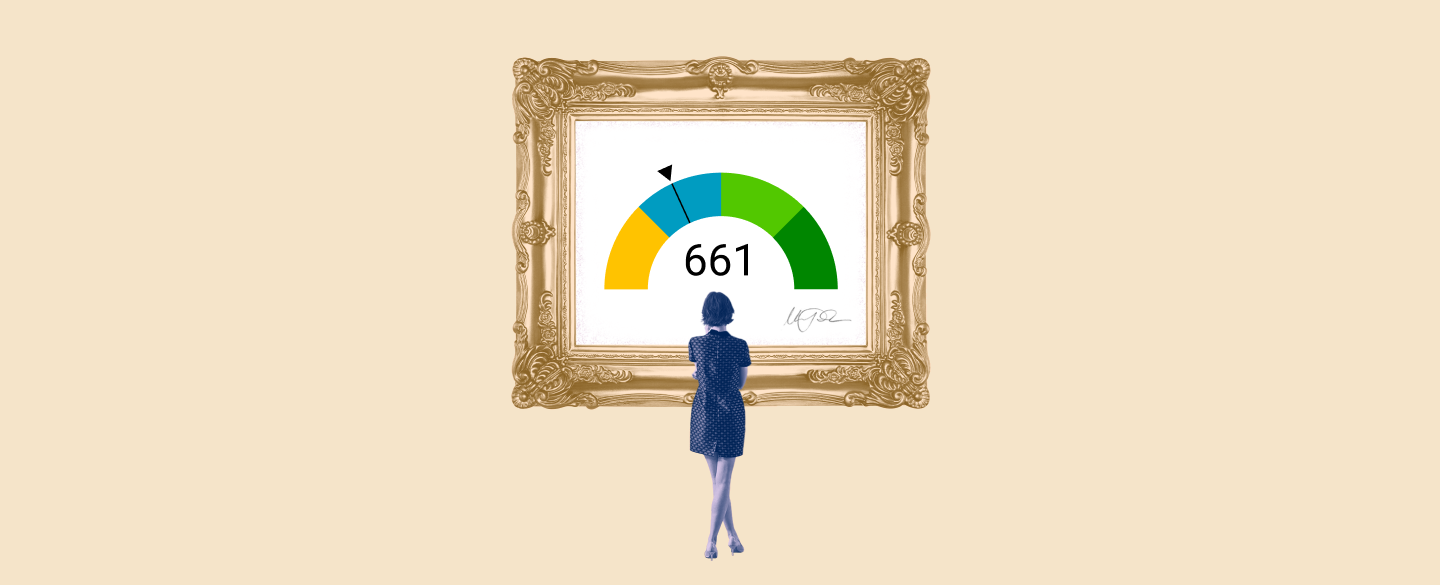

A FICO® Score 661 is a good credit score for individuals looking to start building their credit history. It's right in the middle of the range of acceptable credit scores and can be used as a starting point for understanding your overall creditworthiness. In addition, a 661 FICO® Score can lead to favorable loan terms with lower interest rates or more manageable repayment periods.

Table Of Content:

- 661 Credit Score: Is it Good or Bad?

- 661 Credit Score: What Does It Mean? | Credit Karma

- Is 661 a Good Credit Score? What It Means, Tips & More

- 661 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 661 Credit Score (+ #1 Way To Fix It )

- What Is A Good Credit Score? – Forbes Advisor

- 661 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Minimum Credit Score Do You Need to Buy a Car? - NerdWallet

- 661 Credit Score – Is it Good or Bad? How to Improve Your 661 ...

- What Credit Score Do You Need to Buy a Car?

1. 661 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/661-credit-score/ A FICO® Score of 661 places you within a population of consumers whose credit may be seen as Fair. Your 661 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 661 places you within a population of consumers whose credit may be seen as Fair. Your 661 FICO® Score is lower than the average U.S. credit ...

2. 661 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/661 Apr 30, 2021 ... A 661 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 661 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

3. Is 661 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/661-credit-score/

A credit score of 661 is very close to being "good" credit. In fact, whether or not it qualifies as such is a source of debate, with the answer depending on ...

4. 661 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/661-credit-score-mortgage/

If your credit score is a 661 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

5. 661 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/661-credit-score

6. What Is A Good Credit Score? – Forbes Advisor

https://www.forbes.com/advisor/credit-score/what-is-a-good-credit-score/ Jun 28, 2021 ... Yet FICO, the most widely known credit scoring model, shares some helpful information borrowers can use as a guide. The most common FICO scores ...

Jun 28, 2021 ... Yet FICO, the most widely known credit scoring model, shares some helpful information borrowers can use as a guide. The most common FICO scores ...

7. 661 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/661/ Nov 4, 2021 ... Your credit score is a number representing your creditworthiness. A score of 661 is considered “fair” by FICO and “good” by VantageScore.

Nov 4, 2021 ... Your credit score is a number representing your creditworthiness. A score of 661 is considered “fair” by FICO and “good” by VantageScore.

8. What Minimum Credit Score Do You Need to Buy a Car? - NerdWallet

https://www.nerdwallet.com/article/finance/credit-score-needed-to-buy-car Jun 22, 2022 ... Nearly 65% of cars financed were for borrowers with credit scores of 661 or higher, the report shows. Borrowers with scores between 501 and ...

Jun 22, 2022 ... Nearly 65% of cars financed were for borrowers with credit scores of 661 or higher, the report shows. Borrowers with scores between 501 and ...

9. 661 Credit Score – Is it Good or Bad? How to Improve Your 661 ...

https://www.creditrepairexpert.org/661-credit-score/ Before you can do anything to increase your 661 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

Before you can do anything to increase your 661 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to…

10. What Credit Score Do You Need to Buy a Car?

https://www.investopedia.com/what-credit-score-do-you-need-to-buy-a-car-5181034/GettyImages-951525610-d7fdd0212554481ebbf5e3ac29a10707.jpg) Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to ...

Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to ...

What is a 661 FICO® Score?

A FICO® Score 661 is a good credit score that falls in the middle of the range of acceptable credit scores. It indicates an individual has good financial habits and can be trusted with borrowed funds.

What are the benefits of having a 661 FICO® Score?

Having a 661 FICO® Score will help you get approved for loans at better interest rates and also help you secure more favorable terms, such as longer repayment periods and lower monthly payments.

Is it possible to improve my 661 FICO® Score?

Yes, it is possible to improve your 661 FICO® Score by paying your bills on time, avoiding taking on too much debt, regularly monitoring your credit report for errors or fraudulent activity and using responsible methods of increasing your credit limit.

What other factors contribute to my overall creditworthiness besides my 661 FICO® Score?

Your overall creditworthiness also depends on how well you manage your current debts by keeping balances low and paying bills on time as well as any other types loans you might have such as vehicle loans, mortgages or student loans. Additionally, maintaining positive lines of communication with creditors could potentially benefit one’s overall credit worthiness in the long run.

What happens if I miss payments with a 661 FICO® Score?

Missing payments while trying to maintain a positive line of communication with creditors can significantly affect your FICO® Score as it is based off an individual’s payment history and total amount owed–both will severely decrease if payments are missed or not made on time.

Conclusion:

A FICO® Score 661 marks an individual who has started building up their credit history but still needs to work hard at managing their finances responsibly in order to achieve better loan terms than those offered under this score range. Taking into consideration all factors associated with one’s financial health, including differences in loan types, debts owed and timely payments can all greatly contribute towards achieving higher scores over time when factored into one’s personal finance management strategy appropriately.