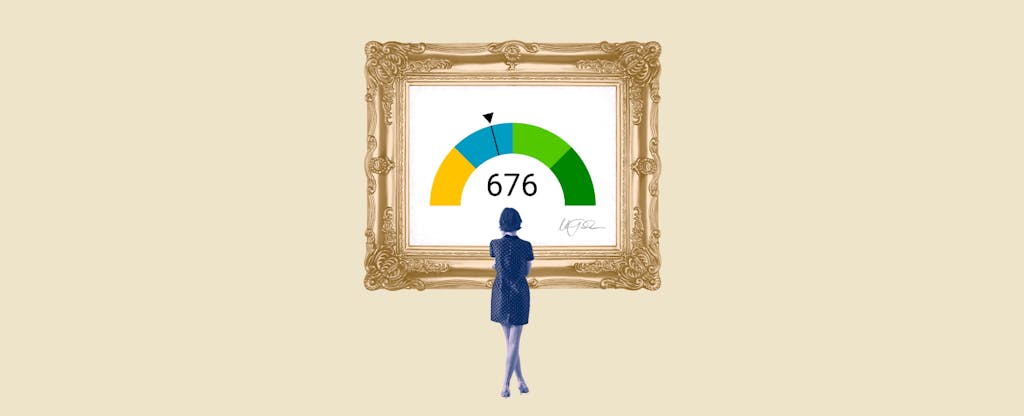

A 676 credit score is considered a good credit score and is typically enough to qualify you for a mortgage loan. A 676 credit score reflects responsible financial behaviors, such as making on-time payments, reducing your debt-to-income ratio, and paying off or limiting credit card debt.

Table Of Content:

- 676 Credit Score: Is it Good or Bad?

- Is 676 a good credit score? | Lexington Law

- Is 676 a Good Credit Score? What It Means, Tips & More

- 676 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 676 Credit Score: What Does It Mean? | Credit Karma

- 676 Credit Score (+ #1 Way To Improve it )

- What Is A Good Credit Score? – Forbes Advisor

- 676 Credit Score: Is it Good or Bad? (Approval Odds)

- 676 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Credit Score is Needed to Buy a House? | SmartAsset.com

1. 676 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/676-credit-score/ 44% Individuals with a 676 FICO® Score have credit portfolios that include auto loan and 27% have a mortgage loan. Recent applications.

44% Individuals with a 676 FICO® Score have credit portfolios that include auto loan and 27% have a mortgage loan. Recent applications.

2. Is 676 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/676 Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 676, you have a high probability of ...

Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 676, you have a high probability of ...

3. Is 676 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/676-credit-score/

What Does a 676 Credit Score Get You? ; Airline/Hotel Credit Card, NO ; Best Mortgage Rates, NO ; Auto Loan with 0% Intro Rate, NO ; Lowest Auto Insurance Premiums ...

4. 676 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/676-credit-score-mortgage/

If your credit score is a 676 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

5. 676 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/676 There's no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair ...

There's no single minimum credit score needed for a car loan. But generally speaking, credit scores in the fair ...

6. 676 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/676-credit-score

7. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... Regardless of the range, FICO Scores serve the same purpose. They help lenders predict the risk of a borrower defaulting on a loan. The higher ...

Jun 28, 2021 ... Regardless of the range, FICO Scores serve the same purpose. They help lenders predict the risk of a borrower defaulting on a loan. The higher ...

8. 676 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/676-credit-score/ Most lenders will approve you for a personal loan with a 676 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

Most lenders will approve you for a personal loan with a 676 credit score. However, your interest rate may be somewhat higher than someone who has “Very Good” ...

9. 676 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/676/ Nov 11, 2021 ... 676 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest ...

Nov 11, 2021 ... 676 is a good credit score. Scores in this range are high enough to get most types of credit, but you won't qualify for the best interest ...

10. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house What interest rate can I get with my credit score? · Excellent (760-850) – Your credit score will have no impact on your interest rate. · Very good (700-760) – ...

What interest rate can I get with my credit score? · Excellent (760-850) – Your credit score will have no impact on your interest rate. · Very good (700-760) – ...

What are the benefits of having a 676 credit score?

Having a 676 credit score can help you secure loans for large purchases like mortgages at more favorable terms and lower interest rates than if you had a lower score. A 676 credit score can also increase your chances of getting approved by lenders since it shows good financial stability.

Is 676 enough to get approved for a mortgage loan?

Yes, generally speaking having a 676 credit score will qualify you for most mortgage loan products. However, the requirements may vary from lender to lender so it's important to review the specific criteria each lender has in place before applying.

Can I still get approved if my credit score is just below 676?

It depends on the lender but some lenders may still approve you for a mortgage loan with scores slightly below 676 as long as other factors demonstrate strong financial responsibility (e.g., low debt-to-income ratio). It's best to contact your prospective lenders directly to learn more about their eligibility criteria.

How can I improve my credit score if it’s below 676?

Improving your credit score requires dedication and patience, but it’s possible with time and effort. The main things you should focus on are making sure all payments are made on time, paying down debts (especially high balances), and monitoring your credit report regularly for any errors or fraudulent activity.

What other factors do lenders consider when approving someone for a mortgage?

Aside from your credit score, lenders look at other aspects of an individual's application such as income, employment history, down payment amount, assets & liabilities, current debt obligations etc. All these factors taken together make up what we refer to as underwriting criteria used by banks in determining whether or not to approve someone for a mortgage loan.

Conclusion:

In conclusion, having a 676 credit score is very beneficial when looking to secure financing like mortgages due its higher likelihood of being approved by most lenders at advantageous interest rates. However there other key factors that are taken into account which must be managed responsibly in order to maximize chances of approval .