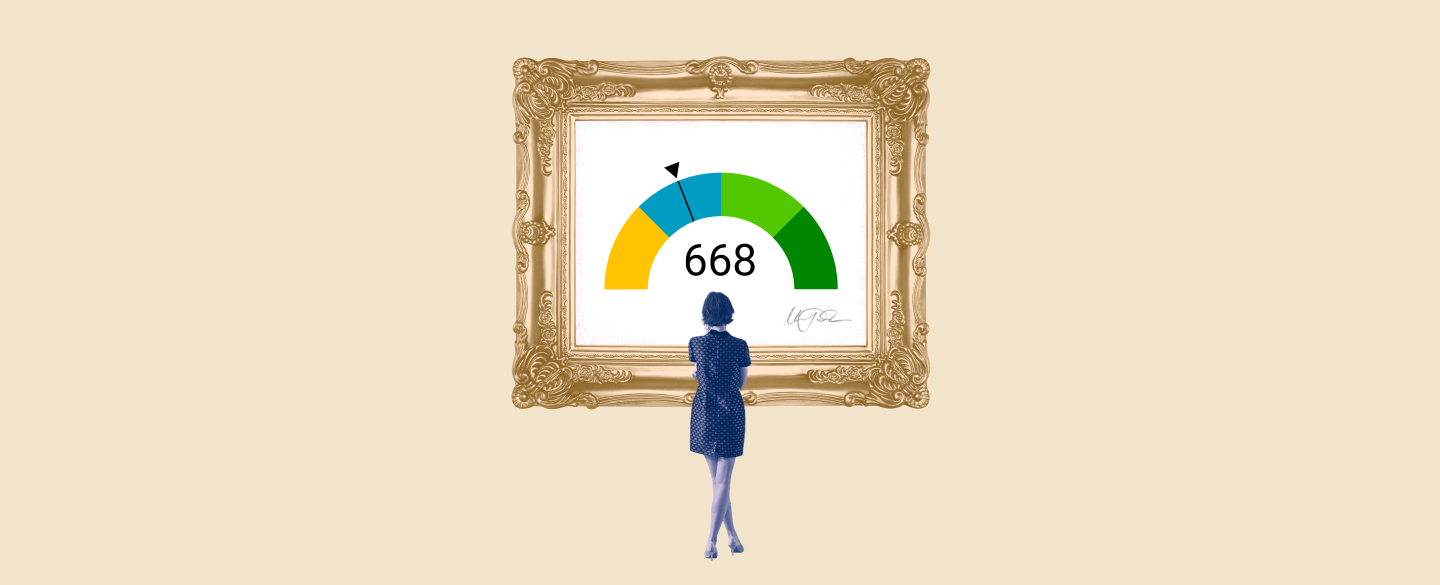

A 668 credit score is a great starting point for anyone looking to apply for a credit card. This credit score puts you in the “good” category, which is typically defined by lenders as having scores between 670 and 739. If you have achieved this rating it means that you have a relatively good relationship with your creditors—you pay on time, don’t extend your limits too much, and generally make responsible choices with your money.

Table Of Content:

- 668 Credit Score: Is it Good or Bad?

- Is 668 a Good Credit Score? What It Means, Tips & More

- 668 Credit Score: What Does It Mean? | Credit Karma

- Is 668 a good credit score? | Lexington Law

- 668 Credit Score (+ #1 Way To Fix It )

- Best Credit Cards if Your FICO Score is Between 650 and 699 ...

- Best Credit Cards for Fair Credit of July 2022 - NerdWallet

- 668 Credit Score: Good or Bad? | Credit Card & Loan Options

- 668 Credit Score: Is it Good or Bad? (Approval Odds)

- 18 Best Credit Cards for 600 to 650 Credit Scores (2022)

1. 668 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/668-credit-score/ A FICO® Score of 668 places you within a population of consumers whose credit may be seen as Fair. Your 668 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 668 places you within a population of consumers whose credit may be seen as Fair. Your 668 FICO® Score is lower than the average U.S. credit ...

