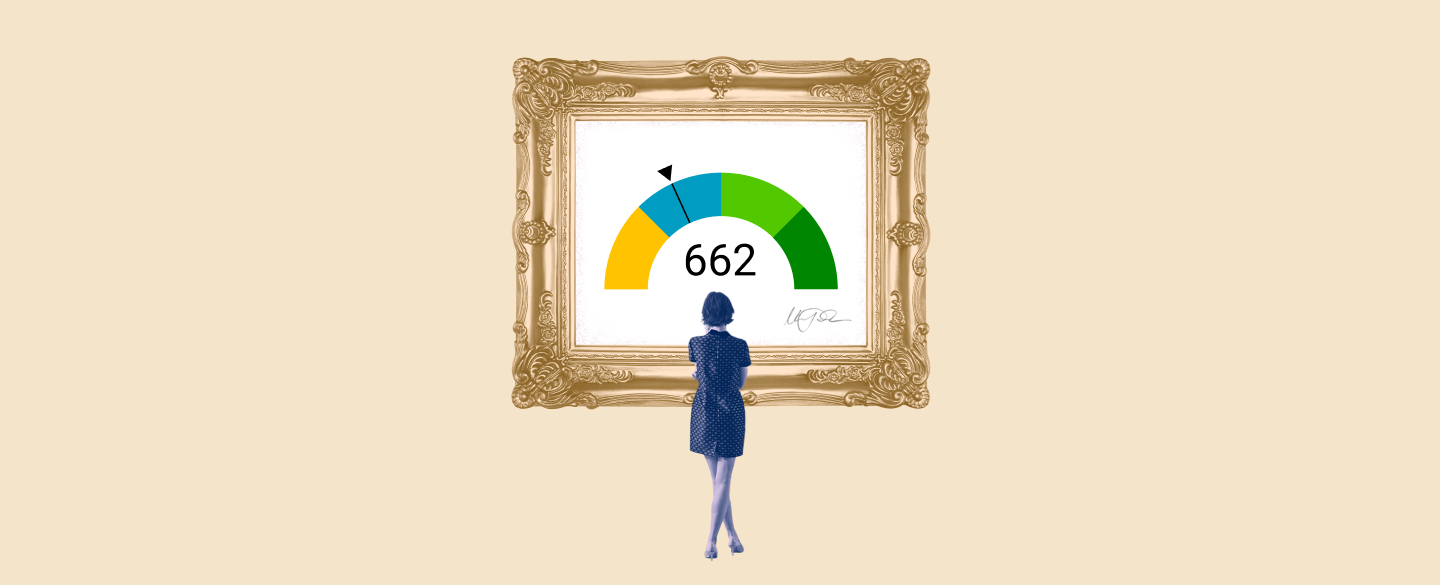

A 662 credit score is an indication of a person's creditworthiness and their ability to pay back their debt. Borrowers with a 662 Credit Score are considered to be in the "Fair" range, which can make it slightly tougher to get approved for some types of loans. However, with a bit of effort and planning, lenders may still be willing to provide financing. Here’s what you need to know about having a 662 credit score.

Table Of Content:

- 662 Credit Score: Is it Good or Bad?

- Is 662 a Good Credit Score? What It Means, Tips & More

- 662 Credit Score: What Does It Mean? | Credit Karma

- 662 Credit Score (+ #1 Way To Fix It )

- 662 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Is 662 a good credit score? | Lexington Law

- 662 Credit Score: Is it Good or Bad? (Approval Odds)

- 662 Credit Score – Is it Good or Bad? How to Improve Your 662 ...

- Will a 662 credit score get me an auto loan with no money down ...

- 662 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

1. 662 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/662-credit-score/ A FICO® Score of 662 places you within a population of consumers whose credit may be seen as Fair. Your 662 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 662 places you within a population of consumers whose credit may be seen as Fair. Your 662 FICO® Score is lower than the average U.S. credit ...

2. Is 662 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/662-credit-score/

A credit score of 662 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

3. 662 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/662 Apr 30, 2021 ... A 662 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 662 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. 662 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/662-credit-score

Jun 11, 2022 ... A 662 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 662 Credit Score. Lenders ...

5. 662 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/662-credit-score-mortgage/

If your credit score is a 662 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

6. Is 662 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/662 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

7. 662 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/662-credit-score/ Is 662 a good credit score? FICO scores range from 300 to 850. As you can see below, a 662 credit score is considered Fair.

Is 662 a good credit score? FICO scores range from 300 to 850. As you can see below, a 662 credit score is considered Fair.

8. 662 Credit Score – Is it Good or Bad? How to Improve Your 662 ...

https://www.creditrepairexpert.org/662-credit-score/ How to Improve Your 662 FICO Score. Before you can do anything to increase your 662 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 662 FICO Score. Before you can do anything to increase your 662 credit score, you need to identify what part of it needs to be improved, ...

9. Will a 662 credit score get me an auto loan with no money down ...

https://www.compareauto.loan/credit-scores/will-a-662-credit-score-get-me-an-auto-loan-with-a-low-rate-of-interest

With a credit score somewhere around 662, you can expect to a better odds of being eligible for an auto loan if you put in an application for vehicle loans ...

10. 662 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/662-credit-score/ A credit score of 662 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

A credit score of 662 is considered a “Fair” credit. It's perfectly average, and individuals with these scores won't have much trouble securing loans and ...

What kind of loan terms are available for someone with a 662 Credit Score?

It depends on the lender, but someone with a 662 Credit Score can expect to receive reasonable loan terms such as lower interest rates and longer repayment periods. An applicant can also improve their chances by using collateral or applying with a cosigner.

How can I improve my 662 Credit Score?

Improving your 662 credit score requires making payments on time, avoiding high balances on accounts, and keeping any new accounts up-to-date with current payments. Additionally, reducing credit card utilization ratios by paying off or consolidating existing debt can help give your score an extra boost.

Is it possible to obtain loan approval at this score?

Yes, although it may require more effort than those with higher scores. Finding the right lender who is willing to look beyond your score can be key in obtaining loan approvals; seeking out specialized lenders who have experience helping people with fair credit ratings can be beneficial in achieving success.

Conclusion:

The Fair rating associated with having a 662 Credit Score means that borrowers will have to take extra steps such as providing collateral or finding appropriate co-signers when applying for loans or other types of financing. Furthermore, improving payment habits and tackling any outstanding debt is key in increasing one’s credit rating over time. With the right lender and approach however, it is possible to secure loan approval even at this level of rating!