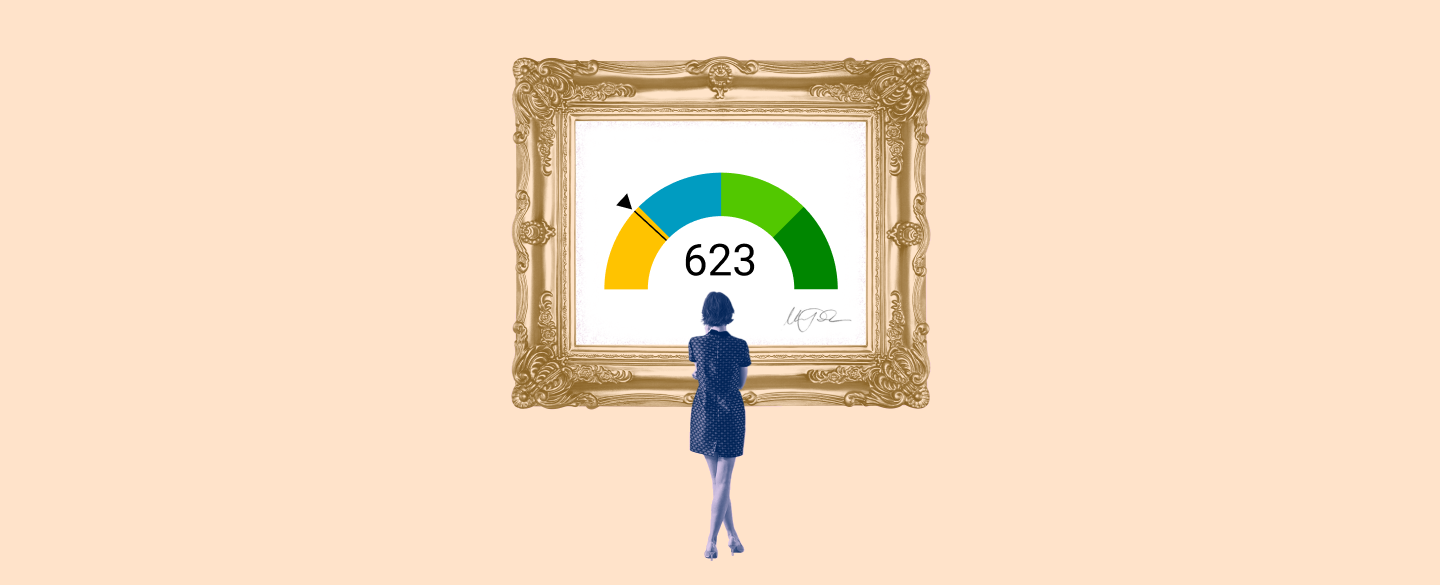

A 623 credit score is a moderate score and indicates that you have an average credit history. It is in the range of fair-to-good credit ratings and lands somewhere between 'acceptable' and 'good'. Having a 623 credit score can help you get approved for some types of loans or financing and build a strong financial future.

Table Of Content:

- 623 Credit Score: Is it Good or Bad?

- 623 Credit Score: What Does It Mean? | Credit Karma

- Is 623 a good credit score? | Lexington Law

- Is 623 a Good Credit Score? Rating, Loans & How to Improve

- 623 Credit Score (+ #1 Way To Fix It )

- 623 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- 623 Credit Score: Is it Good or Bad? (Approval Odds)

- 623 Credit Score – Is it Good or Bad? How to Improve Your 623 ...

- 623 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

- 623 Credit Score: Good or Bad? | Credit Card & Loan Options

1. 623 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/623-credit-score/ A FICO® Score of 623 places you within a population of consumers whose credit may be seen as Fair. Your 623 FICO® Score is lower than the average U.S. credit ...

A FICO® Score of 623 places you within a population of consumers whose credit may be seen as Fair. Your 623 FICO® Score is lower than the average U.S. credit ...

2. 623 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/623 Apr 30, 2021 ... A 623 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 623 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. Is 623 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/623 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

4. Is 623 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/623-credit-score/

A credit score of 623 isn't “good.” It's not even “fair.” Rather, a 623 credit score is actually considered “bad,” according to the standard 300 to 850 ...

5. 623 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/623-credit-score

6. 623 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/623-credit-score-mortgage/

FHA Loan with 623 Credit Score ... FHA loans only require that you have a 580 credit score, so with a 623 FICO, you can definitely meet the credit score ...

7. 623 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/623-credit-score/ FICO scores range from 300 to 850. As you can see below, a 623 credit score is considered Fair. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 623 credit score is considered Fair. Credit Score, Credit Rating, % of population.

8. 623 Credit Score – Is it Good or Bad? How to Improve Your 623 ...

https://www.creditrepairexpert.org/623-credit-score/ How to Improve Your 623 FICO Score. Before you can do anything to increase your 623 credit score, you need to identify what part of it needs to be improved, ...

How to Improve Your 623 FICO Score. Before you can do anything to increase your 623 credit score, you need to identify what part of it needs to be improved, ...

9. 623 Credit Score: Good or Bad, Auto Loan, Credit Card Options ...

https://www.creditdebitpro.com/creditscores/623-credit-score/ A 623 credit score is considered as “poor” score. While people with the 623 FICO score won't have as much trouble getting loans as those with lower credit, ...

A 623 credit score is considered as “poor” score. While people with the 623 FICO score won't have as much trouble getting loans as those with lower credit, ...

10. 623 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/623/ Nov 9, 2021 ... 623 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

Nov 9, 2021 ... 623 is a below-average credit score, but it's approaching the “good” range. It's considered “fair” by every major credit scoring model.

What factors can affect my 623 credit score?

Your 623 credit score is based on your payment history, the amount you owe, the length of your credit history, the type of accounts in your name, and recent inquiries on your report. Making late payments, having too much debt, applying for new lines of credit too frequently can all negatively impact your 623 credit score.

How can I maintain or improve my 623 credit score?

To maintain or even improve a 623 credit score, it's important to make timely payments on all debts or loans each month so that you don't damage your payment history. Pay down existing debt as quickly as possible and try to keep balances low relative to their available limits. Take caution when considering new lines of credit so that you don't increase available debt too quickly.

What types of loans could I qualify for with a 623 credit score?

With a 623 credit score, you may be able to qualify for some standard consumer loan products including personal loans from banks or online lenders at competitive rates; certain auto loans; unsecured business lines of credits; home equity lines; and certain mortgages. However, be sure to shop around for the best terms as rates will vary depending on several factors including length of loan term and loan amount needed.

Will my interest rate be lower with higher scores?

Generally speaking, yes - having higher scores can result in lower interest rates which could save you money over time if you are taking out a long-term loan product such as a mortgage. However, other factors such as length of loan term (15 year vs 30 year) will also play into the interest rate given by lenders.

Is there anything else I should do besides maintaining good scores?

Yes - make sure to check your reports regularly so that any errors or inaccuracies are flagged right away and looked into further if necessary. You should also check for any unauthorized activity that may be present which could signal someone has accessed your accounts fraudulently.

Conclusion:

Having a 623 credit score can open up many opportunities if managed well – from qualifying for certain loan products to potentially saving thousands over time with lower interest rates thanks to higher scores – but it’s important to stay vigilant about monitoring both your reports and accounts monthly so everything remains accurate and secure.