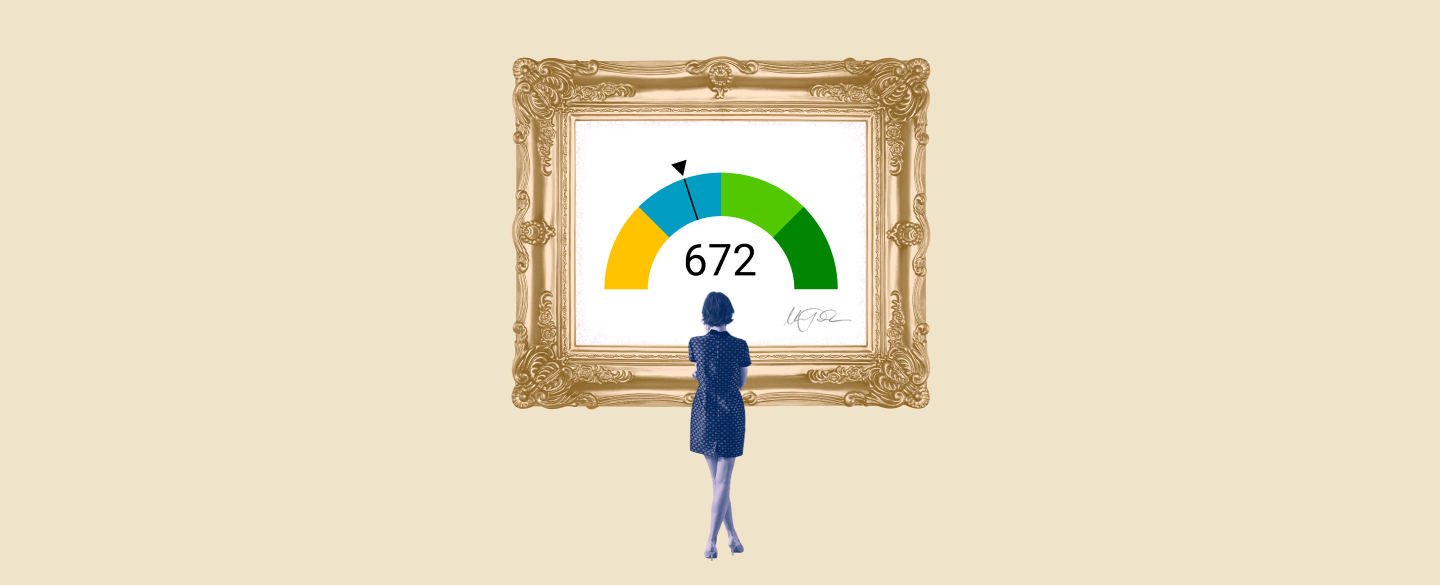

Are you looking to buy a home but have a credit score of 672? Don’t worry! With the right mortgage, you can still achieve your homeownership goals. A 672 credit score mortgage is one option you may consider to make your dream home a reality.

Table Of Content:

- 672 Credit Score: Is it Good or Bad?

- Is 672 a good credit score? | Lexington Law

- 672 Credit Score: What Does It Mean? | Credit Karma

- Is 672 a Good Credit Score? What It Means, Tips & More

- 672 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 672 Credit Score (+ #1 Way To Improve it )

- Is a 672 FICO Credit Score Good or Bad?

- What Is A Good Credit Score? – Forbes Advisor

- 672 Credit Score: Is it Good or Bad? (Approval Odds)

- What Credit Score is Needed to Buy a House? | SmartAsset.com

1. 672 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/672-credit-score/ A 672 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

A 672 FICO® Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to ...

2. Is 672 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/672 Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 672, you have a high probability of ...

Oct 11, 2021 ... A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 672, you have a high probability of ...

3. 672 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/672 A 672 credit score is generally a fair score. While a lot of people have fair scores, you may still find it ...

A 672 credit score is generally a fair score. While a lot of people have fair scores, you may still find it ...

4. Is 672 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/672-credit-score/

See if a 672 credit score is good. Check out 672 credit score loan & credit card options. Learn how to improve a 672 credit score & more.

5. 672 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/672-credit-score-mortgage/

If your credit score is a 672 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

6. 672 Credit Score (+ #1 Way To Improve it )

https://www.creditglory.com/credit-score/672-credit-score

Jul 1, 2022 ... A 672 FICO® Score is considered “Good”. Mortgage, auto, and personal loans are relatively easy to get with a 672 Credit Score.

7. Is a 672 FICO Credit Score Good or Bad?

https://pocketsense.com/672-fico-credit-score-good-bad-9974.html Generally, lenders will consider consumers scoring lower than 600 to be high lending risks. With a score of 672, lenders would not consider your score ...

Generally, lenders will consider consumers scoring lower than 600 to be high lending risks. With a score of 672, lenders would not consider your score ...

8. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... Regardless of the range, FICO Scores serve the same purpose. They help lenders predict the risk of a borrower defaulting on a loan. The higher ...

Jun 28, 2021 ... Regardless of the range, FICO Scores serve the same purpose. They help lenders predict the risk of a borrower defaulting on a loan. The higher ...

9. 672 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/672-credit-score/ Can I get an auto loan with a 672 credit score? ... Most auto lenders will lend to someone with a 672 score. However, if you want to ensure you qualify for the ...

Can I get an auto loan with a 672 credit score? ... Most auto lenders will lend to someone with a 672 score. However, if you want to ensure you qualify for the ...

10. What Credit Score is Needed to Buy a House? | SmartAsset.com

https://smartasset.com/mortgage/what-credit-score-is-needed-to-buy-a-house Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

Your credit score isn't just for getting a mortgage. It paints an overall financial picture. The term “credit score” most commonly refers to a FICO score, a ...

What is considered a 672 credit score?

A 672 credit score falls on the higher end of Fair for most traditional lenders which generally range from 300-850. It is close to Good range (670-739) with some lenders.

Should I be concerned if my credit score is only 672?

While you may have slightly lower access to favorable terms when it comes to mortgages or other loans, the fact that it’s in the Fair range means it won’t majorly impact your ability to qualify for financing.

Can I get approved for a 672 credit score mortgage?

Yes, depending on your overall financial situation and qualifications, you may still be able to get approved for a mortgage with a 672 credit score. Your lender will also likely take into consideration other factors such as employment history and income when making their decision.

What type of loan should I get with a 672 credit score?

The type of loan you should get largely depends on how much money you need, what kind of terms are offered by lenders, and other factors like your debt-to-income ratio and down payment amount. It would be best to work with an experienced lender who can offer tailored guidance based on your individual circumstances.

Are there specialized mortgages specifically designed for people with low credit scores?

Yes, there are various programs available that offer more flexible requirements and lend more readily towards people who have lower than average scores such as those in the 600 range or below. Speak with your lender about what options they can provide in this case.

Conclusion:

While having a 672 credit score does not automatically guarantee approval for any particular type of loan, it does put one in an adequate position among many traditional lenders and could potentially open up pathways towards getting approved for mortgages or other financing options at competitive rates if additional qualifications are also present. If you’re planning ahead and want to find out more information about how best to finance a new house purchase, reach out to specialist lenders now so they can help guide you through the process.