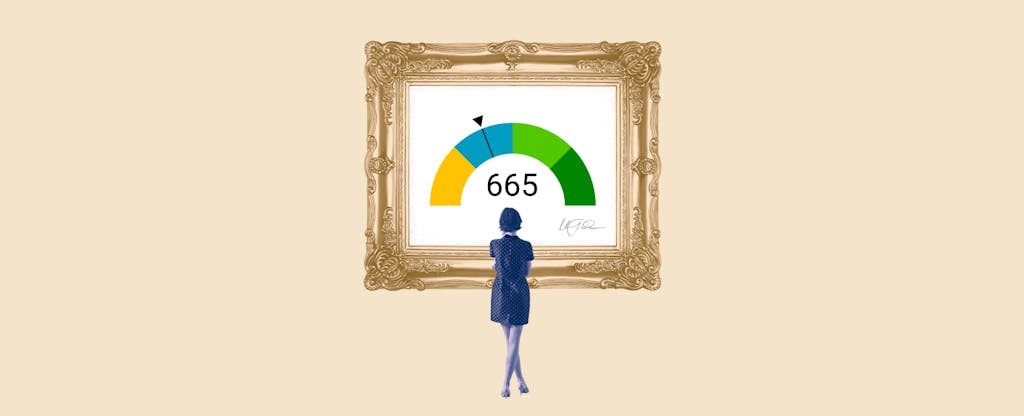

Do you want to know what 665 credit score means? A 665 credit score is a fair score that puts consumers in the middle range of scores. This score lets lenders and creditors know that you are a responsible borrower who usually pays their bills on time. It’s important to note, however, that this score is not good enough for prime loans and may require extra scrutiny or higher down payments from borrowers.

Table Of Content:

- 665 Credit Score: Is it Good or Bad?

- Is 665 a Good Credit Score? What It Means, Tips & More

- 665 Credit Score: What Does It Mean? | Credit Karma

- 665 Credit Score: Good or Bad? | Credit Card & Loan Options

- Is 665 a good credit score? | Lexington Law

- 665 Credit Score (+ #1 Way To Fix It )

- Is 665 considered a good credit score for a car loan? | Jerry

- 665 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 665 Credit Score - is it good enough?

- 665 Credit Score – Is it Good or Bad? How to Improve Your 665 ...

1. 665 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/665-credit-score/ A FICO® Score of 665 places you within a population of consumers whose credit may be seen as Fair. Your 665 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 665 places you within a population of consumers whose credit may be seen as Fair. Your 665 FICO® Score is lower than the average U.S. credit ...

2. Is 665 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/665-credit-score/

Mar 4, 2022 ... A credit score of 665 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, ...

3. 665 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/665 Apr 30, 2021 ... A 665 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 665 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. 665 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/665/ Nov 4, 2021 ... Your credit score is a number representing your creditworthiness. A score of 665 is considered “fair” by FICO and “good” by VantageScore.

Nov 4, 2021 ... Your credit score is a number representing your creditworthiness. A score of 665 is considered “fair” by FICO and “good” by VantageScore.

5. Is 665 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/665 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

6. 665 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/665-credit-score

Jun 11, 2022 ... A 665 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 665 Credit Score. Lenders ...

7. Is 665 considered a good credit score for a car loan? | Jerry

https://getjerry.com/questions/is-665-considered-a-good-credit-score-for-a-car-loan![]() Yes, 665 is considered a good credit score for a car loan! When you have a higher credit score, you increase your chances of getting approved with lower ...

Yes, 665 is considered a good credit score for a car loan! When you have a higher credit score, you increase your chances of getting approved with lower ...

8. 665 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/665-credit-score-mortgage/

If your credit score is a 665 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

9. 665 Credit Score - is it good enough?

https://www.creditdebitpro.com/creditscores/665-credit-score/ A credit score of 665 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 665 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

10. 665 Credit Score – Is it Good or Bad? How to Improve Your 665 ...

https://www.creditrepairexpert.org/665-credit-score/ Each credit agency provides you with a credit score, and these three scores combine to create both your 665 FICO Credit Score and your VantageScore. Your score ...

Each credit agency provides you with a credit score, and these three scores combine to create both your 665 FICO Credit Score and your VantageScore. Your score ...

What kinds of loans can I get with a 665 credit score?

With a 665 credit score, you may be able to qualify for an FHA loan, which requires just 3.5% down payment if your 665 credit score is more than 150 points above the 580 minimum requirement for FHA loans. You may also be able to qualify for some jumbo mortgages depending on your income and other factors.

Does having a 665 credit score hurt my chances of getting approved?

Having a 665 credit score doesn't necessarily mean you won't get approved for a loan or line of credit. However, it does mean that it may take extra scrutiny from the lender before they decide whether or not you are eligible for the loan or line of credit. As such, it's important to make sure all your financial information is up-to-date when applying for any type of lending product.

What kind of interest rates will I receive with this score?

Generally speaking, those with a 665 credit score receive slightly higher interest rates than those with higher scores (above 700). The exact rate varies depending on type of loan you're seeking and other factors including income and debt-to-income ratio (DTI).

Is there anything I can do to raise my 665 credit score?

Yes! There are several steps you can take to raise your 665 credit score such as making sure that all accounts are current at all times and paying off balances in full when possible. Additionally, you can check your report for any errors or inaccuracies and dispute them quickly so they don't bring down your overall average.

How long will it take me to see results after taking these steps?

Depending on how many accounts need to be updated or changed, how large the balances are compared to available limits, and other factors, it could take anywhere from several months to even years before you begin seeing results in terms of your overall average increase in points. However, as long as you stay consistent in making payments on time each month then eventually significant improvement should be seen.

Conclusion:

If you're looking at ways to improve your financial situation then working toward increasing your 665 credit score should be one area where improvements can be made slowly over time. Just remember that consistency is key when working towards improving any part of your finances; no matter how small each step might seem at first.