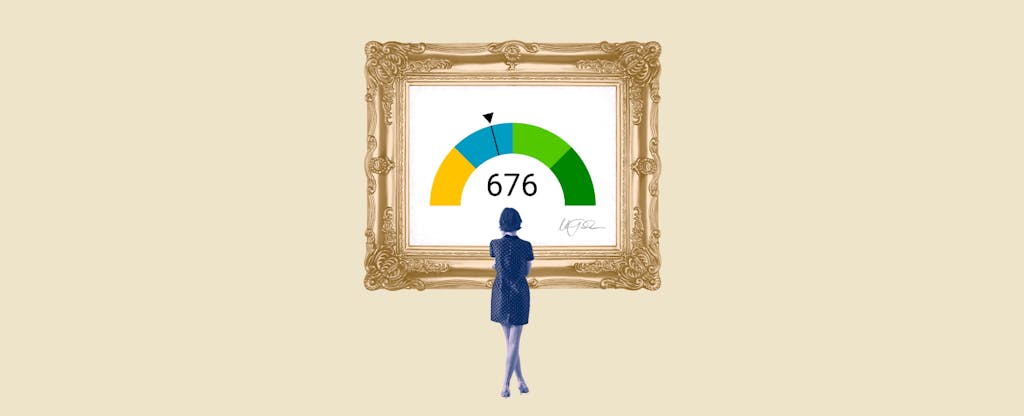

A credit score of 676 is considered to be a good score. It falls in the range of 670-739, which is seen as good or very good by lenders. Having a credit score of this level can help you qualify for loans and other types of financing, such as mortgages. It will also likely give you access to lower interest rates and less rigorous loan terms.

Table Of Content:

- 676 Credit Score: Is it Good or Bad?

- Is 676 a Good Credit Score? What It Means, Tips & More

- Is 676 a good credit score? | Lexington Law

- 676 Credit Score: What Does It Mean? | Credit Karma

- 676 Credit Score: Is it Good or Bad? (Approval Odds)

- What Is A Good Credit Score? – Forbes Advisor

- 676 Credit Score: Good or Bad? | Credit Card & Loan Options

- 676 Credit Score Mortgage Lenders of 2022 | Bad Credit Mortgages

- What Is a Good Credit Score? | Credit.com

- 676 Credit Score (+ #1 Way To Improve it )

1. 676 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/676-credit-score/ A 676 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

A 676 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

2. Is 676 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/676-credit-score/

A credit score of 676 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

3. Is 676 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/676 Oct 11, 2021 ... If you have a credit score of 676, you might be asking yourself, “is 676 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 676, you might be asking yourself, “is 676 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

4. 676 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/676 Apr 30, 2021 ... A 676 credit score is generally considered an average, or fair, credit score. Here's what it means to have fair credit and how to build your ...

Apr 30, 2021 ... A 676 credit score is generally considered an average, or fair, credit score. Here's what it means to have fair credit and how to build your ...

5. 676 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/676-credit-score/ Is 676 a good credit score? FICO scores range from 300 to 850. As you can see below, a 676 credit score is considered Good.

Is 676 a good credit score? FICO scores range from 300 to 850. As you can see below, a 676 credit score is considered Good.

6. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... Yet FICO, the most widely known credit scoring model, shares some helpful information borrowers can use as a guide. The most common FICO scores ...

Jun 28, 2021 ... Yet FICO, the most widely known credit scoring model, shares some helpful information borrowers can use as a guide. The most common FICO scores ...

7. 676 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/676/ Nov 11, 2021 ... 676 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest rates.

Nov 11, 2021 ... 676 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest rates.

8. 676 Credit Score Mortgage Lenders of 2022 | Bad Credit Mortgages

https://www.nonprimelenders.com/676-credit-score-mortgage/

If your credit score is a 676 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range ...

9. What Is a Good Credit Score? | Credit.com

https://www.credit.com/credit-scores/what-is-a-good-credit-score/ Jan 8, 2021 ... For FICO, a good credit score is 670 or higher; a score above 800 is considered exceptional. For VantageScore 3.0, a good score is 661 or higher ...

Jan 8, 2021 ... For FICO, a good credit score is 670 or higher; a score above 800 is considered exceptional. For VantageScore 3.0, a good score is 661 or higher ...

10. 676 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/676-credit-score

What is a 676 Credit Score?

A 676 credit score falls within the "good" range on the FICO Score 8 scale. This score is between 670 and 739 and represents a higher likelihood that you will repay creditors if they provide you with a loan or other type of financing options.

How Can I Improve my Credit Score?

Improving your credit score begins with regularly checking it and understanding what has caused it to fall in the first place. You should pay bills on time, reduce debt, limit new credit applications, and address errors on your report to improve your credit standing. Additionally, using secured credit cards can be a great tool to help build up your score over time if used responsibly.

What are the Benefits of Having a Good Credit Score?

The most apparent benefit of having a good credit score is being able to access attractive loan opportunities from lenders. Higher loan amounts may be available with more favorable terms at lower interest rates; additionally borrowers may have access to different mortgage products such as refinancing or home equity lines of credits (HELOCs). Furthermore, having good credit can boost your chances when applying for jobs such as roles in finance or banking since employers may request a copy of your credit report.

Are There Any Downsides To Holding A Good Credit Score?

Not really, unless someone has an exceptional credit history, there should not be any significant downsides to holding a high rating like 676 on the FICO Scale 8 range. However caution should still be taken when using additional debts such as taking out larger loans since lenders could potentially take advantage by providing even more attractive financing packages that are only possible due to having high/exceptional ratings.

Conclusion:

Having a 676 Credit Score is considered generally good and can open up many pathways for better financial opportunities in both short-term scenarios but also long-term ones too; however caution must still taken so that any additional lending doesn't get out of hand given how attractive these offers may appear due to having an exceptionally high rating.