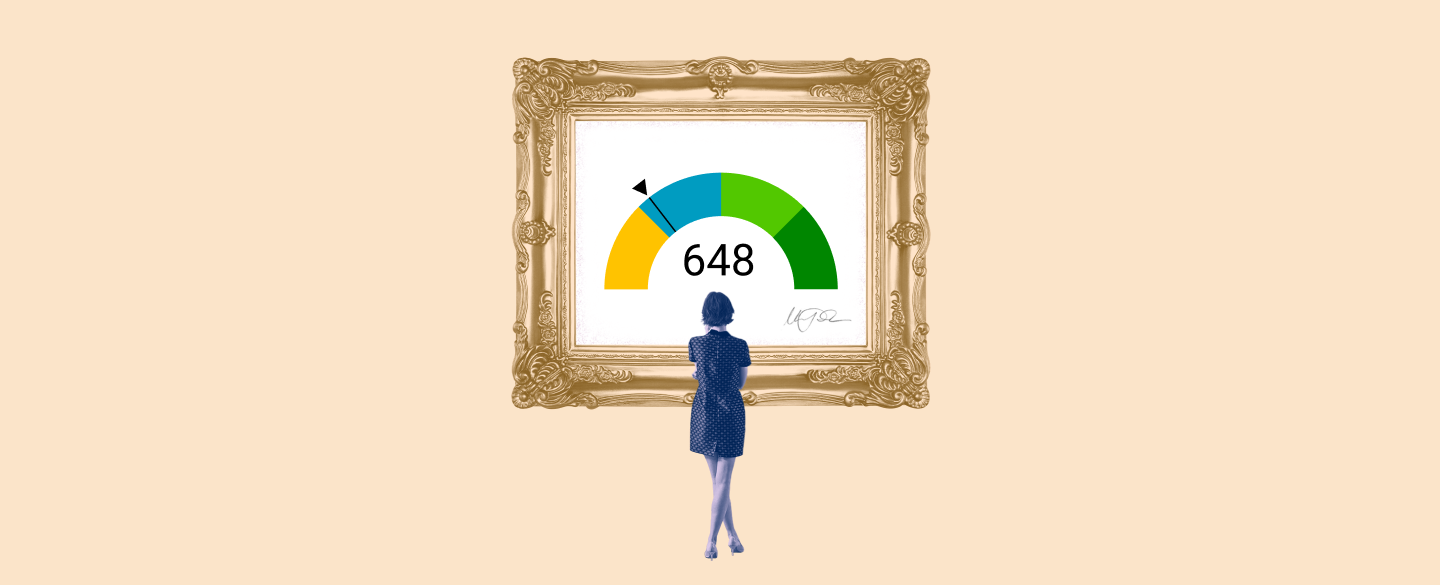

A Transunion credit score of 648 is a respectable score that indicates you have a good history of managing credit. This score should show lenders and creditors that you are a responsible borrower who pays their bills on time, and it will be seen as an indication of your ability to make timely payments in the future.

Table Of Content:

- 648 Credit Score: Is it Good or Bad?

- Is 648 a Good Credit Score? What It Means, Tips & More

- 648 Credit Score: What Does It Mean? | Credit Karma

- What is a Good Credit Score | TransUnion

- 648 Credit Score: Good or Bad? | Credit Card & Loan Options

- 648 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 648 Credit Score (+ #1 Way To Fix It )

- 648 Credit Score – Is it Good or Bad? How to Improve Your 648 ...

- What Credit Score Do You Need To Buy A House? | Rocket Mortgage

- What is a good or average credit score? | Barclaycard

1. 648 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/648-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 648 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 648 FICO® Score is below the average credit score.

2. Is 648 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/648-credit-score/

A 648 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 648 credit score isn't "bad," ...

3. 648 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/648 Apr 30, 2021 ... A 648 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

Apr 30, 2021 ... A 648 credit score is generally a fair score. While a lot of people have fair scores, you may still find it difficult to get approved for ...

4. What is a Good Credit Score | TransUnion

https://www.transunion.com/article/what-is-a-good-credit-score What about TransUnion's credit score? TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may ...

What about TransUnion's credit score? TransUnion uses the VantageScore® 3.0 model, but the above way of looking at it still applies: two different lenders may ...

5. 648 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/648/ Nov 9, 2021 ... 648 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 648 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

6. 648 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/648-credit-score-mortgage/

If your credit score is a 648 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

7. 648 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/648-credit-score

8. 648 Credit Score – Is it Good or Bad? How to Improve Your 648 ...

https://www.creditrepairexpert.org/648-credit-score/ Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine ...

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine ...

9. What Credit Score Do You Need To Buy A House? | Rocket Mortgage

https://www.rocketmortgage.com/learn/what-credit-score-is-needed-to-buy-a-house May 26, 2022 ... FICO® Score Vs. Credit Score. The three national credit reporting agencies – Equifax®, Experian™ and TransUnion® – collect information from ...

May 26, 2022 ... FICO® Score Vs. Credit Score. The three national credit reporting agencies – Equifax®, Experian™ and TransUnion® – collect information from ...

10. What is a good or average credit score? | Barclaycard

https://www.barclaycard.co.uk/personal/money-matters/credit-score-basics/what-is-a-good-or-average-credit-score TransUnion (formerly known as Callcredit) is the UK's second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair.

TransUnion (formerly known as Callcredit) is the UK's second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair.

What is included in my Transunion credit score?

Your Transunion credit score includes information from your past borrowed money such as any loans, mortgages or lines of credit you may have taken out; the amount still owed; length of time these accounts were open; and any delinquent payments made on account within the last two years. It may also include public records such as bankruptcy filings and court judgments.

How does a 648 Transunion credit score compare with other scores?

Your 648 TransUnion score falls in the “Good” range (between 680-719), which means your payment history has been consistent and your accounts are generally up-to-date. This score should be sufficient for most lenders, but there may be exceptions depending on individual lender criteria.

What can I do to improve my Transunion credit score?

Improving your Transunion credit score requires commitment and discipline, but it is possible if you follow some simple steps. These steps include regularly checking your credit report for accuracy; paying all bills on time; only using around 30% of available revolving credit limits; removing erroneous information from your report; improving any collections accounts information if possible; and avoiding applying for new credit unless absolutely necessary.

Conclusion:

Your TransUnion Credit Score of 648 is considered “Good” and shows that you have responsibly managed debt in the past which should make it easier for lenders to consider granting you new loans or lines of credit when needed. Additionally, by following the steps outlined above, you can take active measures to gradually improve upon this solid foundation over time.