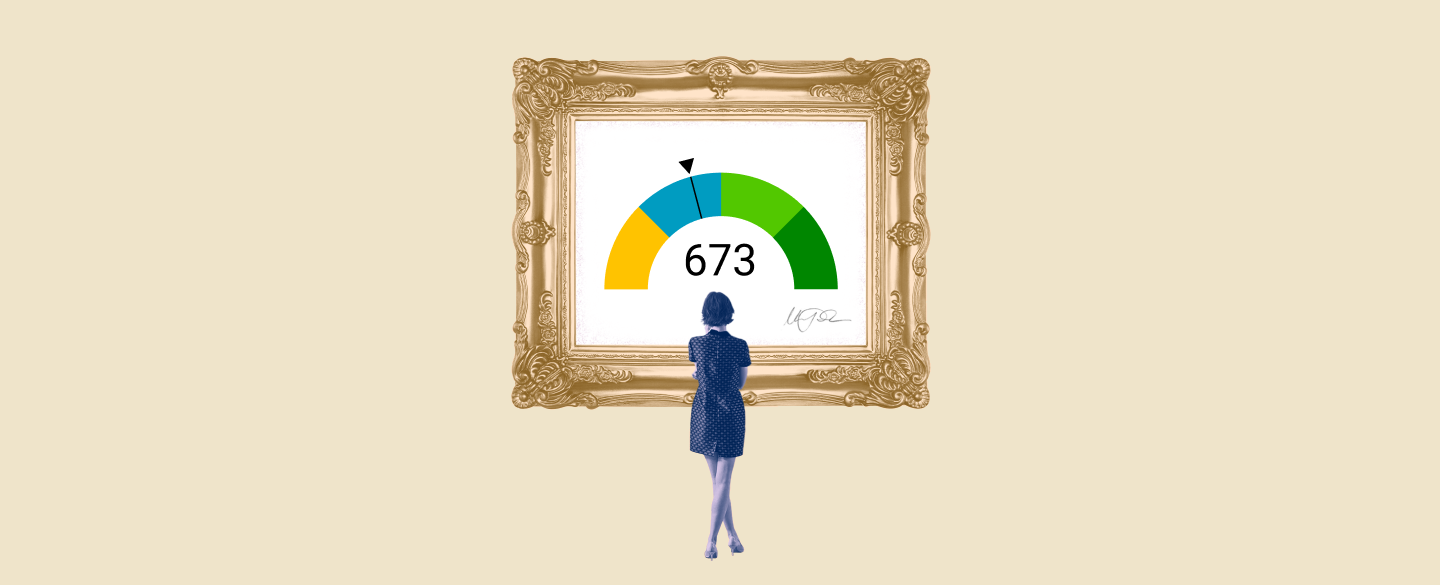

The 673 credit score mortgage rate is a key factor in determining the home loan you may be able to qualify for. It is important to understand what this number means and how it can affect your ability to secure a mortgage. Knowing these details can help you make an informed decision when it comes time to apply for a home loan.

Table Of Content:

- 673 Credit Score: Is it Good or Bad?

- Is 673 a good credit score? | Lexington Law

- 673 Credit Score: What Does It Mean? | Credit Karma

- 673 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Is 673 a Good Credit Score? What It Means, Tips & More

- 673 Credit Score (+ #1 Way To Improve it )

- What Credit Score is Needed to Buy a House? | SmartAsset.com

- What Is A Good Credit Score? – Forbes Advisor

- 673 Credit Score: Is it Good or Bad? (Approval Odds)

- Credit Score Requirements to Buy a House | 2022 Guide

1. 673 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/673-credit-score/ A 673 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

A 673 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

2. Is 673 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/673 Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 673, you have a high probability of ...

Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 673, you have a high probability of ...

3. 673 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/673 What credit card can I get with a 673 credit score? Auto loan rates for fair credit; Mortgage rates for fair credit ...

What credit card can I get with a 673 credit score? Auto loan rates for fair credit; Mortgage rates for fair credit ...

4. 673 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/673-credit-score-mortgage/

If your credit score is a 673 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range ...

5. Is 673 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/673-credit-score/

WalletHub's Rating: No – Based on the rate at which people with 673 credit scores get approved for credit cards that require "good credit" or better, ...

6. 673 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/673-credit-score

7. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house While a specific credit score doesn't guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, let's ...

While a specific credit score doesn't guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, let's ...

8. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... $45,698 over the life of the loan. If you're aiming to qualify for a mortgage lender's lowest rates, that generally falls under a FICO Score of ...

Jun 28, 2021 ... $45,698 over the life of the loan. If you're aiming to qualify for a mortgage lender's lowest rates, that generally falls under a FICO Score of ...

9. 673 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/673-credit-score/ Most lenders will approve you for a personal loan with a 673 credit score. However, your interest rate ... Can I get a home loan with a credit score of 673?

Most lenders will approve you for a personal loan with a 673 credit score. However, your interest rate ... Can I get a home loan with a credit score of 673?

10. Credit Score Requirements to Buy a House | 2022 Guide

https://themortgagereports.com/18621/mortgage-credit-score-minimum-gina-pogol

To a mortgage lender, FICO scores of 670 and above are considered 'good.' Although the best interest rates typically go to ...

What is considered a good 673 Credit Score Mortgage Rate?

Generally, rates between 3.75% and 4.25% are considered good if your credit score is 673 or higher. However, it is important to note that other factors such as income, location, and type of loan also play a role in determining the best rates available for you.

Is my 673 credit score enough to get me approved for a mortgage?

Generally speaking, having a credit score of 673 or higher should be enough to qualify you for most mortgages. However, there are other factors that banks consider when approving mortgage applications and it will vary from bank to bank.

What kind of interest rate can I expect with my 673 credit score?

The interest rate you can expect will depend on the type of loan you are applying for as well as other factors such as your income and location. Generally speaking, people with a 673 credit score may qualify for interest rates ranging from 3.75% - 4.25%.

Can I still get approved if my credit score is lower than 673?

Generally speaking, having a lower credit score than 673 could make it more difficult to get approved for some mortgages but not all lenders will require such high scores. It is important to compare different lenders and their criteria before making any decisions or agreeing to any offers.

Are there other factors involved in getting approved besides my 673 Credit Score Mortgage Rate?

Yes, there are other factors banks consider besides your credit score when determining eligibility such as income, assets, debts and liabilities etc.. Additionally, each lender has its own specific set of requirements which may be different from others so it's important to do your research before applying!

Conclusion:

Understanding the 673 Credit Score Mortgage Rate can help ensure that you make an informed decision about the right home loan option for you. Be sure to compare different lenders with their specific eligibility requirements before committing to any offers or decisions. Good luck!