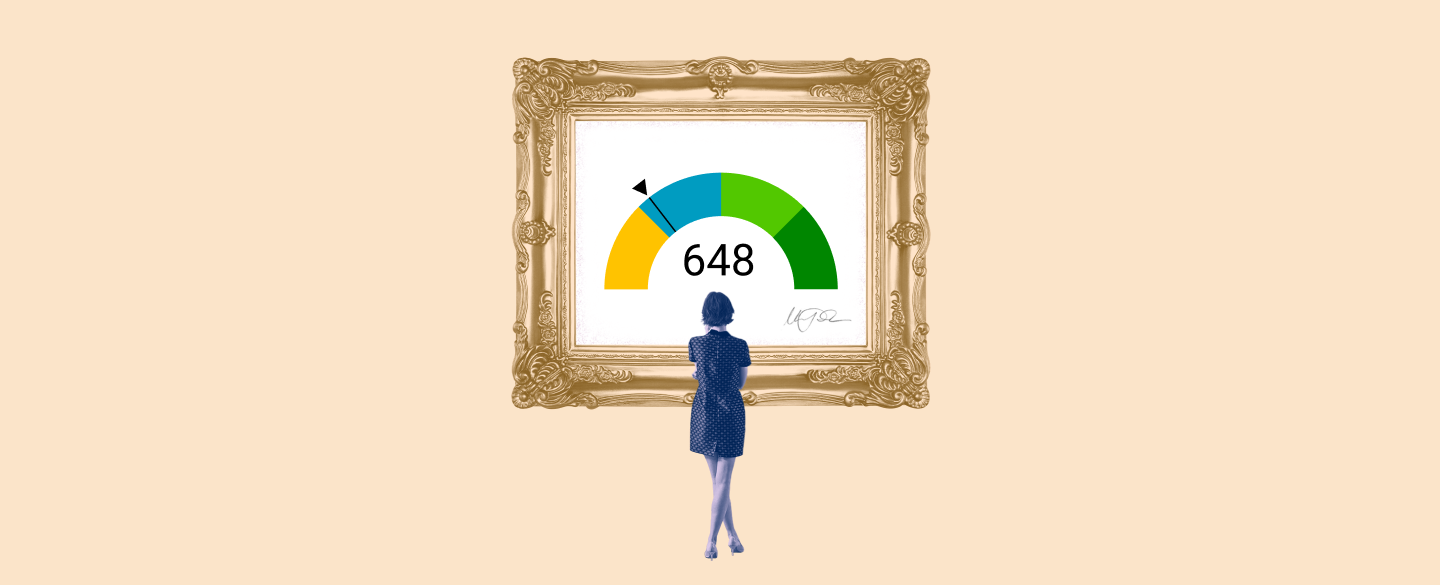

Having a 648 credit score is an important factor in determining your financial capability and stability. It gives you access to various credit products available in the market, while also allowing you to take advantage of other opportunities that may come your way. With a 648 credit score, you can be confident that you are able to manage your finances responsibly and benefit from the financial opportunities available to you.

Table Of Content:

- 648 Credit Score: Is it Good or Bad?

- Is 648 a Good Credit Score? What It Means, Tips & More

- 648 Credit Score: What Does It Mean? | Credit Karma

- 648 Credit Score (+ #1 Way To Fix It )

- 648 Credit Score: Good or Bad? | Credit Card & Loan Options

- What Are The Chances Of Getting a Personal Loan With a 648 ...

- 648 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Is 648 a good credit score? | Lexington Law

- 648 Credit Score – Is it Good or Bad? How to Improve Your 648 ...

- 648 Credit Score: Is it Good or Bad? (Approval Odds)

1. 648 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/648-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 648 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 648 FICO® Score is below the average credit score.

2. Is 648 a Good Credit Score? What It Means, Tips & More

https://wallethub.com/credit-score-range/648-credit-score/

A 648 credit score is not a good credit score, unfortunately. You need a score of at least 700 to have "good" credit. But a 648 credit score isn't "bad," ...

3. 648 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/648 Apr 30, 2021 ... A 648 credit score is generally considered an average, or fair, credit score. Here's what it means to have fair credit and how to build your ...

Apr 30, 2021 ... A 648 credit score is generally considered an average, or fair, credit score. Here's what it means to have fair credit and how to build your ...

4. 648 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/648-credit-score

5. 648 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/648/ Nov 9, 2021 ... 648 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 648 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

6. What Are The Chances Of Getting a Personal Loan With a 648 ...

https://www.creditninja.com/what-are-the-chances-of-getting-a-personal-loan-with-a-648-credit-score/![]() Your chances of getting a personal loan with a 648 credit score are very good! A 648 credit score is considered fair in most cases.

Your chances of getting a personal loan with a 648 credit score are very good! A 648 credit score is considered fair in most cases.

7. 648 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/648-credit-score-mortgage/

If your credit score is a 648 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 ...

8. Is 648 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/648 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

9. 648 Credit Score – Is it Good or Bad? How to Improve Your 648 ...

https://www.creditrepairexpert.org/648-credit-score/ How to Improve Your 648 FICO Score. Before you can do anything to increase your 648 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 648 FICO Score. Before you can do anything to increase your 648 credit score, you need to identify what part of it needs to be improved, ...

10. 648 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/648-credit-score/ Is 648 a good credit score? FICO scores range from 300 to 850. As you can see below, a 648 credit score is considered Fair.

Is 648 a good credit score? FICO scores range from 300 to 850. As you can see below, a 648 credit score is considered Fair.

What are some of the benefits of having a 648 credit score?

Having a 648 credit score gives you access to different types of loan products and other financial services, at more favourable terms than someone with a lower score. It can also save you time and effort on applying for loans because lenders may not require as much documentation as they would from someone with lower scores. Additionally, it opens up new savings opportunities such as higher rates of return or reduced fees on certain accounts.

What factors affect my 648 Credit Score?

Your credit score is affected by five main factors: payment history, amount owed, types of credit used, length of credit history, and recent inquiries into an individual’s credit report. Factors such as timely payments towards debts or loans will provide a positive contribution to your overall credit score while late payments can hurt it.

How can I improve my 648 Credit Score?

Improving your 648 Credit Score requires consistently managing your debt responsibly over time. This means making timely payments towards any existing debts and loans; reducing debt levels if possible; maintaining healthy amounts of unused lines of credits (credit cards); and avoiding too many hard inquiries into an individual’s credit report when applying for new crediting services or products.

Will my 648 Credit Score increase over time?

Yes – if managed responsibly over time, individuals with a 648 Credit Score should be able to slowly increase their overall rating by demonstrating responsible repayment behaviour over the course of several months or years. Additionally, individuals should ensure that they do not take up any more debt than necessary in order to stay within manageable monthly repayment limits.

Is there anything else I should know about having a 648 Credit Score?

It is important to remember that having a good credit rating does not guarantee access to certain loan products or favourable interest rates - other factors such as income levels or type of collateral may also affect these considerations which must be taken into account when seeking new financing opportunities.

Conclusion:

Having a 648 Credit Score offers several advantages but also requires consistent management over time in order to maintain it at this level and even improve upon it further. Understanding the different factors which affect one’s overall rating is key in making sure that responsible spending behaviours are adopted in order for one’s financial situation remain stable over the long-term.