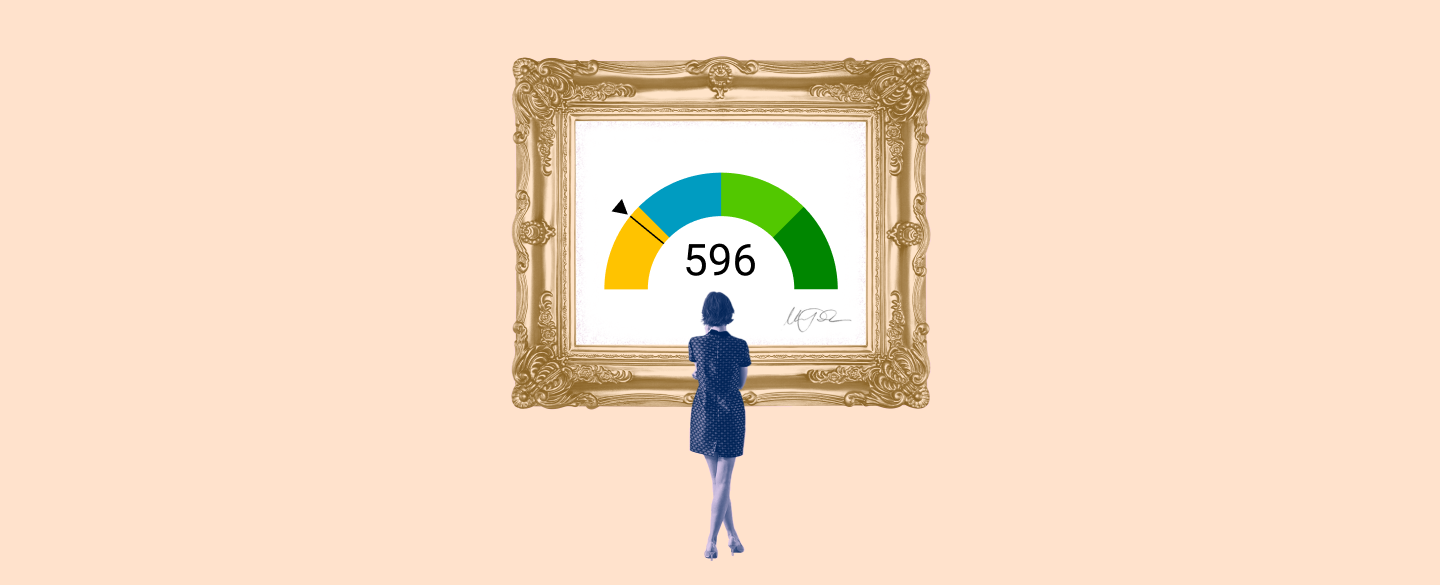

A 596 FICO score can be an important stepping stone to financial success. It is an indication that you’re on the right track when it comes to building a solid foundation for yourself and your family. This credit score range encompasses everything from those just starting out with no credit history to those who have a long and strong history of responsibly managing their finances.

Table Of Content:

- 596 Credit Score: Is it Good or Bad?

- 596 Credit Score: What Does It Mean? | Credit Karma

- 596 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

- Is 596 a Good Credit Score? Rating, Loans & How to Improve

- 596 Credit Score (+ #1 Way To Fix It )

- 596 Credit Score: Is it Good or Bad? (Approval Odds)

- Is 596 a good credit score? | Lexington Law

- 596 Credit Score - Is it Good or Bad? What does it mean in 2022?

- 596 Credit Score: Good or Bad? | Credit Card & Loan Options

- Car loan interest rates with 596 credit score in 2022

1. 596 Credit Score: Is it Good or Bad?

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/596-credit-score/ Your score falls within the range of scores, from 580 to 669, considered Fair. A 596 FICO® Score is below the average credit score.

Your score falls within the range of scores, from 580 to 669, considered Fair. A 596 FICO® Score is below the average credit score.

2. 596 Credit Score: What Does It Mean? | Credit Karma

https://www.creditkarma.com/credit-scores/596 Apr 30, 2021 ... A 596 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

Apr 30, 2021 ... A 596 credit score can be a sign of past credit difficulties or a lack of credit history. Whether you're looking for a personal loan, ...

