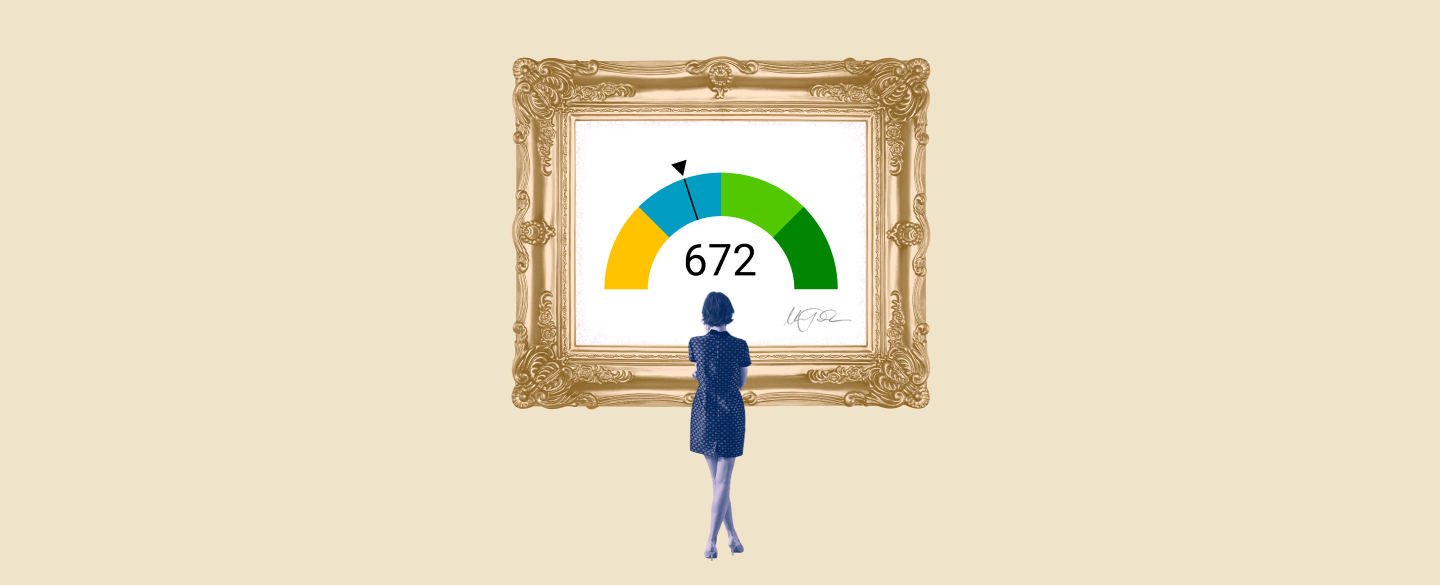

The FICO score is a credit score developed by the Fair Isaac Corporation which assigns a numerical value to each individual’s credit rating. A FICO score of 672, in particular, is considered as ‘Good’ and it falls within the range of 670-739. Having a good FICO score opens up opportunities for people to qualify for better interest rates and repayment terms on loans. Therefore, it is important for individuals to understand their FICO scores and work towards improving them.

Table Of Content:

- 672 Credit Score: Is it Good or Bad?

- Is 672 a Good Credit Score? What It Means, Tips & More

- Is 672 a good credit score? | Lexington Law

- 672 Credit Score: What Does It Mean? | Credit Karma

- Is a 672 FICO Credit Score Good or Bad?

- 672 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- What Is A Good Credit Score? – Forbes Advisor

- 672 Credit Score (+ #1 Way To Improve it )

- 672 Credit Score: Is it Good or Bad? (Approval Odds)

- 672 Credit Score – Is it Good or Bad? How to Improve Your 672 ...

1. 672 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/672-credit-score/ A FICO® Score of 672 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

A FICO® Score of 672 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good ...

2. Is 672 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/672-credit-score/

A credit score of 672 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

3. Is 672 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/672 Oct 11, 2021 ... If you have a credit score of 672, you might be asking yourself, “is 672 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

Oct 11, 2021 ... If you have a credit score of 672, you might be asking yourself, “is 672 a good credit score?” Luckily, the answer is yes: a score of 700 falls ...

4. 672 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/672 Apr 30, 2021 ... A 672 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 672 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

5. Is a 672 FICO Credit Score Good or Bad?

https://pocketsense.com/672-fico-credit-score-good-bad-9974.html Any FICO score of 670 to 739 is considered to be good and shows lenders that you're not a high risk to them. However, a score of 672 may not get you the ...

Any FICO score of 670 to 739 is considered to be good and shows lenders that you're not a high risk to them. However, a score of 672 may not get you the ...

6. 672 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/672-credit-score-mortgage/

If your credit score is a 672 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

7. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

Jun 28, 2021 ... A good credit score gets approval for attractive rates and terms for loans. For FICO score, a credit score between 670 and 739 is generally ...

8. 672 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/672-credit-score

Jul 1, 2022 ... A 672 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 672 Credit Score. Lenders like to ...

9. 672 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/672-credit-score/ Is 672 a good credit score? FICO scores range from 300 to 850. As you can see below, a 672 credit score is considered Good.

Is 672 a good credit score? FICO scores range from 300 to 850. As you can see below, a 672 credit score is considered Good.

10. 672 Credit Score – Is it Good or Bad? How to Improve Your 672 ...

https://www.creditrepairexpert.org/672-credit-score/ Each credit agency provides you with a credit score, and these three scores combine to create both your 672 FICO Credit Score and your VantageScore. Your score ...

Each credit agency provides you with a credit score, and these three scores combine to create both your 672 FICO Credit Score and your VantageScore. Your score ...

How is a 672 FICO Score evaluated?

A 672 FICO Score falls within ‘Good’ category of credit scores. Scores within the range of 670-739 are considered as Good by lenders and creditors when assessing an individual’s creditworthiness.

What are the benefits offered with a 672 FICO Score?

With a 672 FICO Score, you can qualify for better interest rates and repayment terms on loans such as mortgages, auto loans and credit card bills. Additionally, having good credit may even help you get approved for certain jobs or rental properties.

Can my score be improved with a 672FICo Score?

Absolutely! There are many ways to improve one's credit score such as making all payments on time, lowering overall debt levels and avoiding unnecessary hard inquiries. Additionally, requesting corrections of any inaccuracies in your report can also help raise your FICO score.

How long does it take to raise my 672FICo Score ?

The amount of time it takes to improve your FICO score depends on several factors such as your current debt levels and any negative items that may be present on your report. Generally speaking, if you follow the above mentioned steps consistently then you can expect to see an improvement in about three months or so .

Are there any risks associated with having a low FICO Score?

Yes, there are potential risks associated with having a low Fico score such as being denied access to certain products or services such as mortgages or car loans or getting higher interest rates when borrowing money. Therefore , it is important for individuals to maintain good credit scores so that they have access to financial products at reasonable rates.

Conclusion:

Overall , understanding one's own unique Fico score is extremely important in today's economy given how much our daily lives depend on financial products . A 672 fico score indicates that an individual has good credit standing but there are still ways he/she can employ methods to further improve his/her creditworthiness .