2. Is 668 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/668-credit-score/

WalletHub's Rating: No – Based on the rate at which people with 668 credit scores get approved for credit cards that require "good credit" or better, ...

3. 668 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/668 A 668 credit score is generally a fair score. While a lot of people have fair scores, you may ...

A 668 credit score is generally a fair score. While a lot of people have fair scores, you may ...

4. Is 668 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/668 Oct 11, 2021 ... An individual with a 668 credit score will typically receive a credit card interest rate of between 20.5 and 16.5 percent. In comparison, ...

Oct 11, 2021 ... An individual with a 668 credit score will typically receive a credit card interest rate of between 20.5 and 16.5 percent. In comparison, ...

5. 668 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/668-credit-score

Jul 1, 2022 ... Like home and car loans, a personal loan and credit card is difficult to get with a 668 credit score. A secured card with Discover or Capital ...

6. Best Credit Cards if Your FICO Score is Between 650 and 699 ...

https://www.moneyunder30.com/credit-cards/credit-score-650-699 Check out this roundup of the best credit cards for average credit scores. These cards offer the best features you can get for scores 650-699.

Check out this roundup of the best credit cards for average credit scores. These cards offer the best features you can get for scores 650-699.

7. Best Credit Cards for Fair Credit of July 2022 - NerdWallet

https://www.nerdwallet.com/best/credit-cards/fair-credit Jun 29, 2022 ... FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR FAIR CREDIT · Capital One QuicksilverOne Cash Rewards Credit Card · Upgrade Visa® Card with ...

Jun 29, 2022 ... FULL LIST OF EDITORIAL PICKS: BEST CREDIT CARDS FOR FAIR CREDIT · Capital One QuicksilverOne Cash Rewards Credit Card · Upgrade Visa® Card with ...

8. 668 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/668/ Nov 4, 2021 ... A credit score of 668 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. In FICO ...

Nov 4, 2021 ... A credit score of 668 is higher than the lowest credit score of 300, but it's still a long way off from the highest credit score of 850. In FICO ...

9. 668 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/668-credit-score/ Is 668 a good credit score? FICO scores range from 300 to 850. As you can see below, a 668 credit score is considered Fair.

Is 668 a good credit score? FICO scores range from 300 to 850. As you can see below, a 668 credit score is considered Fair.

10. 18 Best Credit Cards for 600 to 650 Credit Scores (2022)

https://www.cardrates.com/advice/best-credit-cards-for-600-to-650-credit-scores/ Feb 1, 2022 ... That's because every credit card is different, and each consumer demographic has unique needs. If your credit score sits in the 600 to 650 range ...

Feb 1, 2022 ... That's because every credit card is different, and each consumer demographic has unique needs. If your credit score sits in the 600 to 650 range ...

What kind of credit cards are available to someone with a 668 credit score?

Credit cards for individuals with a 668 credit score are typically secured or student cards. Secured cards require an upfront security deposit and involve less risk for the lender since they can recoup any losses if the debt isn't paid back. Student cards also offer higher interest rates than traditional cards but often include bonuses and rewards that can make them more attractive to young people just getting started with credit.

What should I consider when applying for a card?

When applying for a card, it’s important to look at all of the features of different options before making a final decision. Look at things like annual fees, interest rates, rewards programs, sign-up bonuses, and even customer service ratings from other users. These features will all help you make the best choice for your personal situation.

How can I improve my chances of being approved?

Improving your chances of approval will depend on how well you manage the rest of your finances. Make regular payments on time each month to show lenders that you are reliable and capable of managing debt responsibly. Additionally, try to keep your debt-to-income ratio low so that it looks like you’re not overextending yourself financially.

Conclusion:

Having a 668 credit score is an excellent starting point when applying for a new credit card. While there may be some restrictions on what types of cards you can qualify for initially, taking steps to improve your overall financial management skills over time could increase your chances of approval and give you access to more options down the line.