3. 596 Credit Score Mortgage Lenders of 2022 - Non-Prime Lenders ...

https://www.nonprimelenders.com/596-credit-score-mortgage/

The most common type of loan available to borrowers with a 596 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, ...

4. Is 596 a Good Credit Score? Rating, Loans & How to Improve

https://wallethub.com/credit-score-range/596-credit-score/

A credit score of 596 isn't “good.” It's not even “fair.” Rather, a 596 credit score is actually considered “bad,” according to the standard 300 to 850 ...

5. 596 Credit Score (+ #1 Way To Fix It )

https://www.creditglory.com/credit-score/596-credit-score

Jul 1, 2022 ... A 596 FICO® Score is considered “Fair”. Mortgage, auto, and personal loans are somewhat difficult to get with a 596 Credit Score. Lenders ...

6. 596 Credit Score: Is it Good or Bad? (Approval Odds)

https://www.crediful.com/fico-credit-score-range/596-credit-score/ FICO scores range from 300 to 850. As you can see below, a 596 credit score is considered Fair. Credit Score, Credit Rating, % of population.

FICO scores range from 300 to 850. As you can see below, a 596 credit score is considered Fair. Credit Score, Credit Rating, % of population.

7. Is 596 a good credit score? | Lexington Law

https://www.lexingtonlaw.com/education/score/596 Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

Oct 11, 2021 ... The FICO model gives credit-using adult consumers a credit score between 300 and 850, ranging from “very poor” to “exceptional.” A credit score ...

8. 596 Credit Score - Is it Good or Bad? What does it mean in 2022?

https://creditscoregeek.com/poor-credit/596/ Basically, those with high scores are considered less of a risk and thus more credit worthy as compared to those with low scores. Credit score 596 and below ...

Basically, those with high scores are considered less of a risk and thus more credit worthy as compared to those with low scores. Credit score 596 and below ...

9. 596 Credit Score: Good or Bad? | Credit Card & Loan Options

https://financejar.com/credit-scores/credit-score-range/596/ Nov 9, 2021 ... 596 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high ...

Nov 9, 2021 ... 596 is a below-average credit score. It's considered “fair” or “poor” by every major credit scoring model. Scores in this range are high ...

10. Car loan interest rates with 596 credit score in 2022

https://creditscoregeek.com/poor-credit/596/auto/ Find out what auto loan rates your 596 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 596.

Find out what auto loan rates your 596 credit score can get you in 2022. Follow this advice to find the best auto loan for the FICO score under 596.

What does a 596 FICO Score mean?

A 596 FICO score indicates that you have a good chance of getting approved for some types of loans or credit cards, but you may not receive favorable interest rates. You may also need to provide additional information to lenders in order for them to consider any applications you make.

How can I improve my 596 FICO Score?

The best way to improve your 596 FICO score is by making on-time payments and keeping balances low on any accounts that are reported to the credit bureaus. Additionally, try to limit your number of inquiries into your credit report, as this will negatively impact your score.

Will my FICO Score continue to go up if I keep paying regularly?

Yes! Establishing and maintaining a consistent payment history is one of the most important aspects when it comes to building good credit over time, so by ensuring that you make all payments on time each month your score will gradually increase over time.

Are there other ways my FICO Score can increase besides making timely payments?

Yes! Making sure that any errors are corrected right away such as inaccurate account information or identity theft incidents can help boost the accuracy of your score in addition to showing lenders that you take care of reporting errors quickly and effectively.

Is there anything else I should keep in mind when trying to maintain/improve my 596 FICO Score?

Keeping an eye on different types of debt such as student loans or auto loans and ensuring all accounts are current and not delinquent will help keep your overall credit health in good shape while also giving lenders confidence in you as a borrower. Additionally, having too many open accounts at once is another factor that could negatively impact your score so try and keep certain types of debt under control in order for it not to affect your overall rating.

Conclusion:

A 596 FICO score can be improved with dedication and discipline using the guidance from this article as well as others related to properly understanding how different types of debt, inquiries into your credit report, and other factors all play into establishing good financial management techniques over time which will ultimately lead towards even higher scores than what was initially attained with a 596 rating.